- China

- /

- Construction

- /

- SHSE:601068

Why Investors Shouldn't Be Surprised By China Aluminum International Engineering Corporation Limited's (SHSE:601068) Low P/S

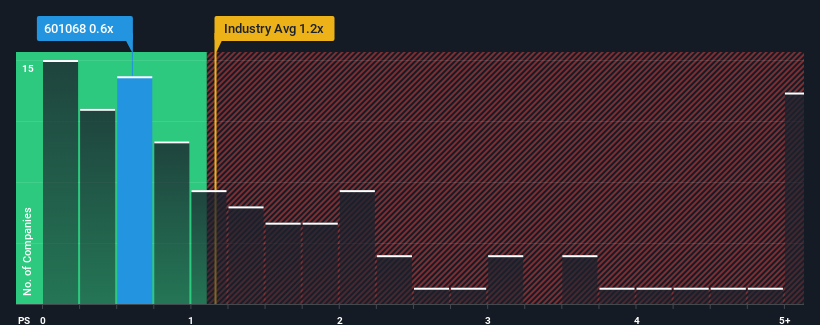

When you see that almost half of the companies in the Construction industry in China have price-to-sales ratios (or "P/S") above 1.2x, China Aluminum International Engineering Corporation Limited (SHSE:601068) looks to be giving off some buy signals with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for China Aluminum International Engineering

How China Aluminum International Engineering Has Been Performing

Recent revenue growth for China Aluminum International Engineering has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on China Aluminum International Engineering will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on China Aluminum International Engineering will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as China Aluminum International Engineering's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 2.7%. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 8.2% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 14% growth forecast for the broader industry.

With this in consideration, its clear as to why China Aluminum International Engineering's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On China Aluminum International Engineering's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of China Aluminum International Engineering's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - China Aluminum International Engineering has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601068

China Aluminum International Engineering

Operates as a technology, engineering service, and equipment provider in the nonferrous metals industry in the People’s Republic of China and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives