Earnings Tell The Story For Hangzhou Youngsun Intelligent Equipment Co., Ltd. (SHSE:603901) As Its Stock Soars 27%

Hangzhou Youngsun Intelligent Equipment Co., Ltd. (SHSE:603901) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

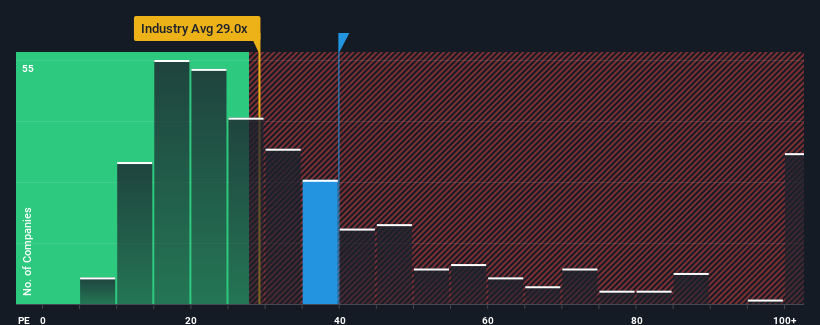

After such a large jump in price, Hangzhou Youngsun Intelligent Equipment's price-to-earnings (or "P/E") ratio of 39.8x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 18x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Hangzhou Youngsun Intelligent Equipment as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Hangzhou Youngsun Intelligent Equipment

Does Growth Match The High P/E?

In order to justify its P/E ratio, Hangzhou Youngsun Intelligent Equipment would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 64%. This means it has also seen a slide in earnings over the longer-term as EPS is down 21% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 141% as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

In light of this, it's understandable that Hangzhou Youngsun Intelligent Equipment's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hangzhou Youngsun Intelligent Equipment's P/E

Hangzhou Youngsun Intelligent Equipment's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hangzhou Youngsun Intelligent Equipment maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Hangzhou Youngsun Intelligent Equipment is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Youngsun Intelligent Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603901

Hangzhou Youngsun Intelligent Equipment

Hangzhou Youngsun Intelligent Equipment Co., Ltd.

Reasonable growth potential slight.

Market Insights

Community Narratives