The Market Lifts Hunan Oil Pump Co., Ltd. (SHSE:603319) Shares 41% But It Can Do More

Despite an already strong run, Hunan Oil Pump Co., Ltd. (SHSE:603319) shares have been powering on, with a gain of 41% in the last thirty days. The last 30 days bring the annual gain to a very sharp 41%.

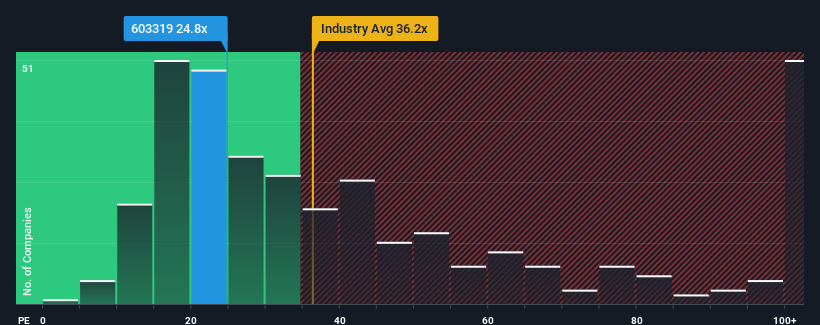

In spite of the firm bounce in price, Hunan Oil Pump's price-to-earnings (or "P/E") ratio of 24.8x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 74x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hunan Oil Pump's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Hunan Oil Pump

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Hunan Oil Pump would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.4%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 21% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 43% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to expand by 40%, which is not materially different.

In light of this, it's peculiar that Hunan Oil Pump's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Hunan Oil Pump's P/E?

Despite Hunan Oil Pump's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hunan Oil Pump currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Hunan Oil Pump that you should be aware of.

You might be able to find a better investment than Hunan Oil Pump. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hunan Oil Pump might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603319

Hunan Oil Pump

Engages in the manufacture and sale of oil pumps in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives