- China

- /

- Construction

- /

- SHSE:603887

Shanghai CDXJ Digital Technology Co.,LTD (SHSE:603887) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

Shanghai CDXJ Digital Technology Co.,LTD (SHSE:603887) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 63% in the last year.

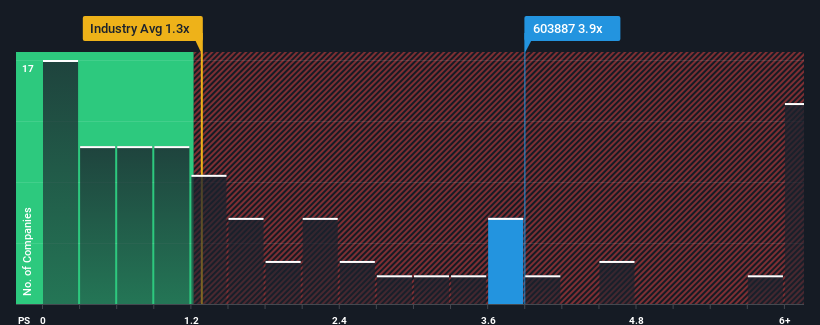

Even after such a large drop in price, given around half the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.3x, you may still consider Shanghai CDXJ Digital TechnologyLTD as a stock to avoid entirely with its 3.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Shanghai CDXJ Digital TechnologyLTD

How Has Shanghai CDXJ Digital TechnologyLTD Performed Recently?

For example, consider that Shanghai CDXJ Digital TechnologyLTD's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Shanghai CDXJ Digital TechnologyLTD, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shanghai CDXJ Digital TechnologyLTD's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 38% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's an unpleasant look.

With this in mind, we find it worrying that Shanghai CDXJ Digital TechnologyLTD's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

A significant share price dive has done very little to deflate Shanghai CDXJ Digital TechnologyLTD's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai CDXJ Digital TechnologyLTD currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It is also worth noting that we have found 3 warning signs for Shanghai CDXJ Digital TechnologyLTD (2 make us uncomfortable!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603887

Shanghai CDXJ Digital TechnologyLTD

Engages in the cloud infrastructure, cloud data service, and geotechnical engineering businesses in China.

Adequate balance sheet low.

Market Insights

Community Narratives