Hangzhou Youngsun Intelligent Equipment Co., Ltd. (SHSE:603901) Doing What It Can To Lift Shares

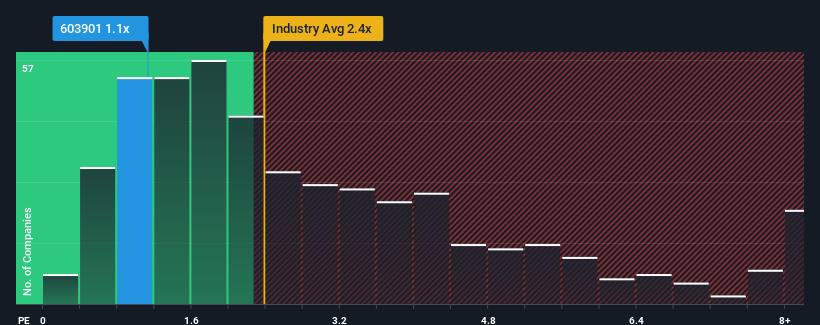

With a price-to-sales (or "P/S") ratio of 1.1x Hangzhou Youngsun Intelligent Equipment Co., Ltd. (SHSE:603901) may be sending bullish signals at the moment, given that almost half of all the Machinery companies in China have P/S ratios greater than 2.4x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Hangzhou Youngsun Intelligent Equipment

What Does Hangzhou Youngsun Intelligent Equipment's P/S Mean For Shareholders?

There hasn't been much to differentiate Hangzhou Youngsun Intelligent Equipment's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Hangzhou Youngsun Intelligent Equipment will help you uncover what's on the horizon.How Is Hangzhou Youngsun Intelligent Equipment's Revenue Growth Trending?

In order to justify its P/S ratio, Hangzhou Youngsun Intelligent Equipment would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Hangzhou Youngsun Intelligent Equipment's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Hangzhou Youngsun Intelligent Equipment's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Hangzhou Youngsun Intelligent Equipment currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 4 warning signs for Hangzhou Youngsun Intelligent Equipment (2 are significant!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Youngsun Intelligent Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603901

Hangzhou Youngsun Intelligent Equipment

Hangzhou Youngsun Intelligent Equipment Co., Ltd.

Reasonable growth potential slight.

Market Insights

Community Narratives