As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across various sectors, with financials and energy showing resilience while healthcare faces challenges. Amid this backdrop, growth companies with high insider ownership can present unique opportunities, as significant insider stakes often signal confidence in a company's long-term potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We'll examine a selection from our screener results.

Yijiahe Technology (SHSE:603666)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yijiahe Technology Co., Ltd. focuses on the research, development, design, and sale of intelligent robots in China with a market capitalization of approximately CN¥5.42 billion.

Operations: The company's revenue segments include the research, development, design, and sale of intelligent robots in China.

Insider Ownership: 28.2%

Earnings Growth Forecast: 71.6% p.a.

Yijiahe Technology is experiencing rapid revenue growth, forecasted at 33.8% annually, outpacing the Chinese market average. Despite current net losses (CNY 80.23 million for nine months in 2024), profitability is expected within three years, surpassing average market growth rates. Recent insider activity includes a significant acquisition of a 5.9% stake by investment funds for CNY 170 million, highlighting confidence in its long-term prospects despite recent share price volatility and ongoing financial losses.

- Get an in-depth perspective on Yijiahe Technology's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Yijiahe Technology's shares may be trading at a premium.

Tongqinglou Catering (SHSE:605108)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tongqinglou Catering Co., Ltd. operates in the catering services industry in China with a market capitalization of approximately CN¥6.16 billion.

Operations: Tongqinglou Catering Co., Ltd. generates its revenue primarily from providing catering services in China.

Insider Ownership: 24.5%

Earnings Growth Forecast: 39.8% p.a.

Tongqinglou Catering is experiencing robust revenue growth, forecasted at 23.2% annually, exceeding the Chinese market's average. Despite trading at a significant discount to its estimated fair value, the company faces challenges with high debt and declining net income (CNY 83.4 million for nine months in 2024). Earnings are expected to grow significantly over the next three years, although recent results show decreased earnings per share compared to last year.

- Take a closer look at Tongqinglou Catering's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Tongqinglou Catering is priced lower than what may be justified by its financials.

Caliway Biopharmaceuticals (TWSE:6919)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Caliway Biopharmaceuticals Co. Ltd focuses on the development of small molecule drugs for medical aesthetics and inflammatory diseases, with a market cap of NT$74.87 billion.

Operations: Caliway Biopharmaceuticals generates its revenue through the development of small molecule drugs targeting medical aesthetics and inflammatory diseases.

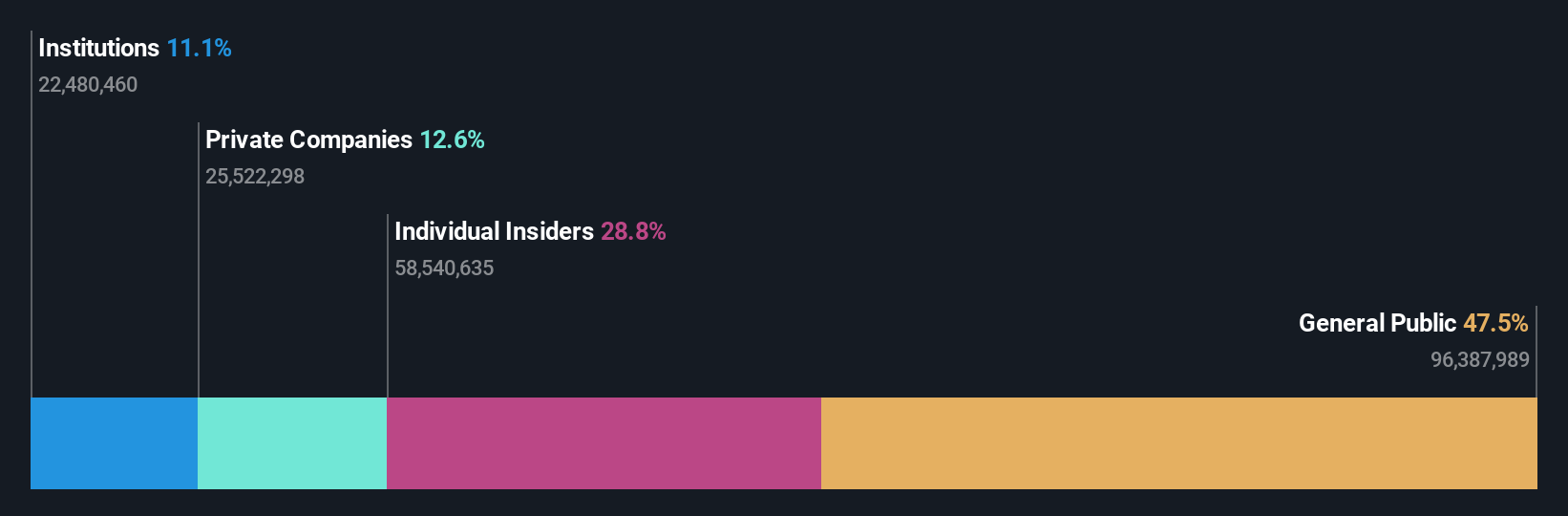

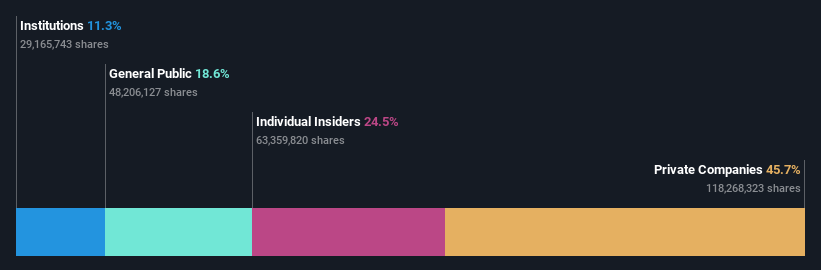

Insider Ownership: 26.9%

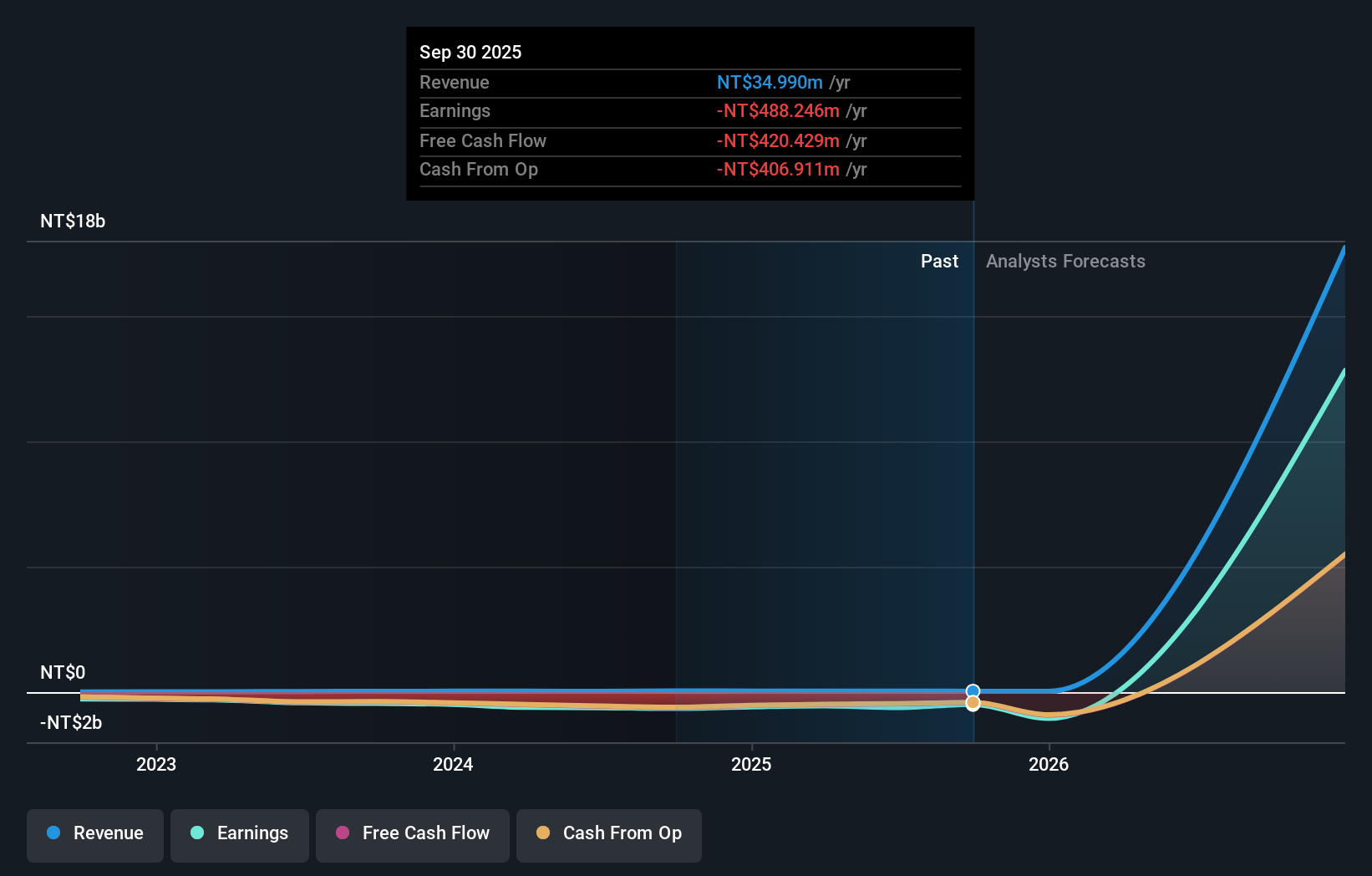

Earnings Growth Forecast: 182.1% p.a.

Caliway Biopharmaceuticals is projected to achieve substantial revenue growth, with forecasts suggesting a 242.7% annual increase, outpacing the broader market. Despite recent shareholder dilution and volatile share prices, the company trades significantly below its estimated fair value. Recent earnings reports reveal increased sales but also widened net losses. The completion of Phase 2b trials for CBL-514 could advance its pipeline significantly, potentially leading to profitability within three years as anticipated by analysts.

- Click to explore a detailed breakdown of our findings in Caliway Biopharmaceuticals' earnings growth report.

- Our valuation report here indicates Caliway Biopharmaceuticals may be undervalued.

Turning Ideas Into Actions

- Delve into our full catalog of 1541 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6919

Caliway Biopharmaceuticals

Caliway Biopharmaceuticals Co.Ltd develops small molecule drugs for medical aesthetic and inflammatory disease.

Excellent balance sheet slight.

Market Insights

Community Narratives