Three Chinese Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As Chinese equities retreated amid weak corporate earnings and economic data, the Shanghai Composite Index and the blue-chip CSI 300 both experienced declines. Despite these challenges, opportunities may exist for discerning investors to identify undervalued stocks that could offer potential value in a turbulent market. In this article, we will explore three Chinese stocks that may be trading below their estimated value. Identifying such stocks often involves looking at their fundamentals, growth potential, and current market conditions to determine if they are priced lower than their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Jiayou International LogisticsLtd (SHSE:603871) | CN¥17.99 | CN¥35.58 | 49.4% |

| Ningxia Baofeng Energy Group (SHSE:600989) | CN¥14.40 | CN¥28.77 | 50% |

| Beijing SDL TechnologyLtd (SZSE:002658) | CN¥5.49 | CN¥10.61 | 48.3% |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥137.89 | CN¥272.77 | 49.4% |

| NBTM New Materials Group (SHSE:600114) | CN¥14.21 | CN¥27.33 | 48% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥17.28 | CN¥33.11 | 47.8% |

| Jiangsu Hongdou IndustrialLTD (SHSE:600400) | CN¥2.11 | CN¥4.12 | 48.8% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.40 | CN¥8.71 | 49.5% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥10.93 | CN¥21.79 | 49.8% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥8.62 | CN¥16.77 | 48.6% |

Let's explore several standout options from the results in the screener.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥46.74 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd. generates revenue through the manufacturing and sale of power distribution and utilization systems both domestically in China and internationally.

Estimated Discount To Fair Value: 19.7%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥33.27, below its estimated fair value of CN¥41.41, indicating it may be undervalued based on cash flows. Despite an unstable dividend track record and forecasted earnings growth (18.8% per year) slower than the Chinese market, its revenue is expected to grow faster than the market at 20.4% annually. Recent H1 2024 results showed significant improvements in sales and net income compared to the previous year.

- Our expertly prepared growth report on Ningbo Sanxing Medical ElectricLtd implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Ningbo Sanxing Medical ElectricLtd with our detailed financial health report.

Jiayou International LogisticsLtd (SHSE:603871)

Overview: Jiayou International Logistics Co., Ltd, with a market cap of CN¥17.43 billion, provides domestic and international multimodal transportation, logistics infrastructure investment and operation, and supply chain trade through its subsidiaries.

Operations: The company's revenue segments include domestic and international multimodal transportation, logistics infrastructure investment and operation, and supply chain trade.

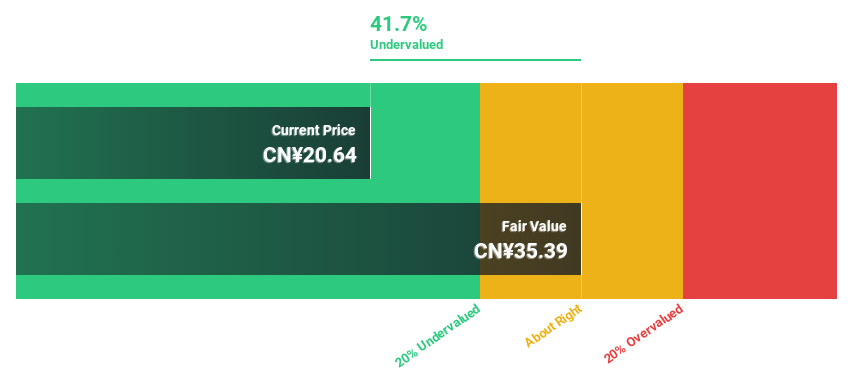

Estimated Discount To Fair Value: 49.4%

Jiayou International Logistics Ltd. is trading at CN¥17.99, significantly below its estimated fair value of CN¥35.58, suggesting it is undervalued based on cash flows. The company reported strong earnings for H1 2024, with sales and revenue nearly doubling year-over-year to CN¥4.64 billion and net income rising to CN¥759 million from CN¥504 million. Forecasts indicate robust annual earnings growth of 24.6%, outpacing the Chinese market average of 23.2%.

- Our comprehensive growth report raises the possibility that Jiayou International LogisticsLtd is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Jiayou International LogisticsLtd.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector and has a market cap of CN¥15.51 billion.

Operations: Eyebright Medical Technology (Beijing) Co., Ltd. generates revenue of CN¥1.51 billion from its Medical Products segment.

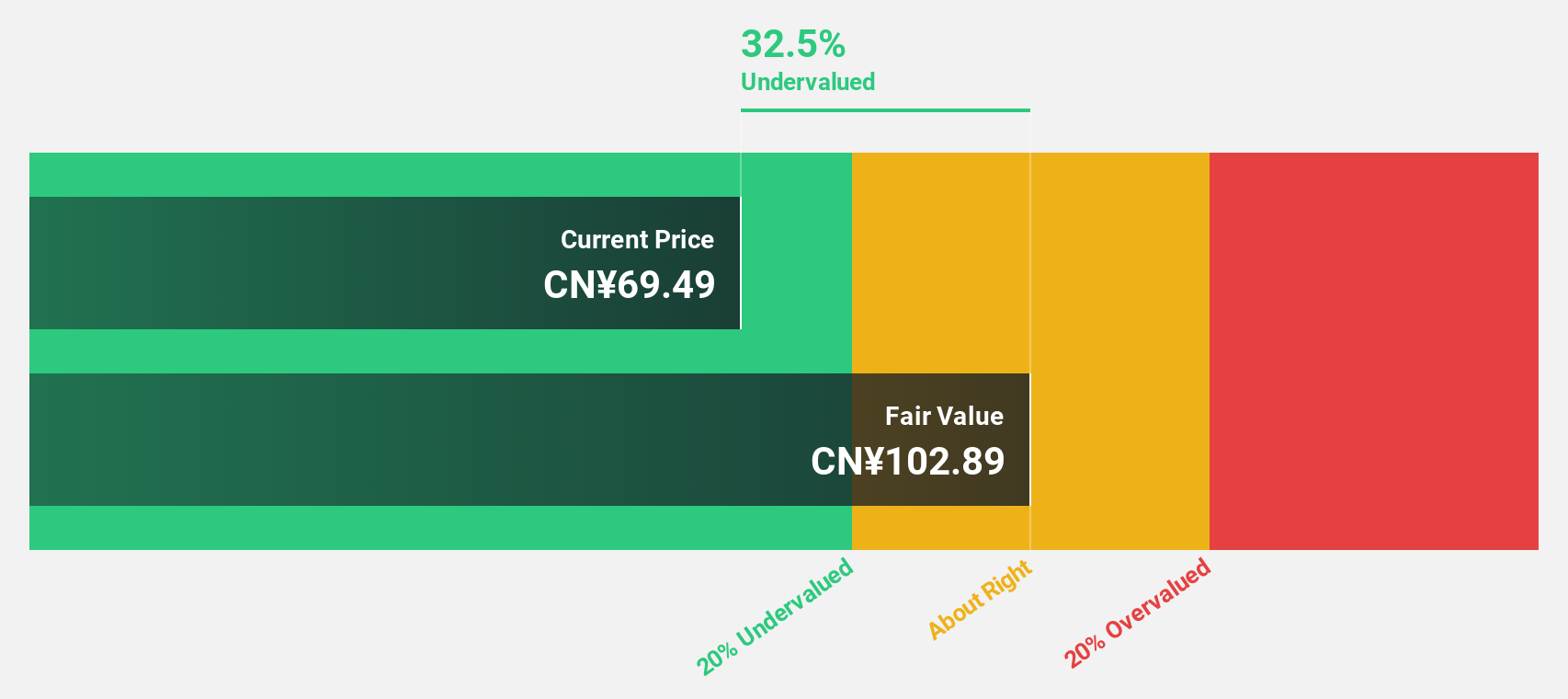

Estimated Discount To Fair Value: 40.4%

Eyebright Medical Technology (Beijing) is trading at CN¥81.81, significantly below its estimated fair value of CN¥137.25, indicating it is undervalued based on cash flows. The company reported strong H1 2024 earnings with sales reaching CN¥680.74 million and net income rising to CN¥208.04 million from a year ago. Forecasts show annual revenue and earnings growth of 27.7% and 28.1%, respectively, outpacing the Chinese market averages, highlighting its potential for substantial future profitability.

- Insights from our recent growth report point to a promising forecast for Eyebright Medical Technology (Beijing)'s business outlook.

- Click to explore a detailed breakdown of our findings in Eyebright Medical Technology (Beijing)'s balance sheet health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 106 Undervalued Chinese Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603871

Jiayou International LogisticsLtd

Engages in the provision of domestic and international multimodal transportation, logistics infrastructure investment, and operation and supply chain trade.

Exceptional growth potential with solid track record.