- Thailand

- /

- Infrastructure

- /

- SET:SAV

Discovering Undiscovered Gems with Potential This February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic indicators, with major indices like the S&P 500 experiencing slight declines amid these challenges. Despite this backdrop, small-cap stocks present intriguing opportunities for investors seeking growth potential, especially as manufacturing activity shows signs of expansion after a prolonged contraction. Identifying promising small-cap stocks involves looking for companies with strong fundamentals and resilience in the face of broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Soulbrain Holdings (KOSDAQ:A036830)

Simply Wall St Value Rating: ★★★★★★

Overview: Soulbrain Holdings Co., Ltd. is engaged in the development, manufacturing, and supply of core materials for the semiconductor, display, and secondary battery cell industries both in South Korea and internationally, with a market cap of approximately ₩730.39 billion.

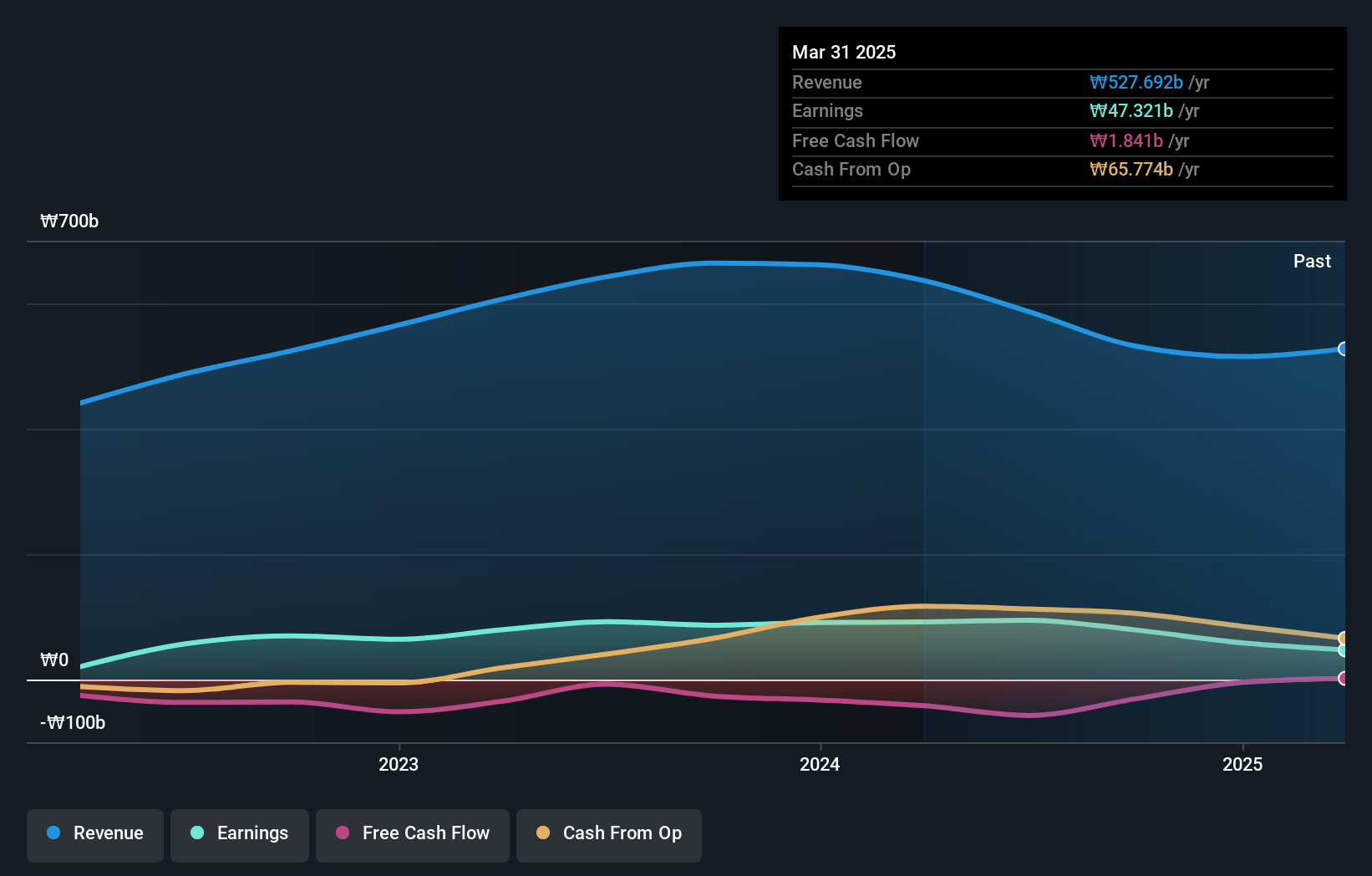

Operations: Soulbrain Holdings generates revenue primarily through its product manufacturing segment, contributing ₩369.61 billion, and its distribution and service segment, which adds ₩108.98 billion.

Soulbrain Holdings, a smaller player in the chemicals sector, is trading significantly below its estimated fair value by 77.5%, which might catch the eye of some investors. Over the past five years, it has reduced its debt to equity ratio from 19.7% to 14.4%, indicating prudent financial management. However, recent earnings have not kept pace with industry growth rates, showing an -8.7% change compared to a sector average of 20.9%. Despite this, the company’s interest payments are well covered with EBIT at 6.8 times interest repayments and it recently announced a share repurchase program worth KRW 10 billion aimed at stabilizing stock prices and enhancing shareholder value.

- Click here to discover the nuances of Soulbrain Holdings with our detailed analytical health report.

Samart Aviation Solutions (SET:SAV)

Simply Wall St Value Rating: ★★★★★★

Overview: Samart Aviation Solutions Public Company Limited is an investment holding company that offers air traffic control services in Cambodia, with a market cap of THB11.78 billion.

Operations: Samart Aviation Solutions generates revenue primarily from utilities and transportation services, amounting to THB1.82 billion.

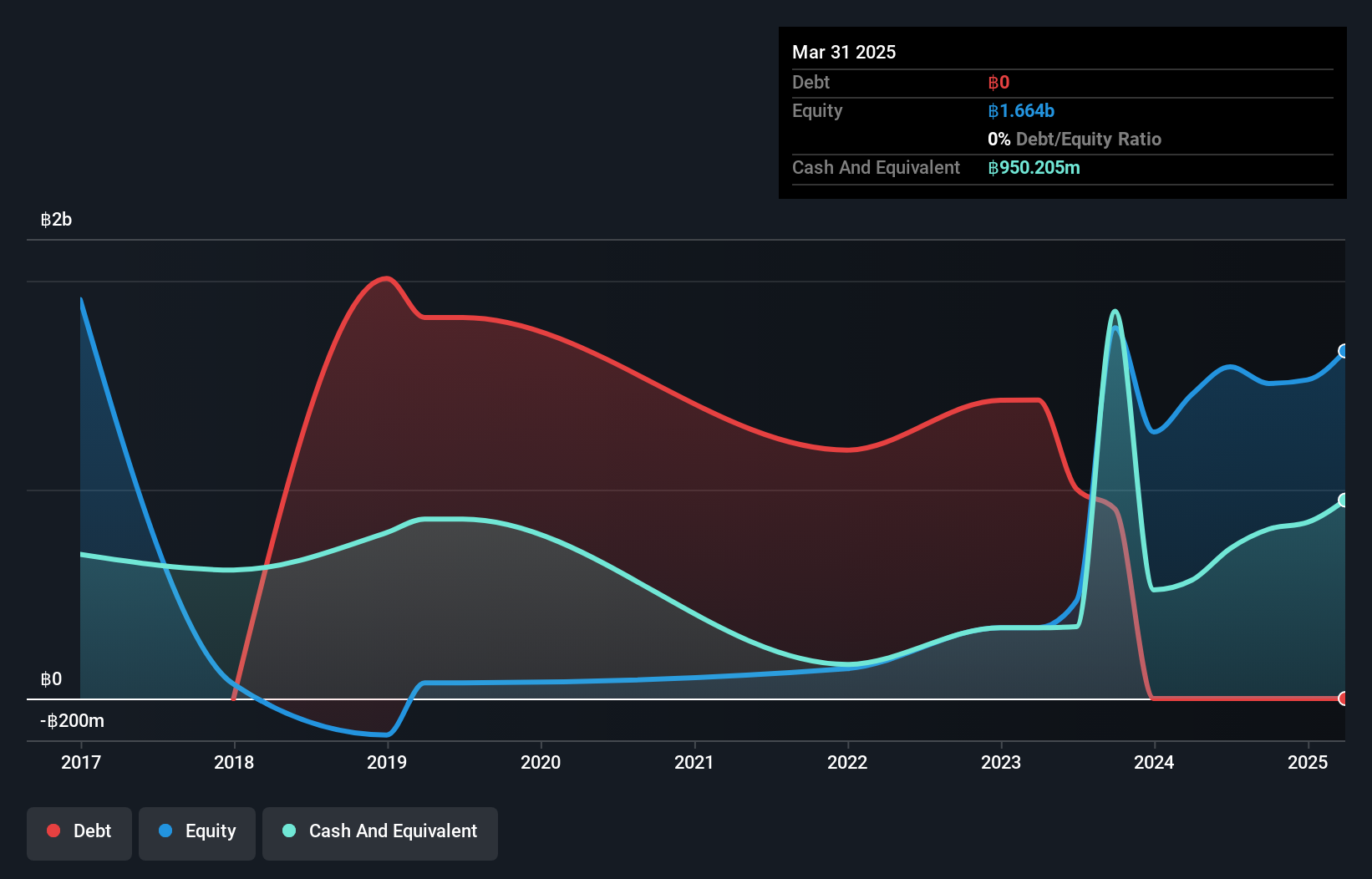

Samart Aviation Solutions, a nimble player in the aviation sector, showcases strong financial health with no debt, a significant improvement from its previous 2162% debt-to-equity ratio five years ago. The company boasts high-quality earnings and has seen an impressive 49% earnings growth over the past year, outpacing the infrastructure industry's average of 20%. With free cash flow reaching US$456.22 million recently and consistent profitability ensuring a solid cash runway, Samart is well-positioned for future expansion. Earnings are projected to grow by 17% annually, indicating promising prospects in this competitive field.

- Navigate through the intricacies of Samart Aviation Solutions with our comprehensive health report here.

Assess Samart Aviation Solutions' past performance with our detailed historical performance reports.

Jiangsu Hengshang Energy Conservation Technology (SHSE:603137)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Hengshang Energy Conservation Technology Co., Ltd. operates in the energy conservation sector and has a market cap of CN¥2.20 billion.

Operations: Hengshang Energy Conservation Technology generates revenue primarily from its energy conservation products and services. The company's net profit margin is a key financial metric, reflecting its profitability efficiency in the sector.

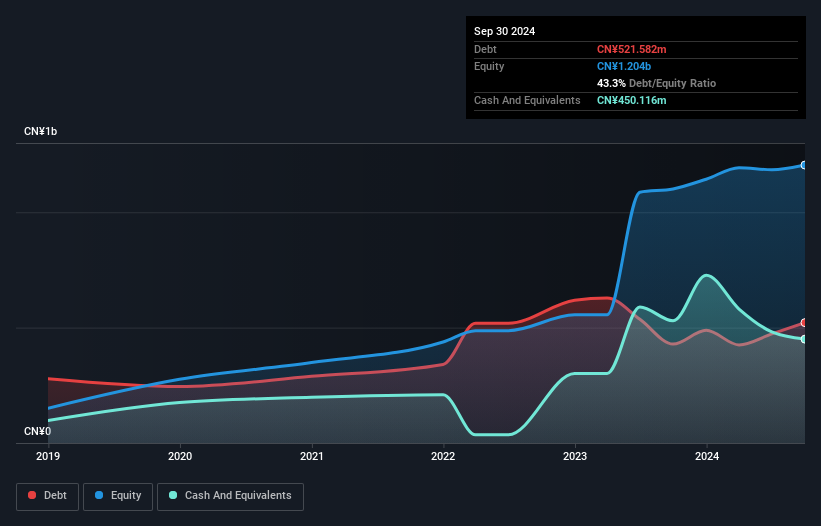

Jiangsu Hengshang Energy Conservation Technology, a smaller player in the market, presents an intriguing profile with its debt to equity ratio dropping from 103.6% to 43.3% over five years, indicating improved financial stability. Its price-to-earnings ratio of 16.9x is notably lower than the Chinese market average of 37.1x, suggesting potential undervaluation. Despite negative earnings growth of -3.3% last year compared to the industry average of -8%, it maintains high-quality earnings and satisfactory net debt levels at 5.9%. The company's EBIT covers interest payments comfortably at a rate of 10.6x, enhancing its financial robustness amidst sector challenges.

Where To Now?

- Discover the full array of 4708 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SAV

Samart Aviation Solutions

An investment holding company, provides air traffic control services in Cambodia, Laos, and Thailand.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives