- China

- /

- Electrical

- /

- SHSE:603031

Exploring Global Undiscovered Gems with Solid Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by hopes for interest rate cuts and mixed economic indicators, small-cap stocks have shown resilience, with the Russell 2000 Index rising amidst these fluctuations. In such a dynamic environment, identifying undiscovered gems with solid potential often involves seeking companies that demonstrate strong fundamentals and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiamen Jihong | 17.57% | 6.86% | -18.83% | ★★★★★★ |

| ASIX Electronics | NA | -2.46% | -3.16% | ★★★★★★ |

| 104 | NA | 9.90% | 10.14% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 44.30% | -13.35% | 24.08% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Zhongyeda Electric | 0.41% | -0.88% | -14.90% | ★★★★★☆ |

| KNJ | 65.48% | 8.93% | 40.98% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 11.75% | 17.91% | -3.17% | ★★★★★☆ |

| Sichuan Zigong Conveying Machine Group | 54.32% | 21.85% | 16.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Anhui Anfu Battery TechnologyLtd (SHSE:603031)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Anfu Battery Technology Co., Ltd, along with its subsidiaries, focuses on the research, development, production, and sales of batteries both within China and internationally with a market capitalization of CN¥10.36 billion.

Operations: Anfu Battery generates revenue primarily from the production and sale of batteries. The company's financial performance is highlighted by a notable gross profit margin trend, which has shown fluctuations over recent periods. It operates within a market capitalization of CN¥10.36 billion, reflecting its scale in the battery industry.

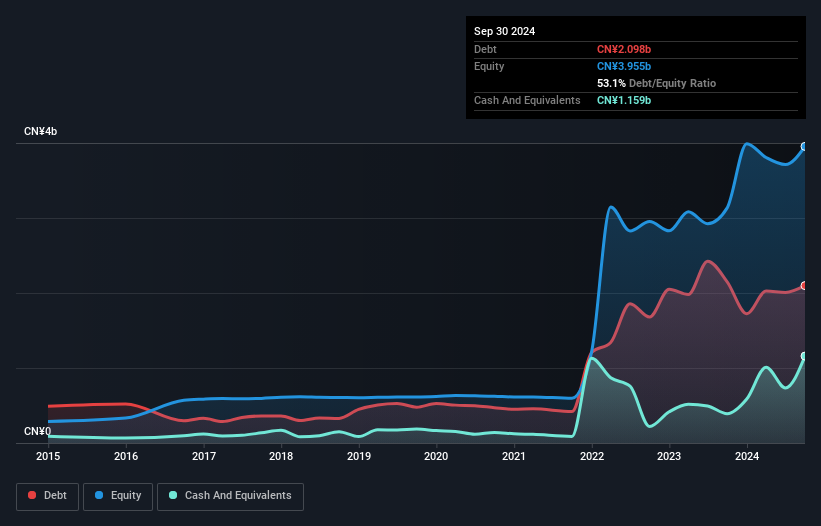

Anhui Anfu Battery Technology has shown promising financial health with a debt to equity ratio improving from 75.5% to 43.8% over five years, indicating effective management of liabilities. Their net debt to equity ratio stands at a satisfactory 2.7%, reflecting robust fiscal discipline. Earnings have surged by 18.4% in the past year, outpacing the electrical industry average of 3.3%, highlighting strong operational performance and growth potential in their niche market segment. Recent earnings reports show net income rising to CNY 174 million compared to CNY 150 million last year, with basic earnings per share increasing from CNY 0.71 to CNY 0.81, reinforcing its solid profitability trajectory.

Huatu Cendes (SZSE:300492)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huatu Cendes Co., Ltd. is an architectural design company that offers professional design, consulting, and engineering services to a diverse range of clients in China, with a market cap of CN¥13.96 billion.

Operations: Huatu Cendes generates revenue through its architectural design, consulting, and engineering services offered to various enterprises and government agencies in China. The company's financial performance is characterized by a focus on providing specialized services across different client segments.

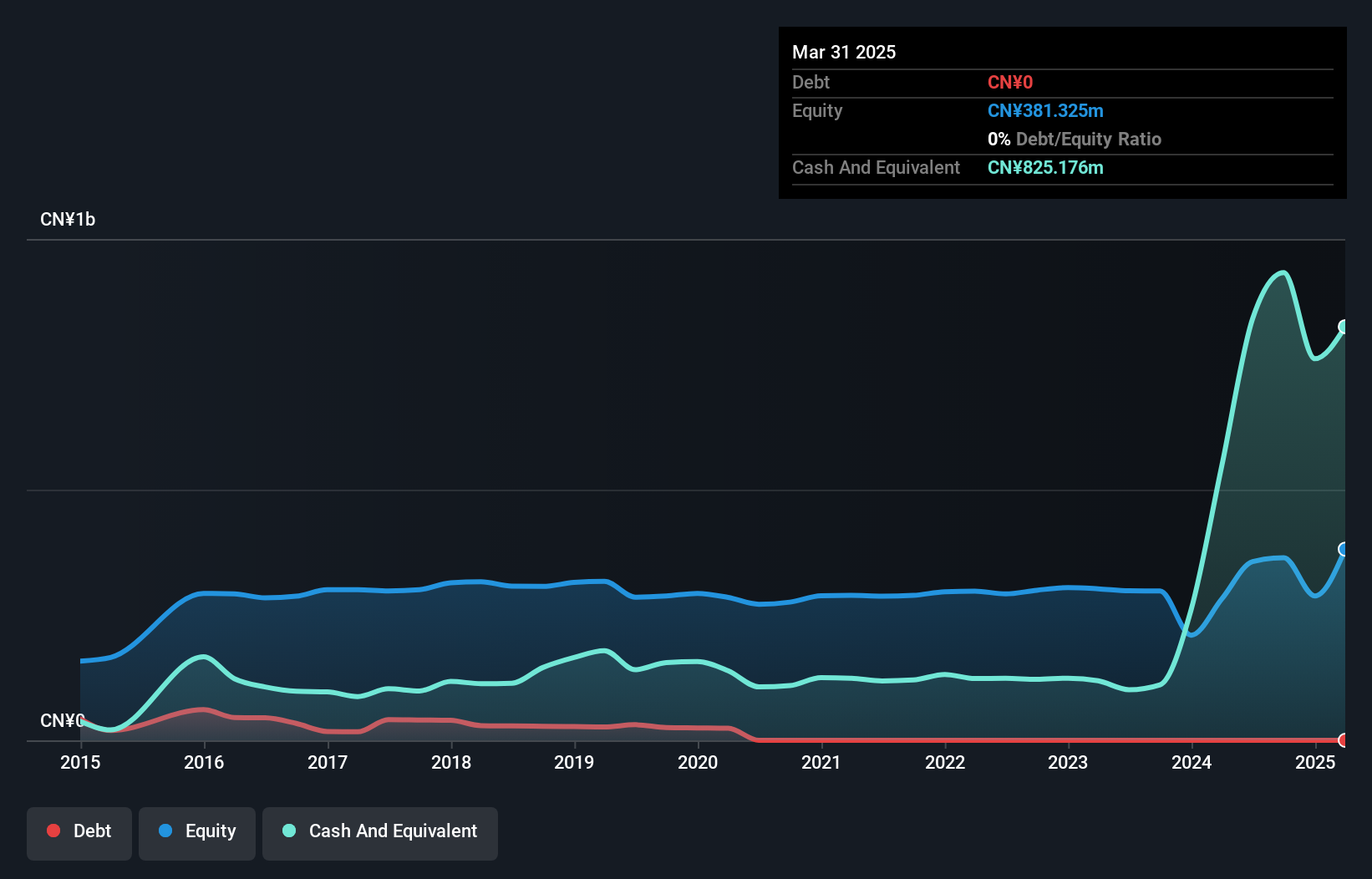

Huatu Cendes is making waves with impressive financial strides, reporting CNY 2.46 billion in sales for the first nine months of 2025, up from CNY 2.13 billion the previous year. Net income also saw a boost to CNY 249 million from last year's CNY 129 million, showcasing strong growth momentum. Despite a rise in debt to equity ratio to 104%, earnings growth outpaced the industry at an astonishing rate of over 319% last year. The company has proposed a dividend payout of CNY 5 per ten shares, reflecting confidence in its financial health and future prospects amidst ongoing strategic adjustments.

- Unlock comprehensive insights into our analysis of Huatu Cendes stock in this health report.

Assess Huatu Cendes' past performance with our detailed historical performance reports.

Shanghai Zhongzhou Special Alloy Materials (SZSE:300963)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Zhongzhou Special Alloy Materials Co., Ltd. operates in the special alloy materials industry, with a market capitalization of CN¥8.94 billion.

Operations: The company generates revenue primarily from the production and sale of special alloy materials. It has a market capitalization of CN¥8.94 billion.

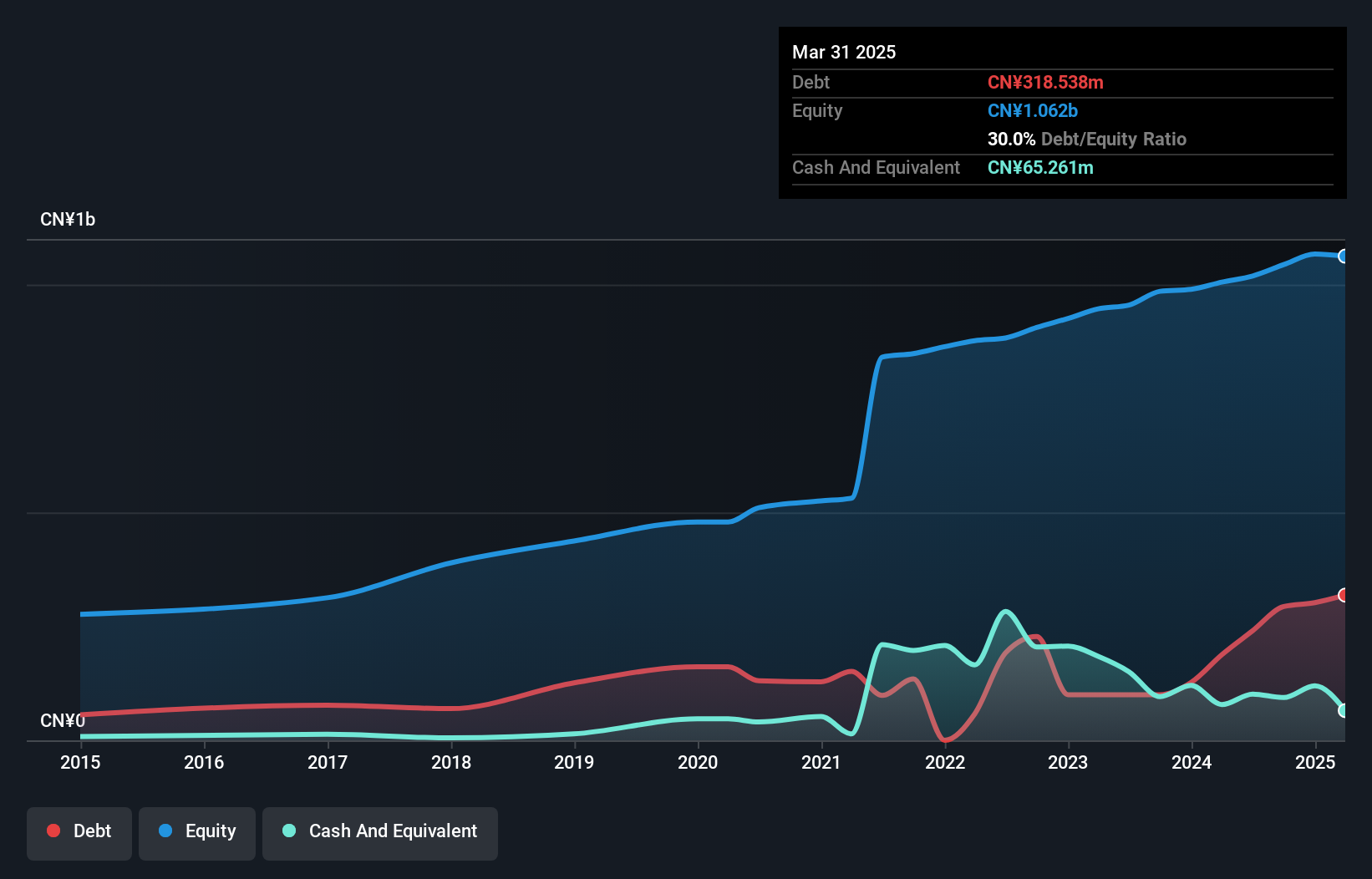

Shanghai Zhongzhou Special Alloy Materials has shown mixed performance recently. Despite the challenging backdrop, its EBIT covers interest payments 10.4 times over, indicating strong financial health in that area. However, earnings took a hit with a net income of CNY 53.84 million for the nine months ending September 2025 compared to CNY 72.79 million previously, while sales dropped from CNY 807.14 million to CNY 688.27 million year-over-year. The company's debt-to-equity ratio rose from 25% to 36% over five years but remains satisfactory at a net debt level of about 32%. Earnings per share also decreased from CNY 0.16 to CNY 0.12 during this period, reflecting these pressures on profitability and growth prospects amidst industry challenges and volatile market conditions.

Make It Happen

- Navigate through the entire inventory of 3006 Global Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603031

Anhui Anfu Battery TechnologyLtd

Researches, develops, produces, and sells batteries in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026