- Japan

- /

- Commercial Services

- /

- TSE:6564

Exploring None's Undiscovered Gems In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and near-record highs in major U.S. stock indices, small-cap stocks have struggled to keep pace, with the Russell 2000 Index trailing larger benchmarks. In this environment of economic uncertainty and shifting monetary policies, identifying undiscovered gems requires a keen focus on companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Guangdian Electric Group (SHSE:601616)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Guangdian Electric Group Co., Ltd. operates in the transmission, distribution, and control equipment manufacturing industry with a market capitalization of approximately CN¥3.50 billion.

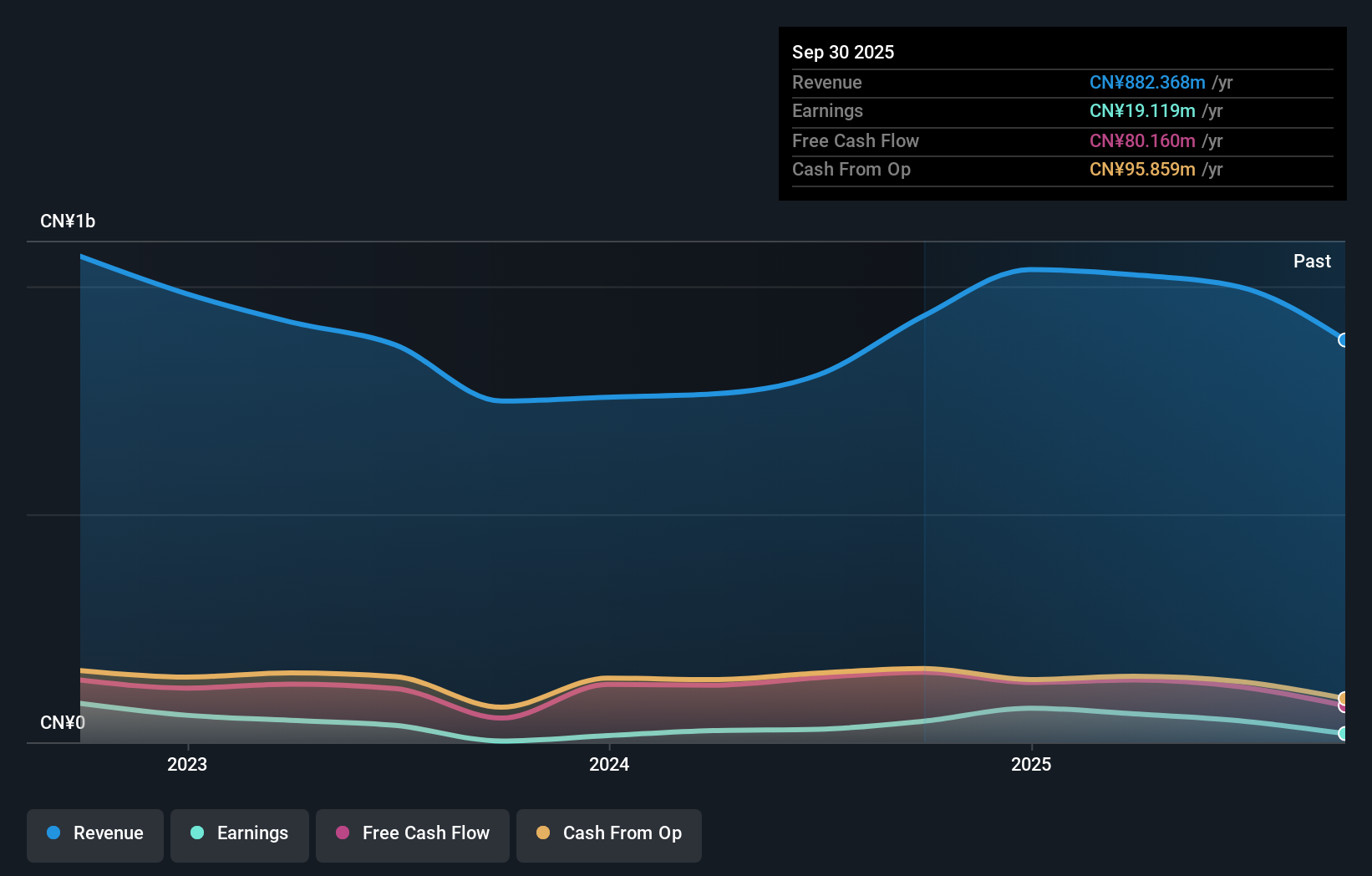

Operations: Shanghai Guangdian Electric Group generates revenue primarily from its transmission, distribution, and control equipment manufacturing segment, with reported earnings of CN¥935.54 million.

Shanghai Guangdian Electric Group, a relatively small player in the electrical industry, has demonstrated impressive financial growth. Over the past year, earnings surged by 1568%, significantly outpacing the industry's modest 1.1% increase. The company is debt-free and doesn't face interest coverage issues, which is a positive sign for its financial health. However, recent results were influenced by a CN¥15.6M one-off gain that may not reflect ongoing performance trends. Despite this anomaly, Guangdian's free cash flow remains positive at CN¥153.66M as of September 2024, suggesting robust operational efficiency and potential for future stability.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Guangdian Electric Group.

Learn about Shanghai Guangdian Electric Group's historical performance.

MayAir Technology (China) (SHSE:688376)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MayAir Technology (China) Co., Ltd. focuses on the research, development, production, and sale of medical air purification equipment and atmospheric environment treatment products in China with a market cap of CN¥4.49 billion.

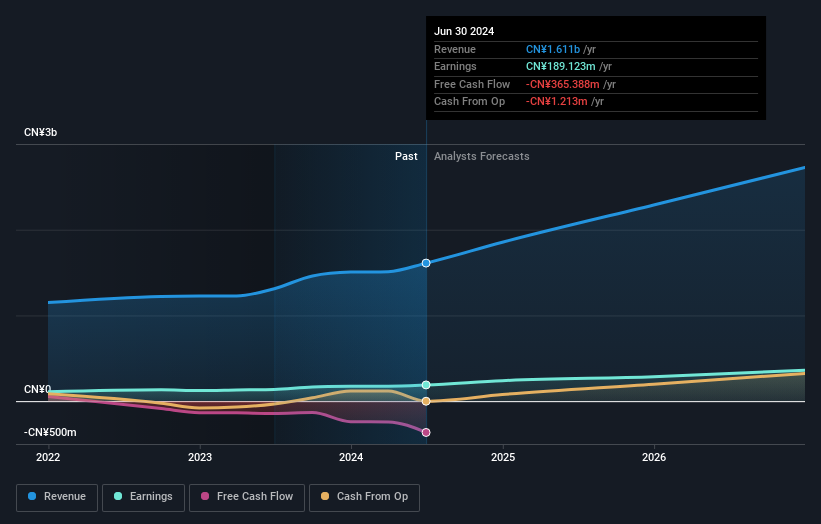

Operations: MayAir generates revenue primarily from its medical air purification equipment and atmospheric environment treatment products. The company reported a net profit margin of 12.5%, highlighting its efficiency in converting revenue into actual profit.

In the niche of air purification, MayAir Technology stands out with its robust financials and promising growth trajectory. Despite a levered free cash flow that dipped to -US$333.58 million as of February 2025, the company has maintained a strategic focus on capital expenditure, which reached US$322.52 million in the same period. Its price-to-earnings ratio at 25.5x is appealing compared to the broader CN market at 36.6x, suggesting potential undervaluation. With earnings growth of 16.1% last year surpassing industry averages and forecasts predicting an annual increase of 25%, MayAir seems poised for sustained expansion in its sector.

Midac Holdings (TSE:6564)

Simply Wall St Value Rating: ★★★★★★

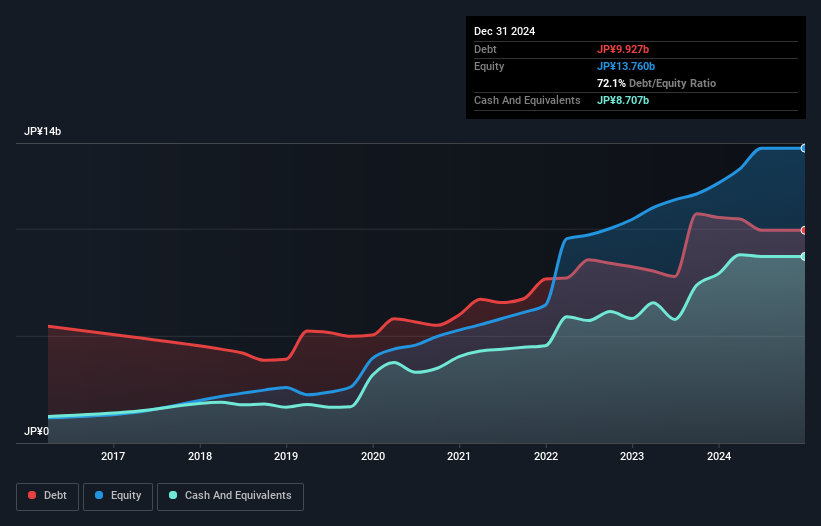

Overview: Midac Holdings Co., Ltd. operates in Japan, focusing on the collection, transportation, cleaning, treatment, and disposal of industrial waste with a market capitalization of ¥46.36 billion.

Operations: Midac Holdings generates revenue primarily from services related to industrial waste management in Japan. The company has a market capitalization of ¥46.36 billion, indicating its significant presence in the industry.

Midac Holdings, a small cap player, has been making waves with its impressive financial performance. Over the past year, earnings surged by 50%, outpacing the Commercial Services industry’s 11% growth. This growth trajectory is set to continue with forecasts predicting a 12% annual increase in earnings. The company is trading at nearly 43% below its estimated fair value, indicating potential upside for investors. Additionally, Midac's debt to equity ratio has significantly improved from 128% to around 66% over five years, while interest payments are comfortably covered by EBIT at over 40 times coverage.

- Dive into the specifics of Midac Holdings here with our thorough health report.

Review our historical performance report to gain insights into Midac Holdings''s past performance.

Where To Now?

- Unlock our comprehensive list of 4716 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6564

Midac Holdings

Engages in the collection, transportation, cleaning, treatment, and disposal of industrial waste in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives