- China

- /

- Electrical

- /

- SHSE:603303

Hengdian Group Tospo Lighting Co., Ltd. (SHSE:603303) Stock Catapults 26% Though Its Price And Business Still Lag The Market

Those holding Hengdian Group Tospo Lighting Co., Ltd. (SHSE:603303) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

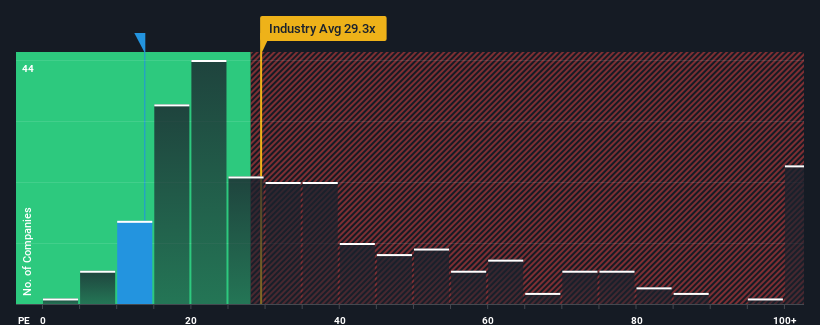

Even after such a large jump in price, Hengdian Group Tospo Lighting's price-to-earnings (or "P/E") ratio of 13.7x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Hengdian Group Tospo Lighting certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Hengdian Group Tospo Lighting

How Is Hengdian Group Tospo Lighting's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Hengdian Group Tospo Lighting's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 51%. EPS has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 8.3% over the next year. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Hengdian Group Tospo Lighting's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Hengdian Group Tospo Lighting's P/E

Even after such a strong price move, Hengdian Group Tospo Lighting's P/E still trails the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hengdian Group Tospo Lighting's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Hengdian Group Tospo Lighting that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hengdian Group Tospo Lighting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603303

Hengdian Group Tospo Lighting

Engages in the research and development, production, sale, and servicing of civil, commercial, and automotive lighting products in China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives