As global markets navigate choppy waters, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing the economic landscape for opportunities. Amidst this backdrop, identifying stocks with strong fundamentals and growth potential becomes crucial, especially in sectors resilient to current market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Runner (Xiamen) (SHSE:603408)

Simply Wall St Value Rating: ★★★★★★

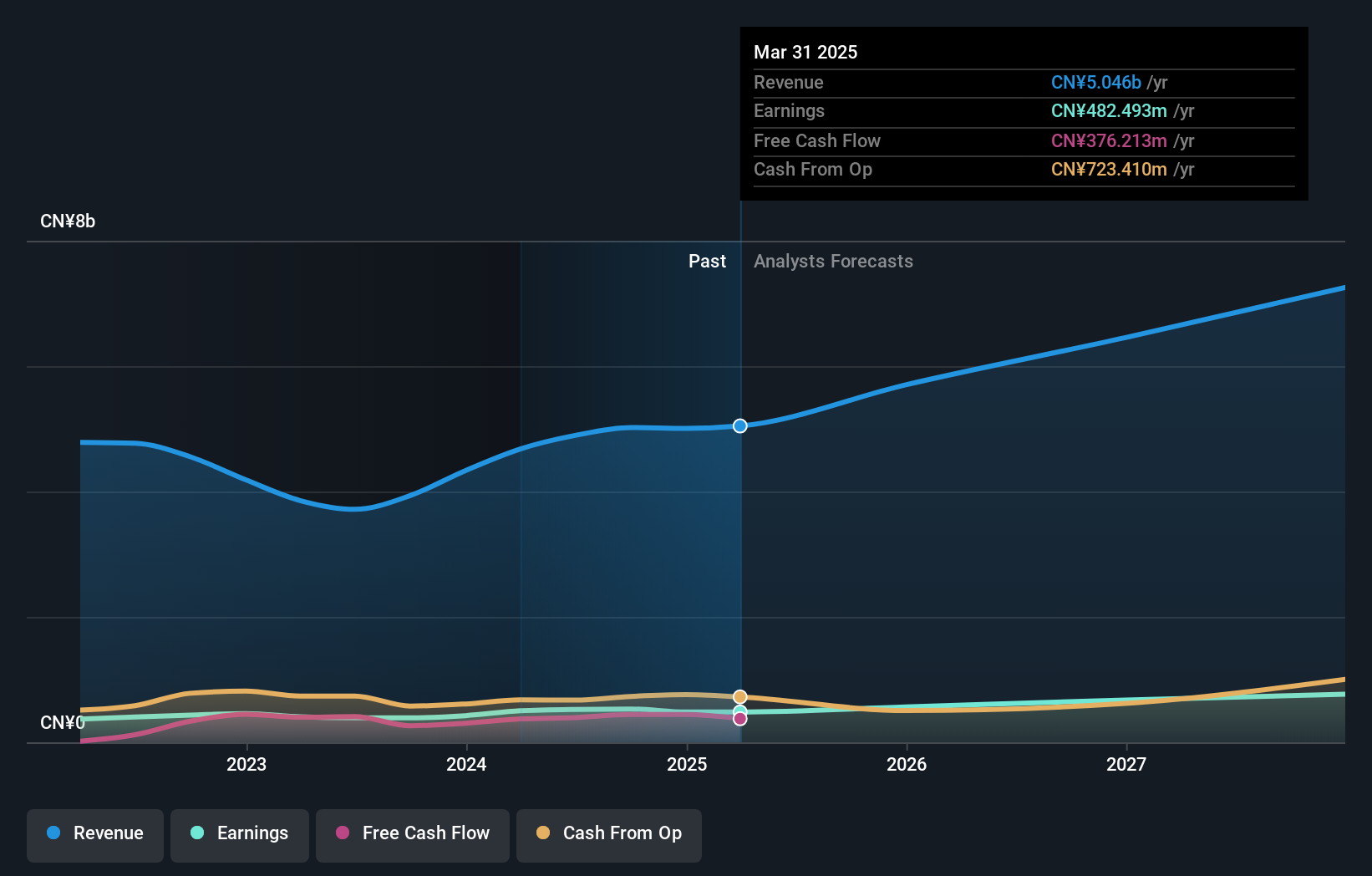

Overview: Runner (Xiamen) Corp. specializes in the R&D, design, production, and sale of kitchen and bathroom products as well as water purification products both domestically and internationally, with a market cap of CN¥5.81 billion.

Operations: Runner (Xiamen) generates revenue primarily from the sale of kitchen and bathroom products, along with water purification products. The company's gross profit margin currently stands at 28.5%, reflecting its pricing strategy and cost management in these product segments.

Runner (Xiamen) has shown impressive earnings growth of 35.9% over the past year, outpacing the building industry's -8%. The company is trading at a price-to-earnings ratio of 10.9x, which is favorable compared to the broader CN market's 34.1x. It reported sales of CNY 3.78 billion for the first nine months of 2024, up from CNY 3.09 billion in the previous year, with net income rising to CNY 396.6 million from CNY 290.2 million last year. With high-quality earnings and reduced debt-to-equity from 13.5% to 5.6% over five years, Runner seems well-positioned for future growth prospects.

- Get an in-depth perspective on Runner (Xiamen)'s performance by reading our health report here.

Evaluate Runner (Xiamen)'s historical performance by accessing our past performance report.

Shih Her Technologies (TPEX:3551)

Simply Wall St Value Rating: ★★★★★★

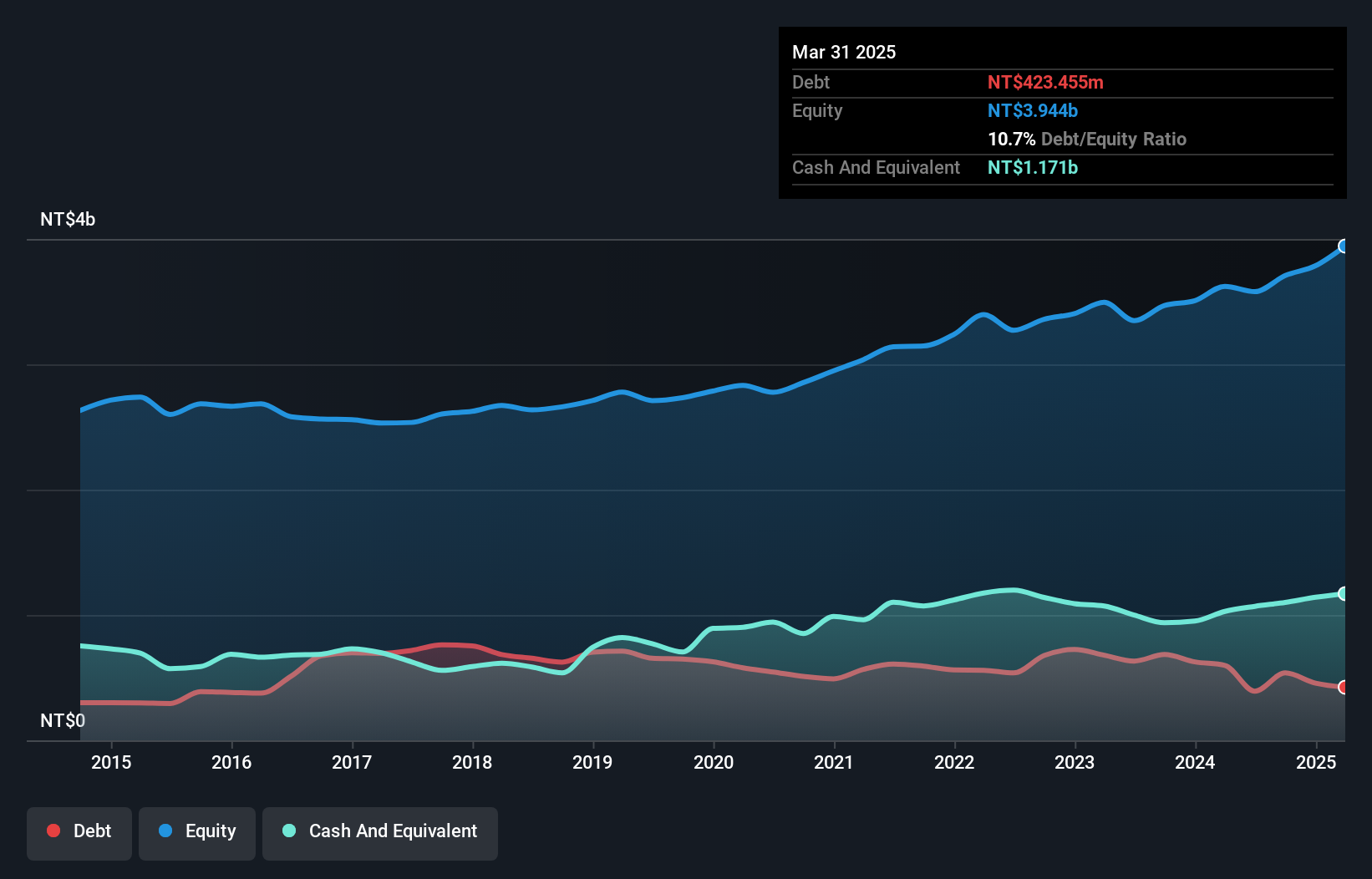

Overview: Shih Her Technologies Inc. specializes in precision cleaning and reborn treatment services for manufacturing equipment parts used in the semiconductor, photoelectricity, and solar energy industries, with a market capitalization of NT$8.24 billion.

Operations: The company generates revenue primarily from the Taiwanese region, with NT$2.03 billion attributed to its main operations and additional contributions from Changyu Technology and Yuanguang Technology Co., Ltd. Mainland Area contributes NT$430.11 million, while adjustments and eliminations account for a reduction of NT$91.40 million in total revenue.

Shih Her Technologies, a small player in the semiconductor space, has shown promising growth with earnings increasing by 10.9% over the past year, outpacing the industry's 5.9%. The company reported a significant boost in sales for Q3 2024 at TWD 645.75 million compared to TWD 552.27 million last year, and net income rose to TWD 96.32 million from TWD 66.42 million a year ago. With its debt-to-equity ratio reduced from 23.7% to 14.5% over five years and more cash than total debt, Shih Her appears financially sound despite recent share price volatility.

- Delve into the full analysis health report here for a deeper understanding of Shih Her Technologies.

North Pacific BankLtd (TSE:8524)

Simply Wall St Value Rating: ★★★★☆☆

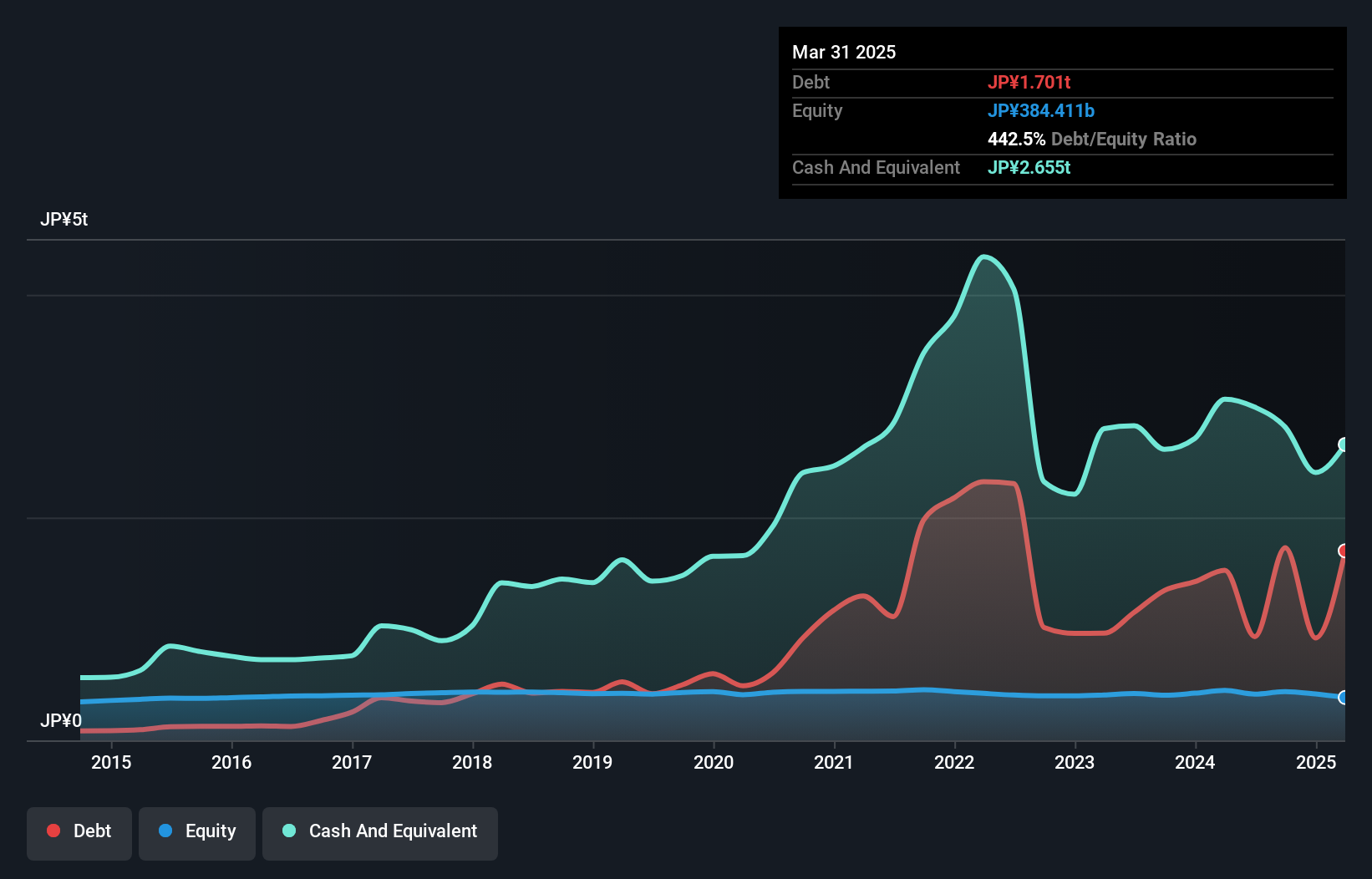

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market cap of ¥171.84 billion.

Operations: The primary revenue stream for North Pacific Bank, Ltd. is its banking segment, generating ¥112.17 billion, followed by its leasing business at ¥23.99 billion.

North Pacific Bank, with total assets of ¥13.25 trillion and equity of ¥437.5 billion, has been making waves with its impressive earnings growth of 66.6% over the past year, outpacing the industry average of 22.6%. The bank's total deposits stand at ¥10.89 trillion against loans totaling ¥7.48 trillion, reflecting a net interest margin of 0.6%. Despite having an appropriate level of bad loans at 1.2%, it holds a low allowance for these at just 48%. Recently, it increased its dividend to ¥6.50 per share from last year's ¥5, signaling confidence in future prospects.

- Unlock comprehensive insights into our analysis of North Pacific BankLtd stock in this health report.

Assess North Pacific BankLtd's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 4628 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603408

Runner (Xiamen)

Engages in the research and development, design, production, and sale of kitchen and bathroom products, water purification products, and other products in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives