- China

- /

- Construction

- /

- SHSE:601226

Market Participants Recognise Huadian Heavy Industries Co., Ltd.'s (SHSE:601226) Earnings

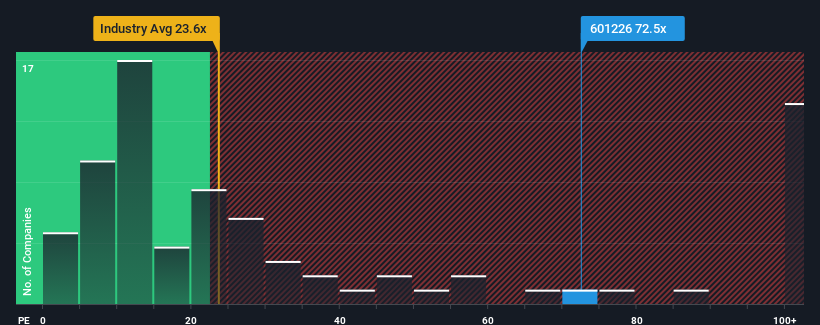

With a price-to-earnings (or "P/E") ratio of 72.5x Huadian Heavy Industries Co., Ltd. (SHSE:601226) may be sending very bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 39x and even P/E's lower than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Huadian Heavy Industries has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Huadian Heavy Industries

Is There Enough Growth For Huadian Heavy Industries?

In order to justify its P/E ratio, Huadian Heavy Industries would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 49%. This means it has also seen a slide in earnings over the longer-term as EPS is down 43% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 125% during the coming year according to the three analysts following the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Huadian Heavy Industries' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Huadian Heavy Industries' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Huadian Heavy Industries maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Huadian Heavy Industries, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Huadian Heavy Industries. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Huadian Heavy Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huadian Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601226

Huadian Heavy Industries

Engages in the design and contracting of EPC projects and equipment manufacturing activities.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives