- China

- /

- Trade Distributors

- /

- SHSE:600710

Undiscovered Gems in Global Markets for September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and persistent inflation concerns, major U.S. stock indexes have experienced declines, with small-cap indices like the Russell 2000 registering losses after a period of gains. Amid this backdrop of economic uncertainty and fluctuating market sentiment, identifying promising investment opportunities requires a focus on stocks that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 1.17% | 2.62% | ★★★★★★ |

| Sinopower Semiconductor | NA | 0.64% | -7.63% | ★★★★★★ |

| AzureWave Technologies | 4.84% | -0.95% | 13.13% | ★★★★★★ |

| Aerospace Hi-Tech Holding Group | NA | 5.18% | 42.12% | ★★★★★★ |

| Shanghai Chlor-Alkali Chemical | 21.54% | 8.54% | -3.80% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| New Asia Construction & Development | 44.83% | 8.29% | 44.77% | ★★★★★☆ |

| KNJ | 75.75% | 8.26% | 43.04% | ★★★★★☆ |

| Dura Tek | 1.52% | 68.54% | 50.63% | ★★★★★☆ |

| Jiangxi Jiangnan New Material Technology | 70.94% | 21.41% | 14.67% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sumec (SHSE:600710)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumec Corporation Limited operates in the supply and industrial chain business in China with a market capitalization of CN¥13.49 billion.

Operations: Sumec Corporation Limited generates its revenue primarily from its supply and industrial chain operations in China. The company's market capitalization is approximately CN¥13.49 billion, indicating its significant presence in the industry.

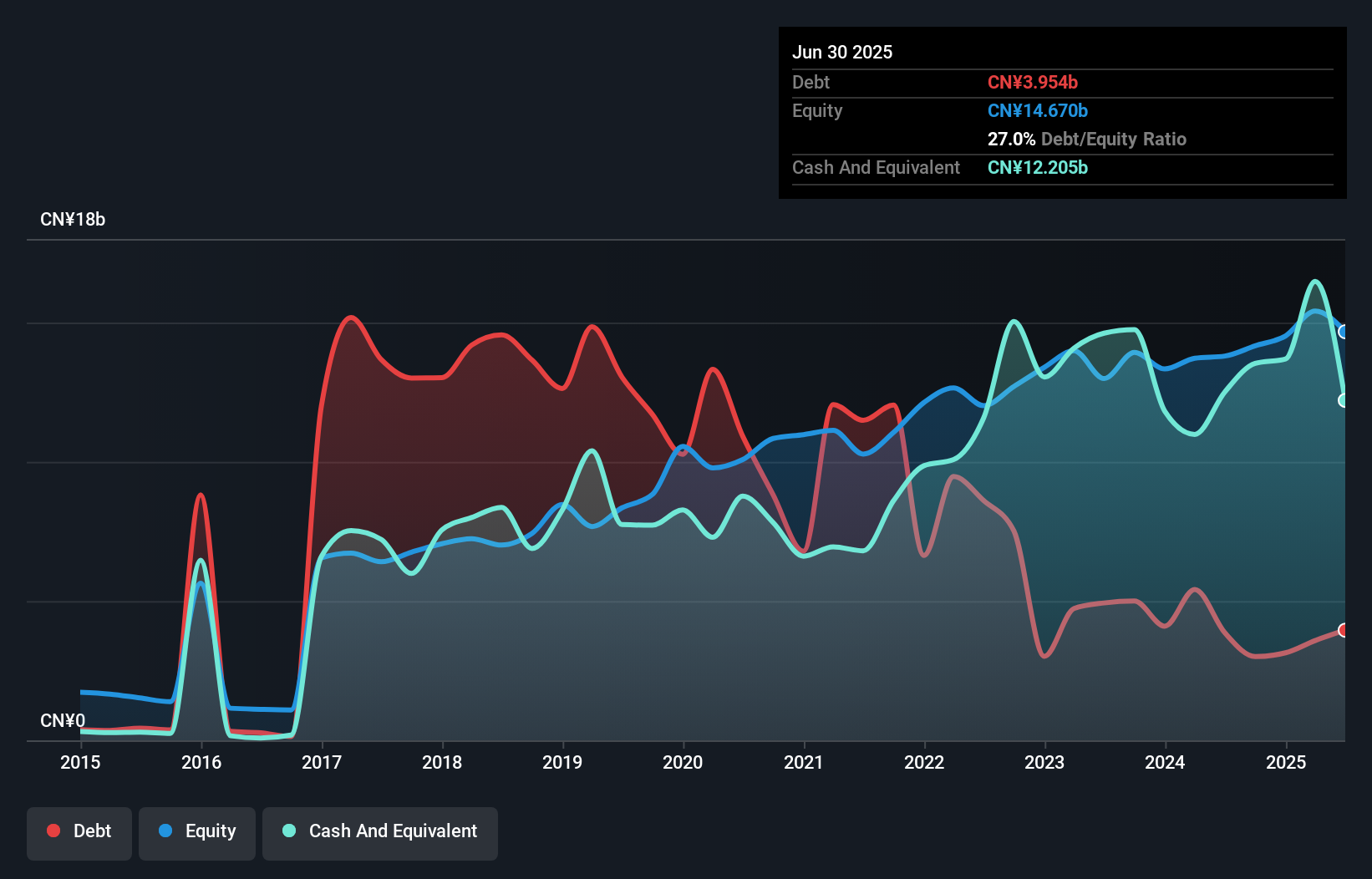

Sumec Corporation, a smaller player in the industry, has shown promising financial resilience. Its earnings grew by 11.7% over the past year, outpacing the Trade Distributors sector's -5.1%. The company's debt-to-equity ratio significantly improved from 108.3% to 27% over five years, highlighting effective debt management. Recent earnings for the half-year ended June 2025 show net income at CNY 645.83 million compared to CNY 573.48 million a year earlier, with basic earnings per share rising to CNY 0.49 from CNY 0.44 last year—an indication of steady performance despite slightly lower sales figures of CNY 55,101 million compared to CNY 55,949 million previously reported.

- Take a closer look at Sumec's potential here in our health report.

Gain insights into Sumec's historical performance by reviewing our past performance report.

Zhejiang Langdi Group (SHSE:603726)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Langdi Group Co., Ltd. focuses on the production and sale of household air conditioning wheels, mechanical fans, and polymer composite materials in China, with a market capitalization of CN¥4.42 billion.

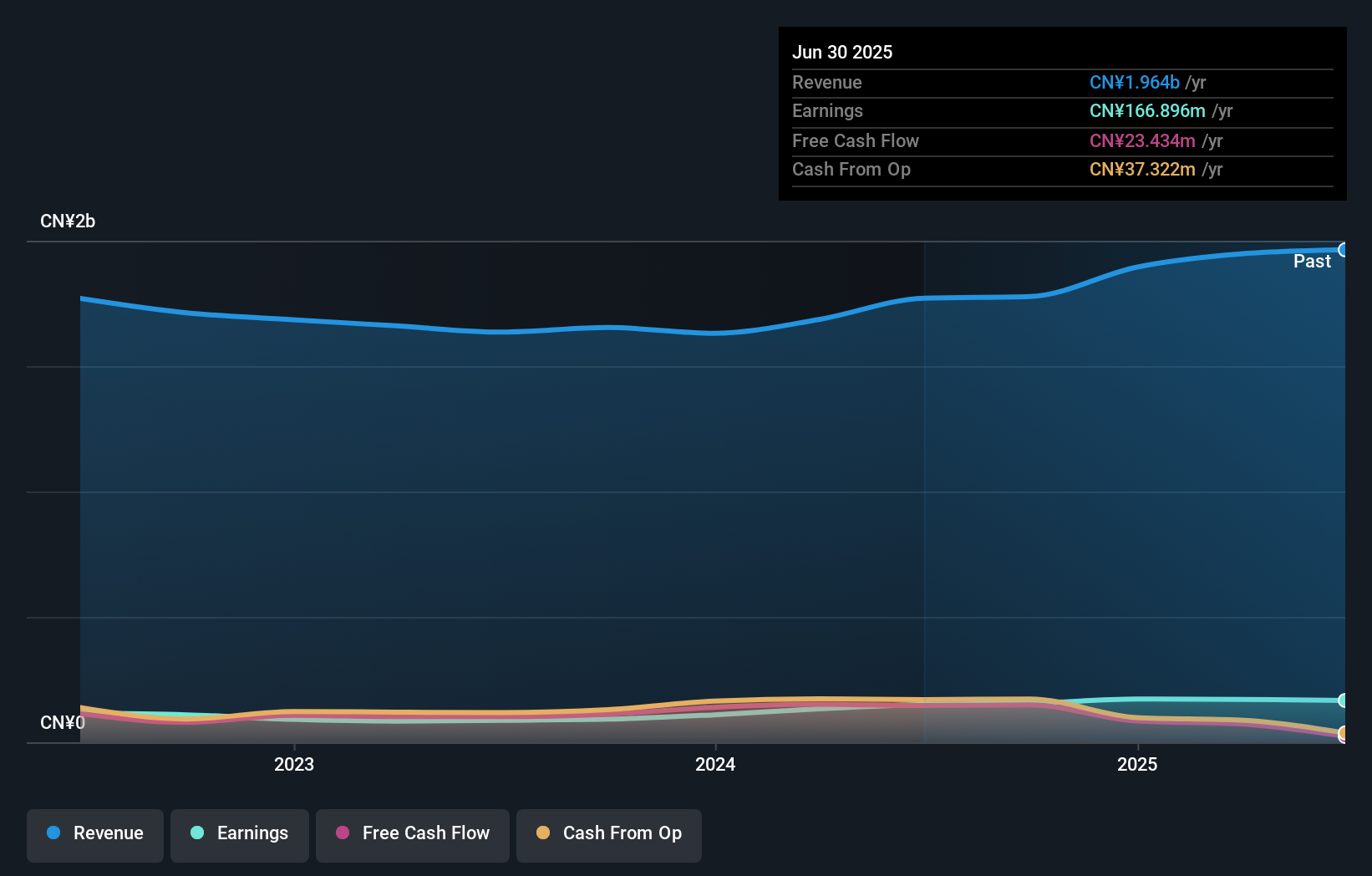

Operations: Langdi Group generates revenue primarily from its electronic components and parts segment, amounting to CN¥1.96 billion. The company's market capitalization is CN¥4.42 billion.

Zhejiang Langdi Group, a smaller player in the machinery sector, shows promising signs despite some challenges. With earnings growth of 10.8% over the past year, it outpaced the industry's 4%, highlighting its competitive edge. The company's net debt to equity ratio stands at a satisfactory 11.1%, and its interest payments are well covered with EBIT at 25.5x coverage, indicating financial robustness. Although recent revenue increased to CNY 1,059 million from CNY 990 million last year, net income slightly dropped to CNY 90 million from CNY 95 million, reflecting potential cost pressures or investments impacting short-term profitability.

- Click to explore a detailed breakdown of our findings in Zhejiang Langdi Group's health report.

Explore historical data to track Zhejiang Langdi Group's performance over time in our Past section.

Zhe Jiang Headman MachineryLtd (SHSE:688577)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhe Jiang Headman Machinery Co., Ltd. manufactures and sells computer numerical control machine tools, with a market capitalization of CN¥11.98 billion.

Operations: Headman Machinery generates revenue primarily from the sale of computer numerical control machine tools. The company's financial performance is characterized by a focus on optimizing its cost structure to enhance profitability, with a notable emphasis on improving its net profit margin.

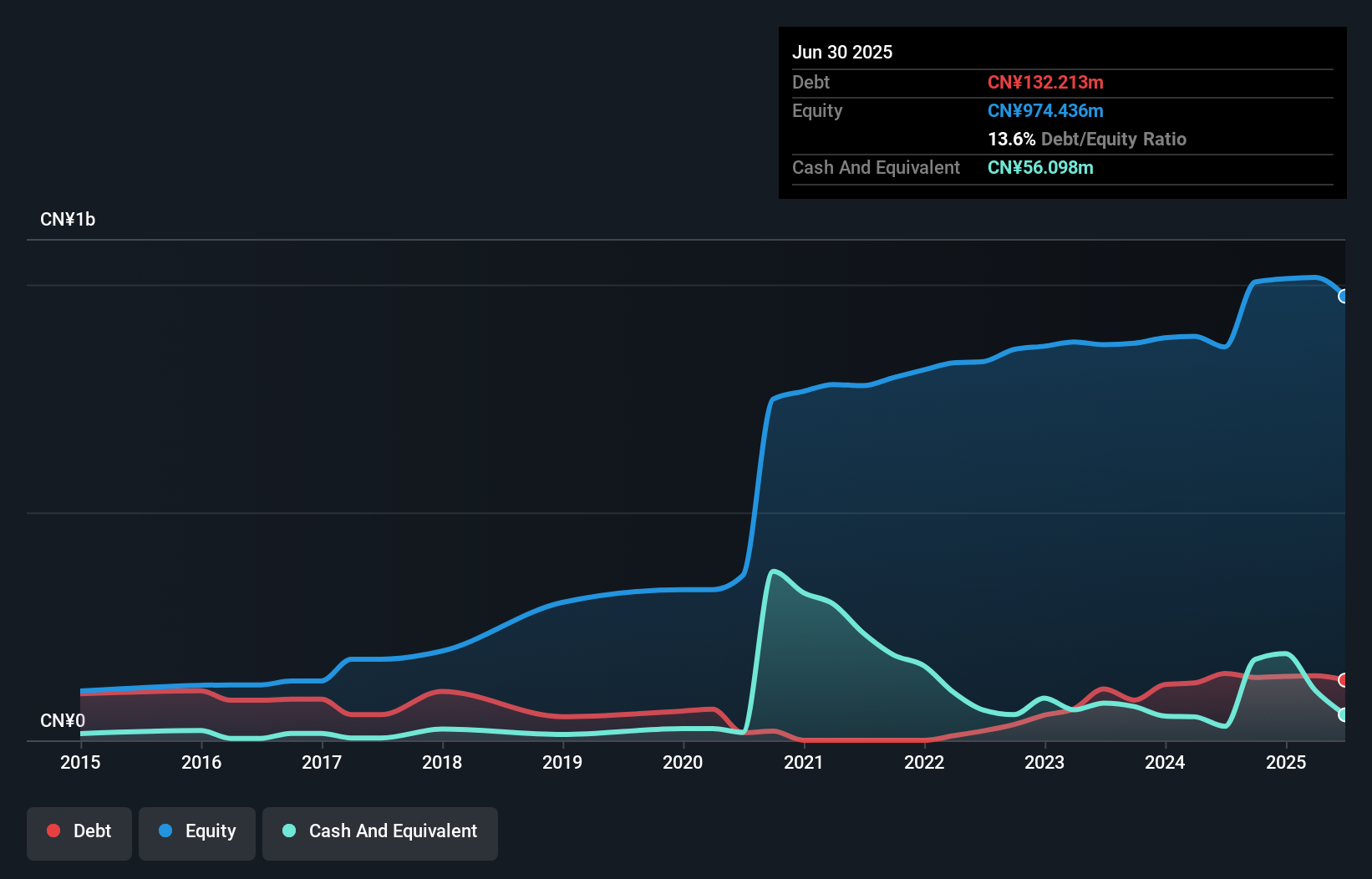

Zhe Jiang Headman Machinery, a relatively small player in the machinery sector, has been navigating a mixed financial landscape. The company reported earnings growth of 6.6% over the past year, outpacing the industry average of 4%. However, its earnings have decreased by 21.2% annually over five years. A notable one-off gain of CN¥8.4 million influenced recent results, while net income for H1 2025 was CN¥8.07 million compared to CN¥10.96 million last year. With a satisfactory net debt to equity ratio at 7.8%, interest payments are well covered by EBIT at 4.5x coverage despite volatile share prices recently observed.

Where To Now?

- Investigate our full lineup of 2938 Global Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600710

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives