- Philippines

- /

- Industrials

- /

- PSE:LTG

Unveiling Undiscovered Gems In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by record highs in major indexes like the S&P 500 and Nasdaq Composite, small-cap stocks have experienced a mixed performance, with the Russell 2000 Index seeing declines after recent outperformance. In this environment of economic shifts and sector dispersion, identifying promising small-cap stocks requires a keen focus on companies that exhibit resilience and growth potential amid evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| CHT Security | NA | 11.75% | 35.75% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Kinpo Electronics | 126.70% | 5.77% | 32.85% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

LT Group (PSE:LTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: LT Group, Inc. operates in the banking, distilled spirits, beverages, tobacco, property development, and other sectors both in the Philippines and internationally with a market capitalization of ₱111.63 billion.

Operations: LT Group, Inc. generates revenue primarily from its banking sector, contributing ₱73.11 billion, followed by distilled spirits at ₱33.12 billion and beverages at ₱18.38 billion. The company's net profit margin shows a notable trend of 24%, reflecting its profitability across these diverse sectors.

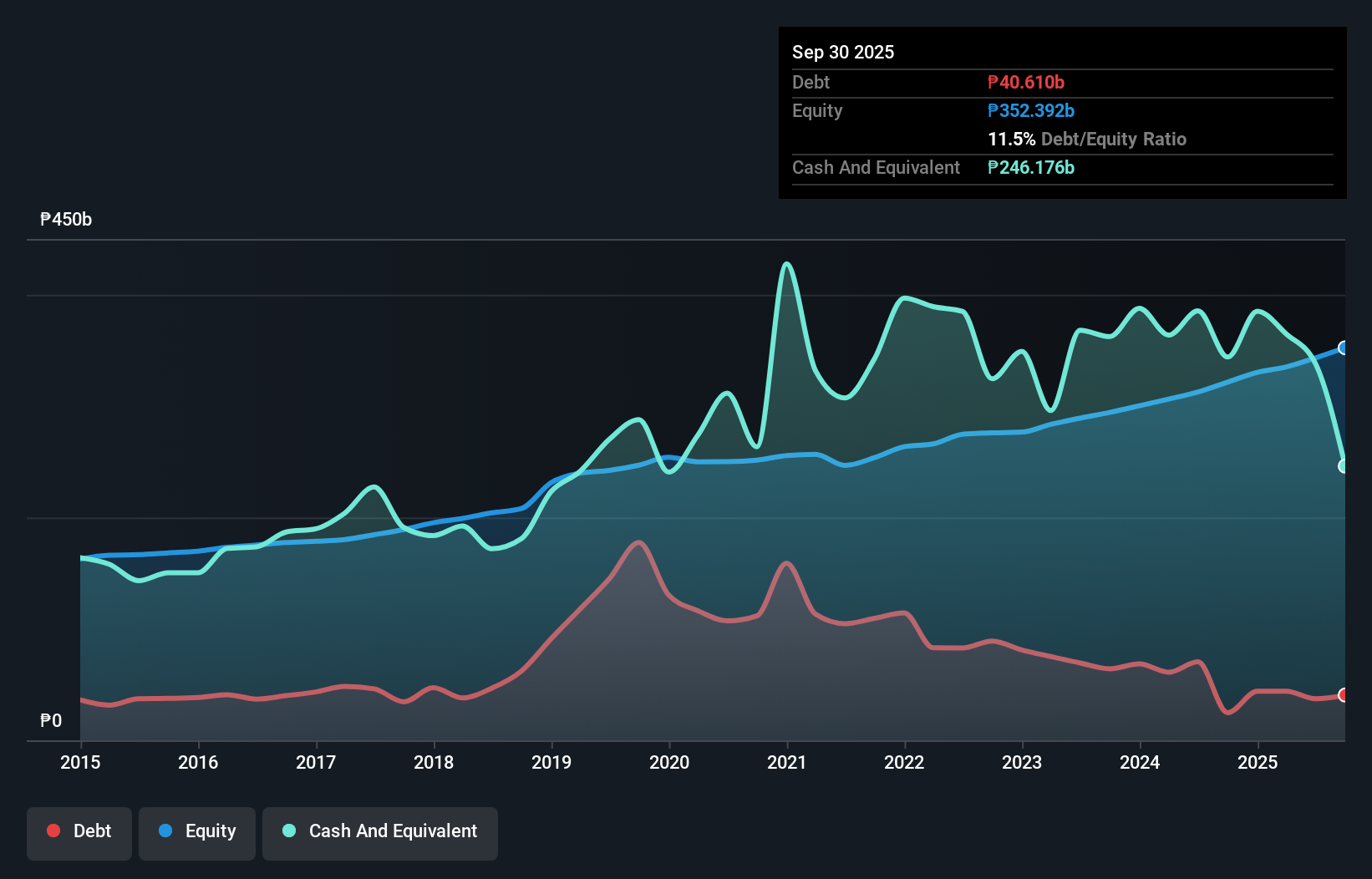

LT Group, a notable player in its sector, showcases robust financial health with a debt-to-equity ratio reduced to 7.7% over five years and interest payments well-covered by EBIT at 70.7 times. Despite earnings growth of 8.5% last year not surpassing the Industrials industry average of 10.7%, LTG remains profitable with positive free cash flow and more cash than total debt. Trading at a price-to-earnings ratio of 4.3x, significantly below the Philippine market's average of 9.4x, it offers good relative value compared to peers, supported by high-quality past earnings and recent revenue growth to PHP 34 billion in Q3 from PHP 30 billion last year.

Shanghai Guangdian Electric Group (SHSE:601616)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Guangdian Electric Group Co., Ltd. operates in the electrical equipment manufacturing sector, focusing on transmission and distribution control equipment, with a market capitalization of CN¥3.47 billion.

Operations: Shanghai Guangdian Electric Group generates revenue primarily from its transmission and distribution control equipment manufacturing segment, amounting to CN¥935.54 million.

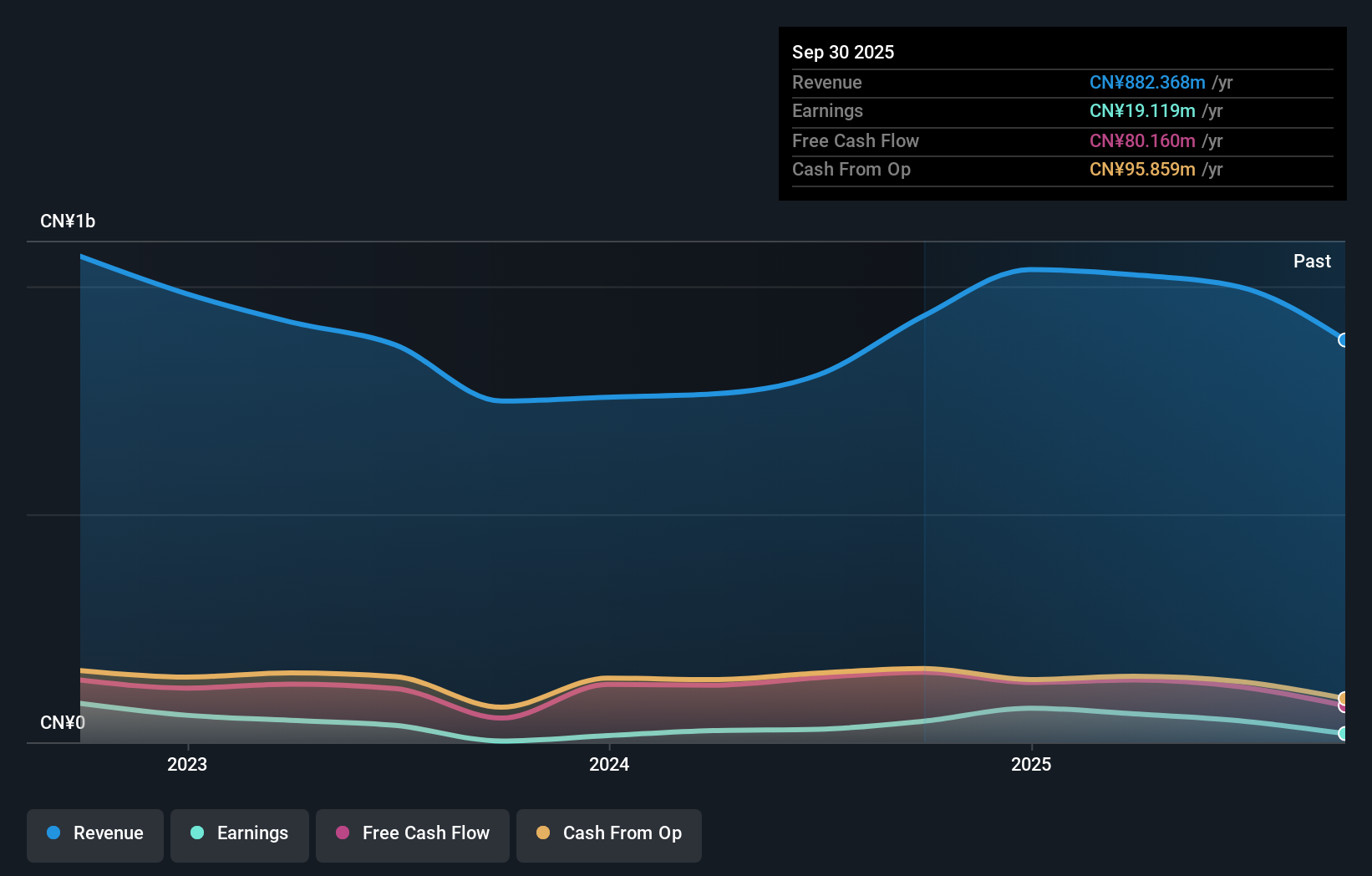

Shanghai Guangdian Electric Group is making waves with impressive earnings growth of 1568% over the past year, outpacing the electrical industry's 1.6%. This small cap is debt-free, eliminating concerns about interest coverage. Recent results show a net income of CNY 47.95 million for nine months ending September 2024, up from CNY 16.11 million a year earlier, with sales climbing to CNY 736.19 million from CNY 557.48 million in the same period last year. Despite a notable one-off gain of CN¥15.6M impacting recent financials, it remains profitable and free cash flow positive at CN¥153.66M as of September 2024.

- Take a closer look at Shanghai Guangdian Electric Group's potential here in our health report.

Understand Shanghai Guangdian Electric Group's track record by examining our Past report.

Taiwan Speciality Chemicals (TPEX:4772)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Speciality Chemicals Corporation focuses on the production and distribution of specialty electronic-graded gases and chemicals in Taiwan, with a market capitalization of NT$24.52 billion.

Operations: Taiwan Speciality Chemicals generates revenue primarily from the research, development, and sales of precision chemical materials, amounting to NT$808.72 million.

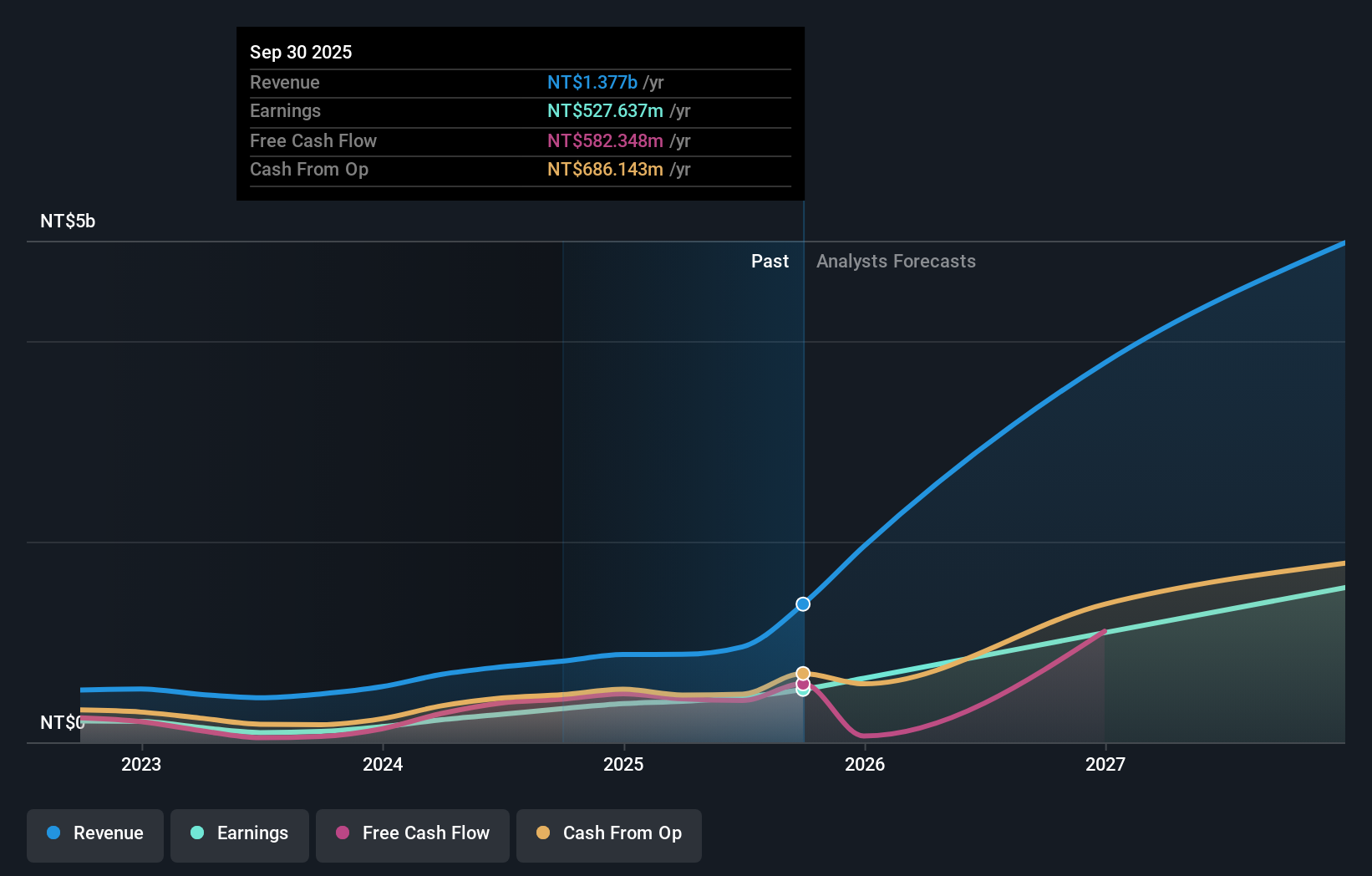

Taiwan Speciality Chemicals, a nimble player in its field, has shown impressive financial strides recently. Sales for the third quarter reached TWD 213.97 million, up from TWD 156.93 million last year, while net income soared to TWD 99.56 million from TWD 43.63 million. Basic earnings per share increased to TWD 0.71 compared to TWD 0.32 previously reported, showcasing strong profitability with high-quality earnings and no debt burden over the past five years. Despite some shareholder dilution this year and recent volatility in share price, the company remains debt-free and boasts a robust cash flow position with levered free cash flow of US$429.89 by September's end in 2024.

Seize The Opportunity

- Access the full spectrum of 4631 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:LTG

LT Group

Engages in banking, distilled spirits, beverages, tobacco, property development, and other businesses in the Philippines, rest of Asia, the United States of America, Canada, Other European Union countries, the Middle East, the United Kingdom, and the Oceania.

Good value with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.