- China

- /

- Construction

- /

- SHSE:603929

Discovering Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of declining major stock indexes and a cooling labor market, small-cap stocks have faced notable underperformance, as evidenced by the Russell 2000 Index's recent struggles against larger peers. In such an environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities in less-explored segments of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

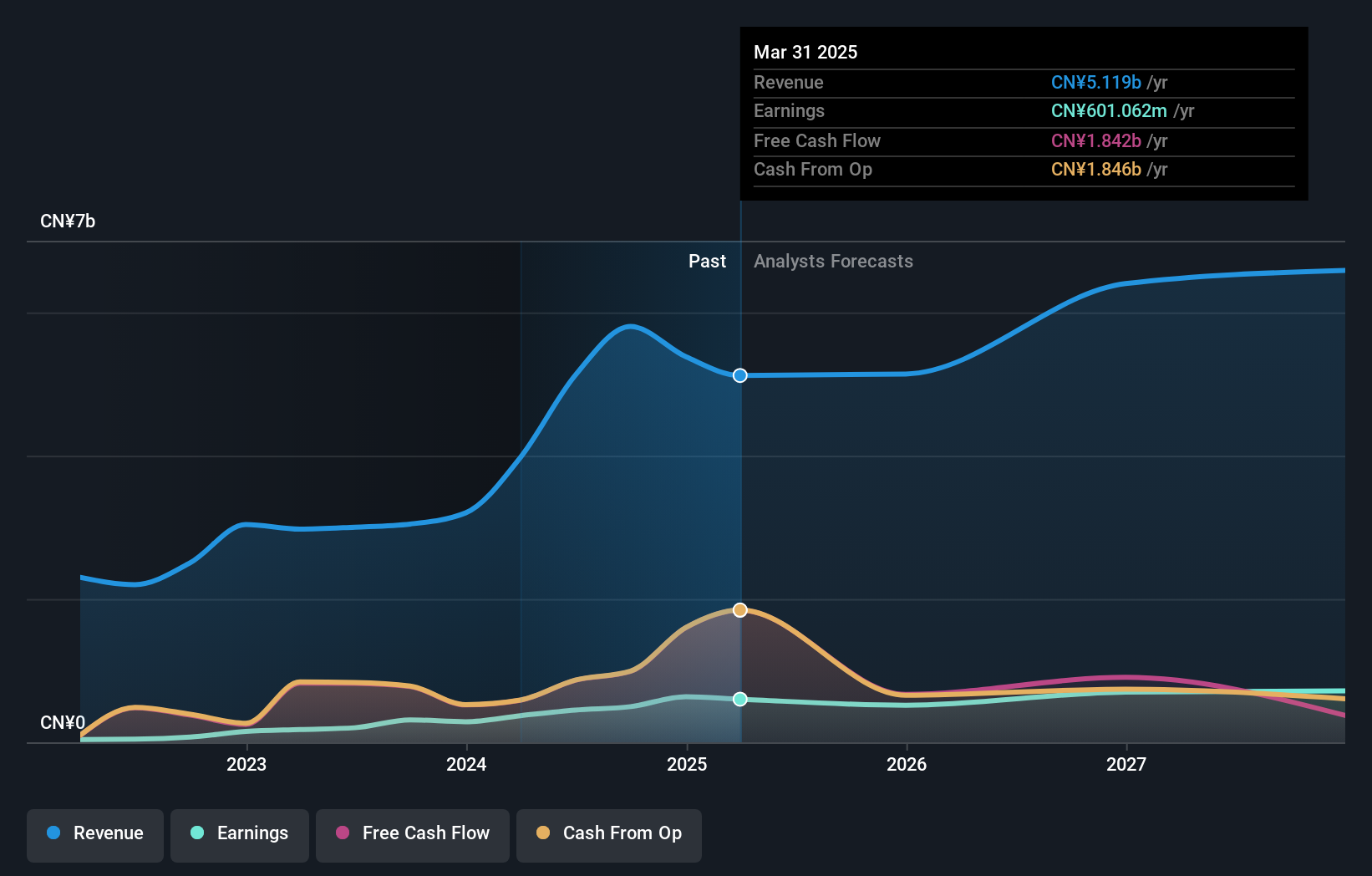

Xiaocaiyuan International Holding (SEHK:999)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xiaocaiyuan International Holding Ltd. is an investment holding company that operates in the restaurant business in the People’s Republic of China, with a market cap of approximately $1.29 billion.

Operations: Xiaocaiyuan generates revenue primarily from its restaurant operations, which contribute CN¥3.05 billion, and its delivery business, adding CN¥1.49 billion.

Xiaocaiyuan International Holding recently completed an IPO, raising HKD 860.04 million by offering over 101 million shares at HKD 8.5 each. This company, characterized by its small market presence, has shown impressive financial performance with earnings growth of 124% in the past year—significantly outpacing the Hospitality industry's average of 13%. Additionally, it boasts high-quality earnings and a robust debt profile with more cash than total debt. Despite these strengths, its shares remain highly illiquid. The company's interest payments are well-covered by EBIT at a ratio of 31 times coverage.

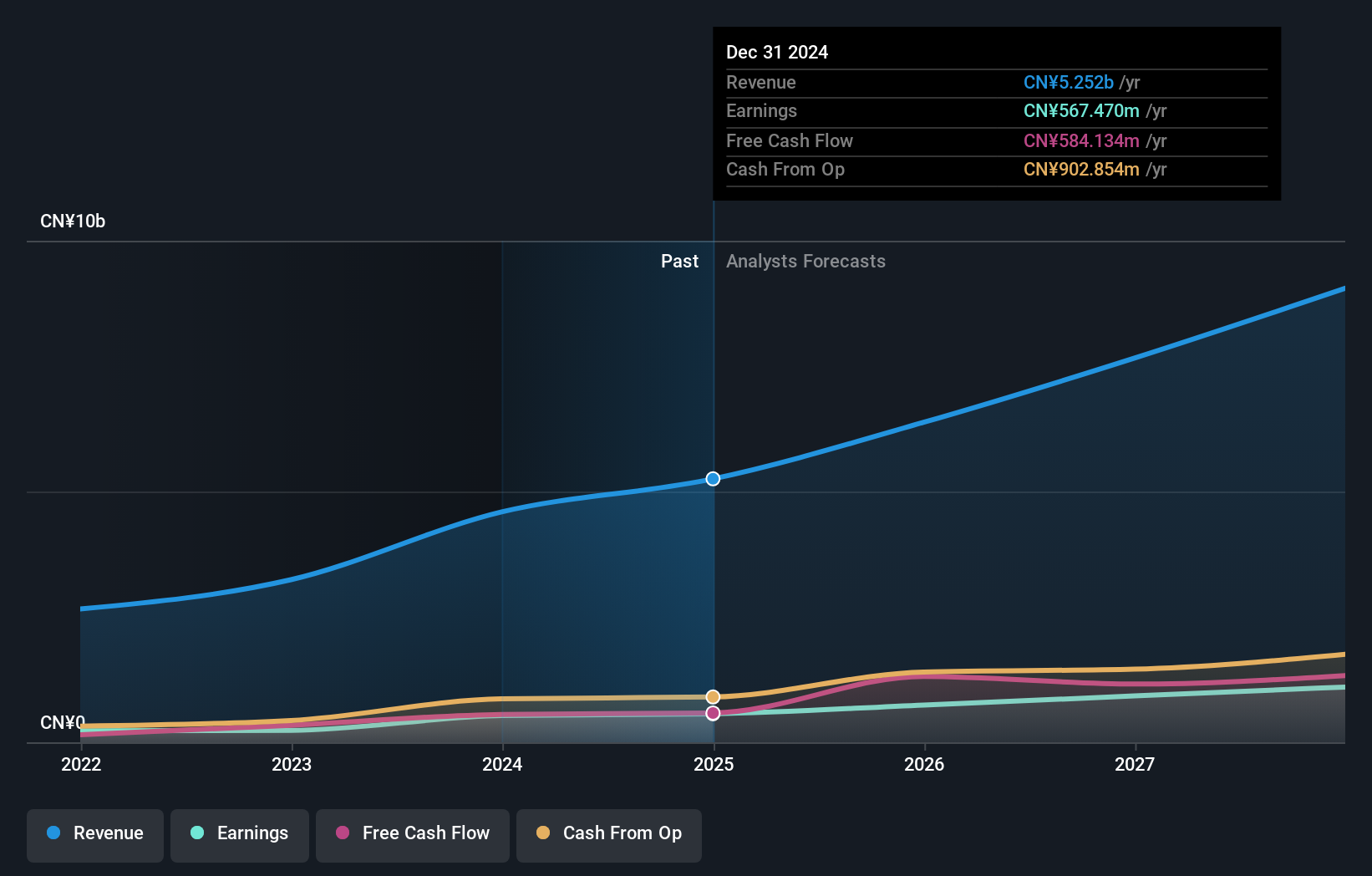

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Value Rating: ★★★★★★

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China with a market cap of CN¥5.75 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates revenue primarily through its specialized engineering technical services in China. The company's net profit margin has shown fluctuations, reflecting changes in cost management and operational efficiency over time.

L&K Engineering (Suzhou) Ltd. showcases a compelling narrative with its debt-free status and impressive earnings growth of 59.2% over the past year, outpacing the construction industry's -3.9%. The company's recent financial performance highlights sales reaching CNY 4.42 billion, up from CNY 1.82 billion the previous year, while net income rose to CNY 439 million from CNY 228 million. With basic earnings per share doubling to CNY 2.06, L&K appears undervalued by about 45% compared to its fair value estimate, suggesting potential for further appreciation in its market valuation amidst robust industry positioning and profitability prospects.

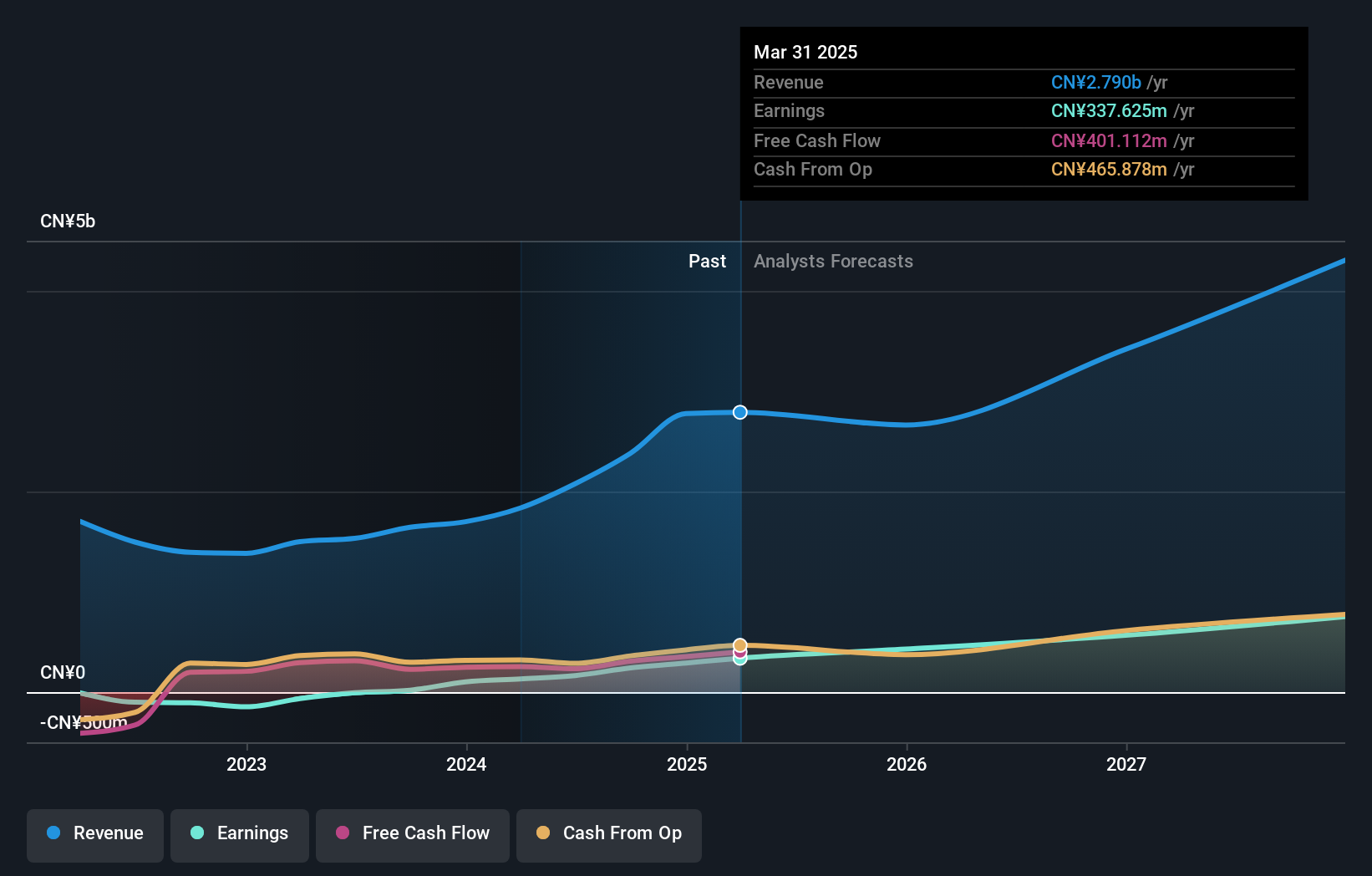

Streamax Technology (SZSE:002970)

Simply Wall St Value Rating: ★★★★★☆

Overview: Streamax Technology Co., Ltd. focuses on the research, development, manufacturing, and sale of AI-powered mobile safety and industrial management solutions for commercial vehicles both in China and internationally, with a market cap of CN¥8.07 billion.

Operations: Streamax Technology generates revenue primarily from AI-powered mobile safety and industrial management solutions for commercial vehicles. The company's financial performance is highlighted by a market cap of CN¥8.07 billion, reflecting its scale in the industry.

Streamax Technology, a dynamic player in the auto components sector, has seen remarkable earnings growth of 1145.4% over the past year, outpacing the industry's 10.5%. This growth is supported by a solid financial position with more cash than total debt and free cash flow positivity. Despite shareholder dilution in the past year, Streamax's price-to-earnings ratio of 34.2x remains attractive compared to the CN market's 36.3x. Recent earnings reported for nine months ending September 2024 show net income at CNY 220 million from CNY 81 million last year, indicating strong operational performance and potential for future value creation.

- Delve into the full analysis health report here for a deeper understanding of Streamax Technology.

Gain insights into Streamax Technology's past trends and performance with our Past report.

Make It Happen

- Click through to start exploring the rest of the 4612 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603929

L&K Engineering (Suzhou)Ltd

Provides specialized engineering technical services in China.

Flawless balance sheet, undervalued and pays a dividend.