- China

- /

- Electrical

- /

- SHSE:603063

With EPS Growth And More, Shenzhen Hopewind Electric (SHSE:603063) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Shenzhen Hopewind Electric (SHSE:603063). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Shenzhen Hopewind Electric

How Fast Is Shenzhen Hopewind Electric Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Shenzhen Hopewind Electric grew its EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Shenzhen Hopewind Electric shareholders is that EBIT margins have grown from 10% to 15% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

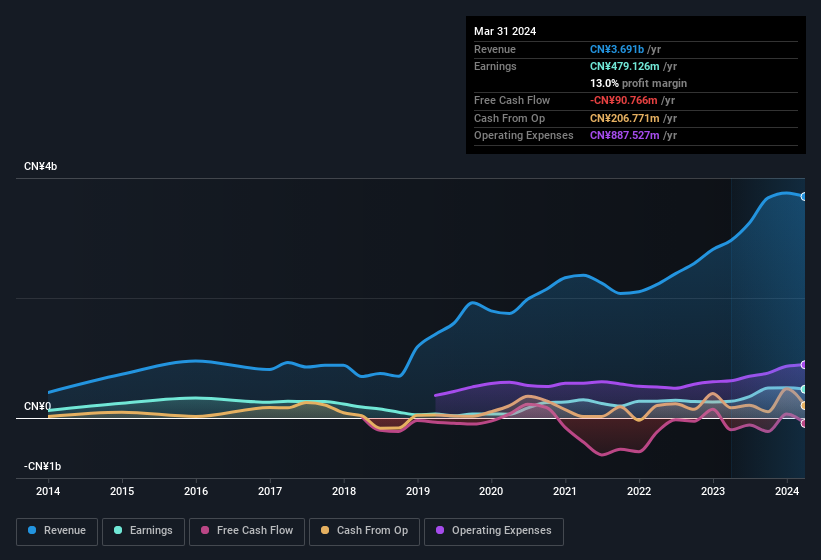

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Shenzhen Hopewind Electric's future profits.

Are Shenzhen Hopewind Electric Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Shenzhen Hopewind Electric insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥2.2b. That equates to 30% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Shenzhen Hopewind Electric, with market caps between CN¥2.9b and CN¥12b, is around CN¥963k.

The Shenzhen Hopewind Electric CEO received CN¥675k in compensation for the year ending December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Shenzhen Hopewind Electric Worth Keeping An Eye On?

One important encouraging feature of Shenzhen Hopewind Electric is that it is growing profits. The growth of EPS may be the eye-catching headline for Shenzhen Hopewind Electric, but there's more to bring joy for shareholders. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. Even so, be aware that Shenzhen Hopewind Electric is showing 1 warning sign in our investment analysis , you should know about...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603063

Shenzhen Hopewind Electric

Engages in the research and development, manufacture, sale, and service of energy and electric drive products.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives