Jingjin Equipment Inc.'s (SHSE:603279) Earnings Are Not Doing Enough For Some Investors

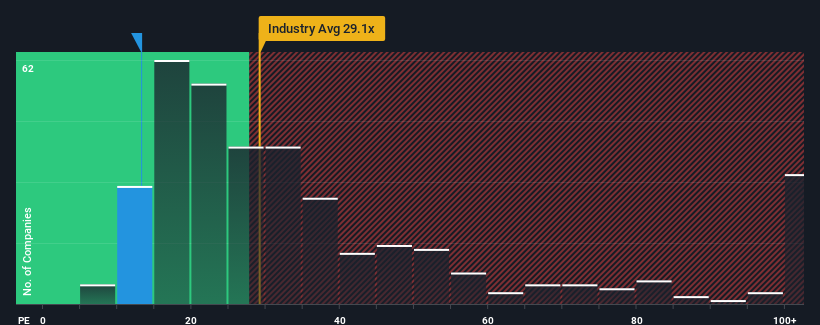

With a price-to-earnings (or "P/E") ratio of 13.2x Jingjin Equipment Inc. (SHSE:603279) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 53x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Jingjin Equipment has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Jingjin Equipment

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Jingjin Equipment's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 123% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 16% over the next year. Meanwhile, the rest of the market is forecast to expand by 35%, which is noticeably more attractive.

With this information, we can see why Jingjin Equipment is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Jingjin Equipment's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Jingjin Equipment that you need to take into consideration.

If these risks are making you reconsider your opinion on Jingjin Equipment, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Jingjin Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603279

Jingjin Equipment

Offers environmental protection products and services in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives