3 Growth Companies With High Insider Ownership And Up To 32% Revenue Growth

Reviewed by Simply Wall St

In a week marked by record highs in major U.S. stock indexes and a notable outperformance of growth shares over value stocks, the global market landscape continues to be shaped by economic data and geopolitical developments. As investors navigate these conditions, identifying growth companies with substantial insider ownership can offer insights into potential long-term value, as such ownership often signals confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningbo Lehui International Engineering EquipmentLtd (SHSE:603076)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Lehui International Engineering Equipment Ltd (SHSE:603076) specializes in the manufacturing of engineering equipment, with a market cap of CN¥2.87 billion.

Operations: Revenue segments for SHSE:603076 are not provided in the available text.

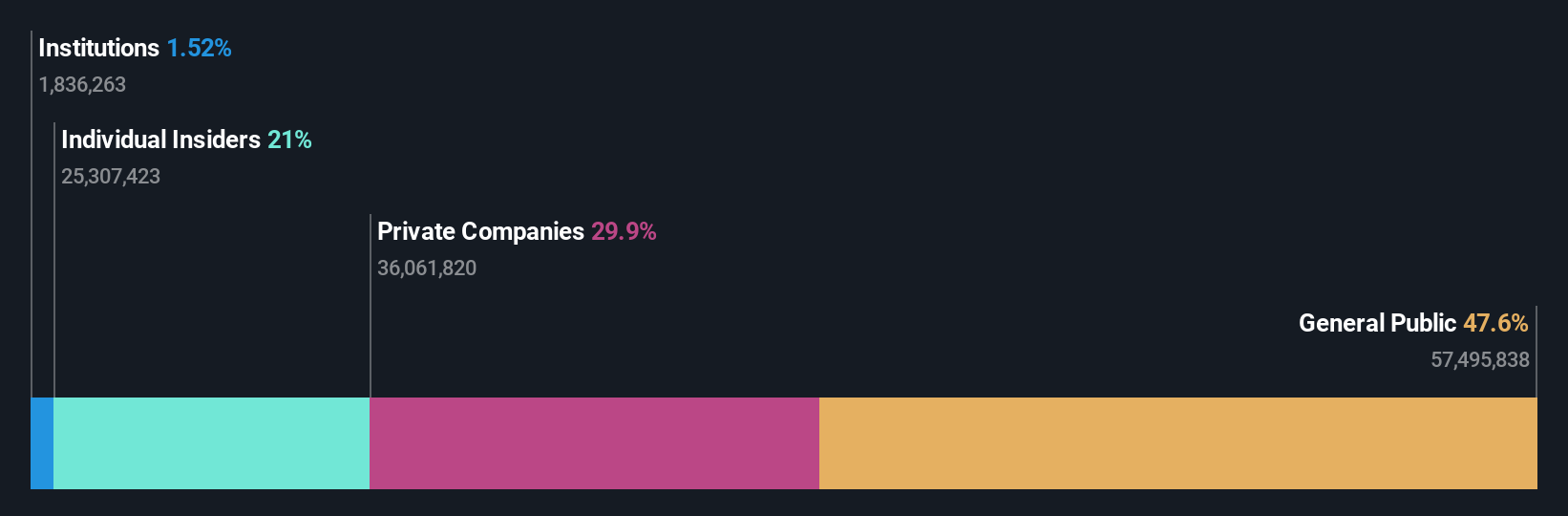

Insider Ownership: 21.2%

Revenue Growth Forecast: 15.2% p.a.

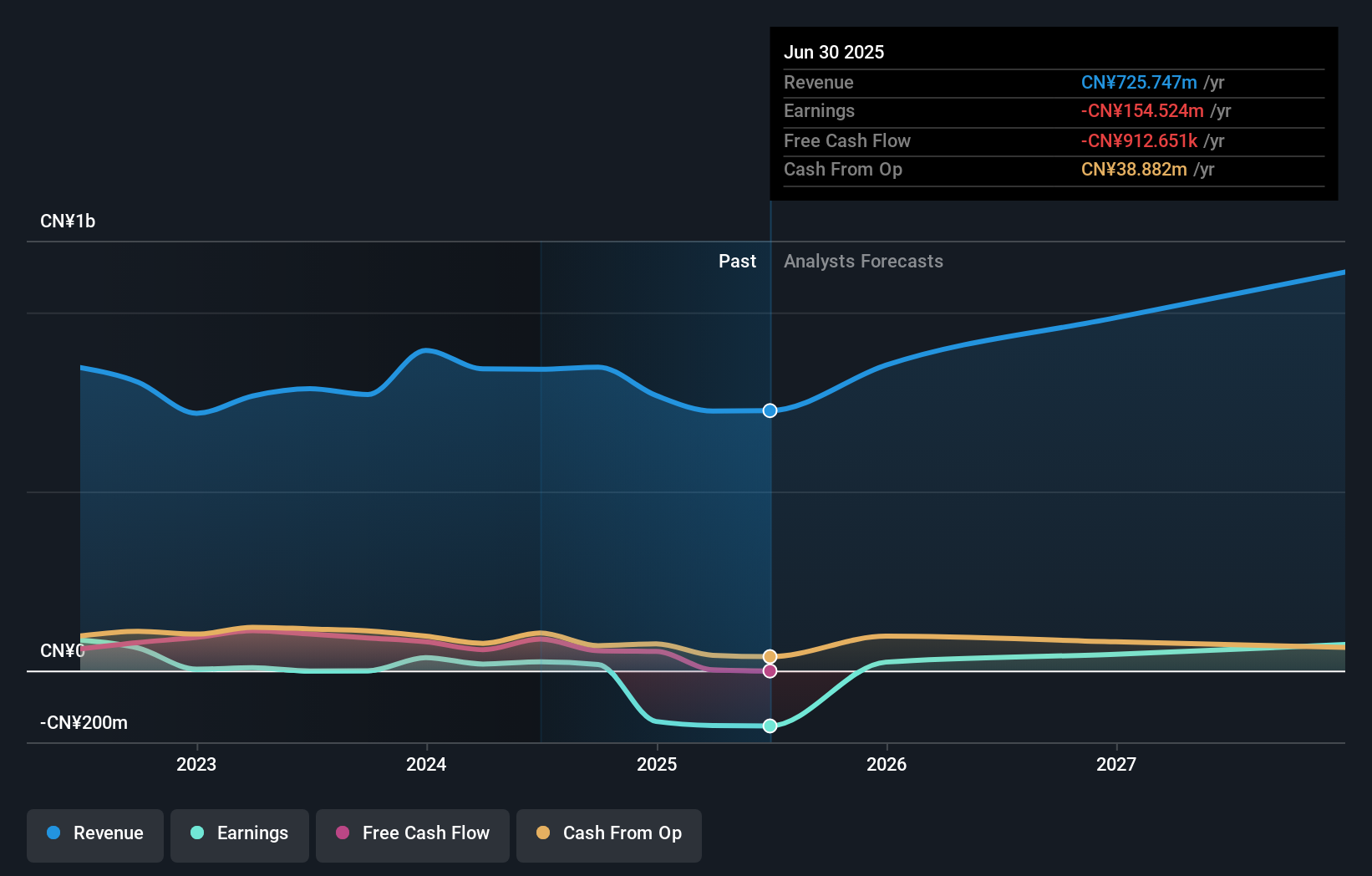

Ningbo Lehui International Engineering Equipment Ltd. demonstrates significant growth potential with earnings expected to grow 63.4% annually over the next three years, outpacing the Chinese market's 25.9%. Despite a decline in sales to CNY 947.08 million for nine months ending September 2024, net income increased slightly to CNY 40.53 million. The company faces challenges with an unstable dividend track record and low forecasted return on equity of 7.9% in three years, but maintains high insider ownership stability without recent trading activity among insiders.

- Click to explore a detailed breakdown of our findings in Ningbo Lehui International Engineering EquipmentLtd's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Ningbo Lehui International Engineering EquipmentLtd shares in the market.

Vanchip (Tianjin) Technology (SHSE:688153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vanchip (Tianjin) Technology Co., Ltd. is a Chinese company that designs, manufactures, and sells radio frequency front end and high end analog chips, with a market cap of CN¥17.23 billion.

Operations: The company's revenue is primarily generated from its Electronic Components & Parts segment, totaling CN¥2.86 billion.

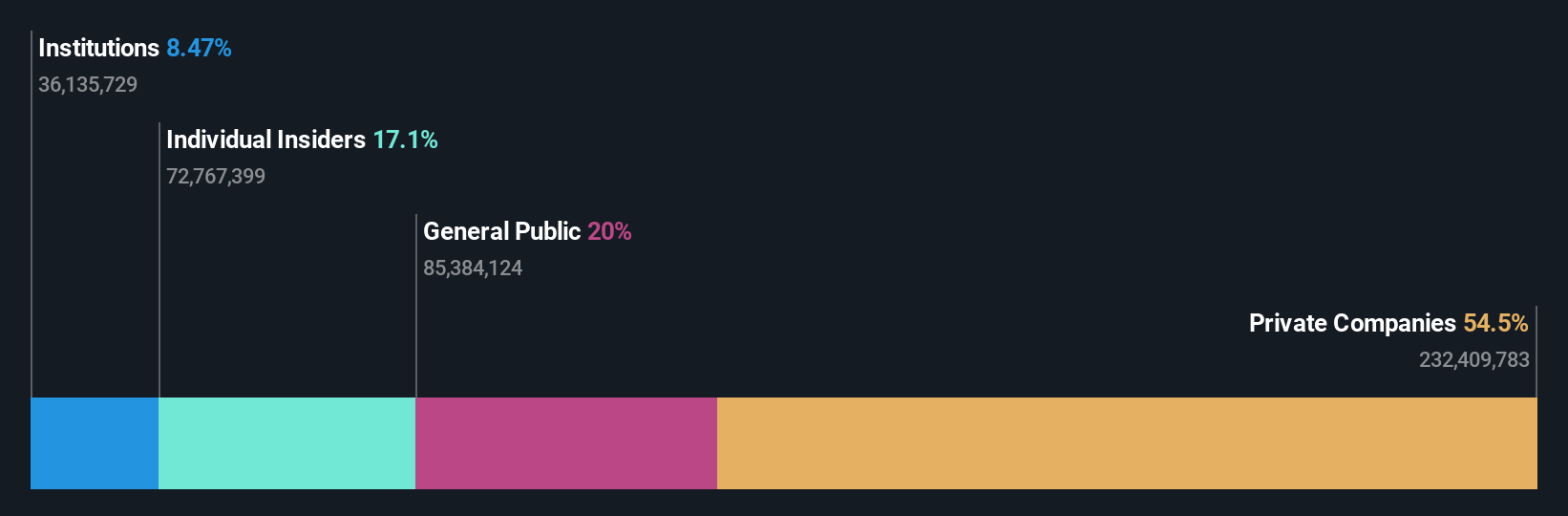

Insider Ownership: 16.9%

Revenue Growth Forecast: 32.1% p.a.

Vanchip (Tianjin) Technology is poised for robust growth with earnings projected to increase 86.17% annually, surpassing the Chinese market's growth rate. However, recent financials show a net loss of CNY 32.12 million for the first nine months of 2024, alongside declining sales of CNY 1.49 billion from the previous year. Despite high revenue growth expectations at 32.1%, insider ownership stability is challenged by past shareholder dilution and no recent insider trading activity.

- Click here to discover the nuances of Vanchip (Tianjin) Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Vanchip (Tianjin) Technology implies its share price may be lower than expected.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. produces and sells smart sensors and optoelectronic instrument products, with a market cap of CN¥4.08 billion.

Operations: The company's revenue segments include smart sensors and optoelectronic instrument products.

Insider Ownership: 30.7%

Revenue Growth Forecast: 19.3% p.a.

Beijing Beetech shows potential for significant earnings growth, projected at 55.3% annually, outpacing the Chinese market's 25.9%. However, recent financials reveal a net loss of CNY 3.76 million for the first nine months of 2024, with sales declining to CNY 518.63 million from the previous year. Despite a lack of recent insider trading activity and high share price volatility, revenue is expected to grow faster than the market at 19.3% annually.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Beetech.

- Our valuation report here indicates Beijing Beetech may be overvalued.

Make It Happen

- Discover the full array of 1509 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Lehui International Engineering EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603076

Ningbo Lehui International Engineering EquipmentLtd

Ningbo Lehui International Engineering Equipment Co.,Ltd.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives