- China

- /

- Electrical

- /

- SZSE:002892

Undiscovered Gems In Global Markets For March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflation concerns, and fluctuating growth forecasts, small-cap stocks have been particularly impacted, with indices like the Russell 2000 seeing significant declines. Amidst this backdrop of uncertainty and cautious investor sentiment, finding undiscovered gems in the market requires a keen eye for companies that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.78% | 21.11% | ★★★★★★ |

| Baazeem Trading | 11.05% | -1.88% | -2.38% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

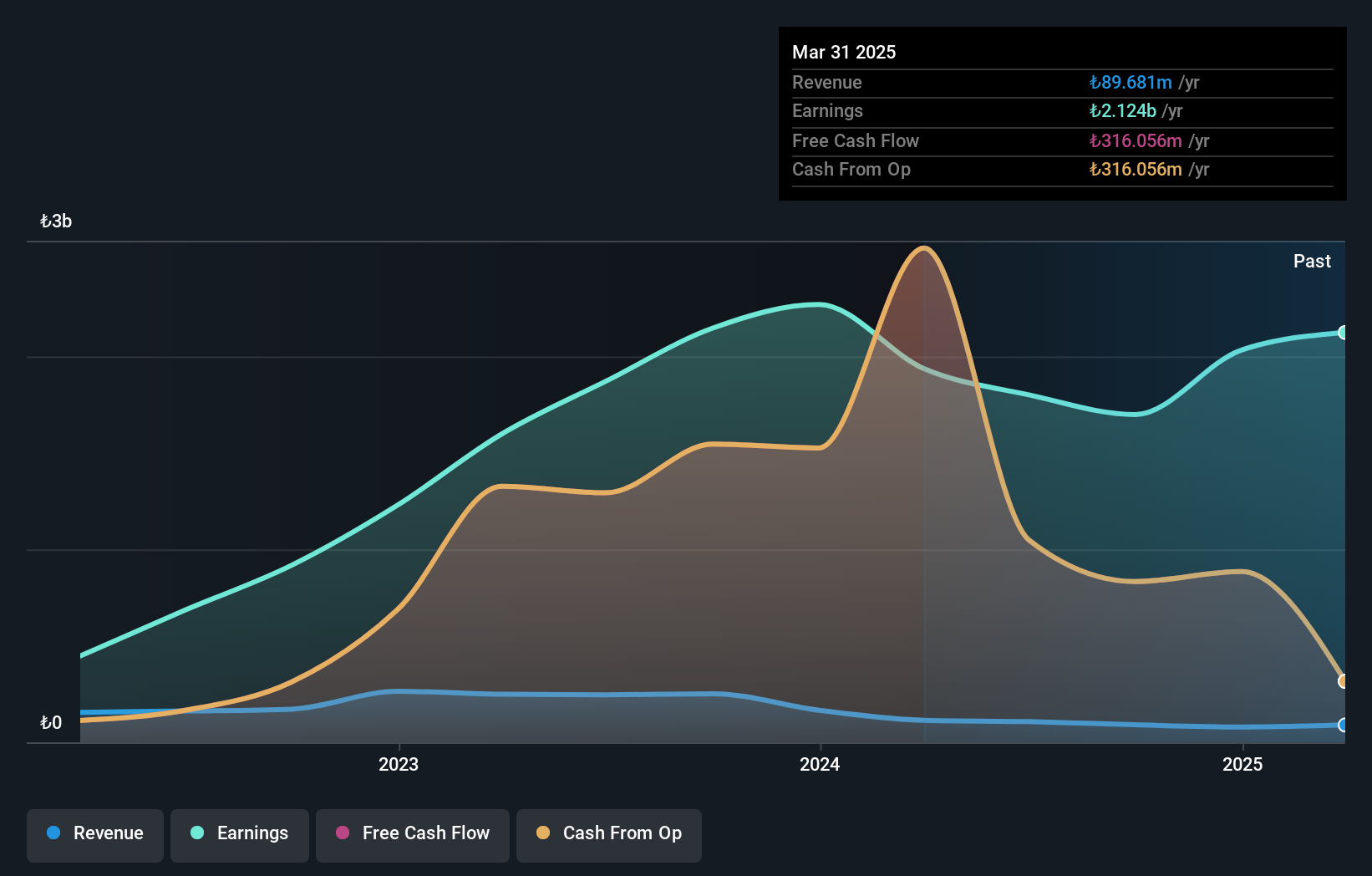

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S. is an investment company that, along with its subsidiaries, focuses on investing in the industrial, commercial, and service sectors and has a market capitalization of TRY53.86 billion.

Operations: Borusan Yatirim ve Pazarlama, through its subsidiaries, derives revenue from investments across the industrial, commercial, and service sectors. The company has a market capitalization of TRY53.86 billion.

Borusan Yatirim ve Pazarlama, a nimble player in the market, reported TRY 79.45 million in sales for 2024, down from TRY 165.95 million the previous year. Despite this dip, it maintains a strong financial footing with no debt compared to five years ago when its debt-to-equity ratio was at 1%. The company's net income reached TRY 2,033.24 million for the year. While earnings growth took a hit at -10.4%, Borusan's free cash flow remains positive and it boasts high-quality past earnings, painting a picture of resilience amidst industry challenges.

- Click here to discover the nuances of Borusan Yatirim ve Pazarlama with our detailed analytical health report.

Learn about Borusan Yatirim ve Pazarlama's historical performance.

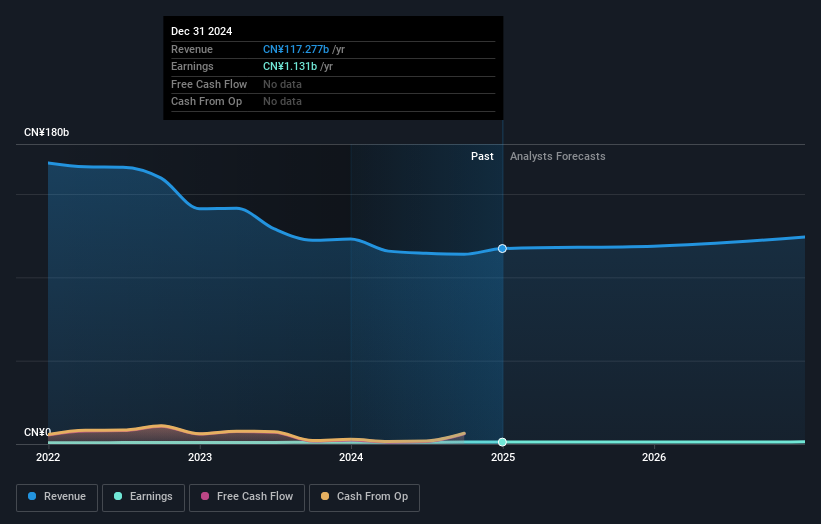

Sumec (SHSE:600710)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumec Corporation Limited operates in the supply and industrial chain business in China with a market capitalization of CN¥13.60 billion.

Operations: Sumec Corporation Limited generates revenue primarily through its supply and industrial chain operations in China. The company's financial performance is characterized by a focus on cost management, impacting its net profit margin.

Sumec, a company with solid financials, seems to offer an intriguing investment opportunity. Its earnings grew by 9.9% last year, outpacing the Trade Distributors industry’s -28.2%. The firm reported net income of CNY 1,131 million for 2024, up from CNY 1,029 million in the previous year. With a debt-to-equity ratio reduction from 132.7% to 21.2% over five years and free cash flow positivity, Sumec appears financially robust. Trading at a significant discount to its estimated fair value and boasting high-quality past earnings further enhances its appeal in the market landscape.

- Dive into the specifics of Sumec here with our thorough health report.

Understand Sumec's track record by examining our Past report.

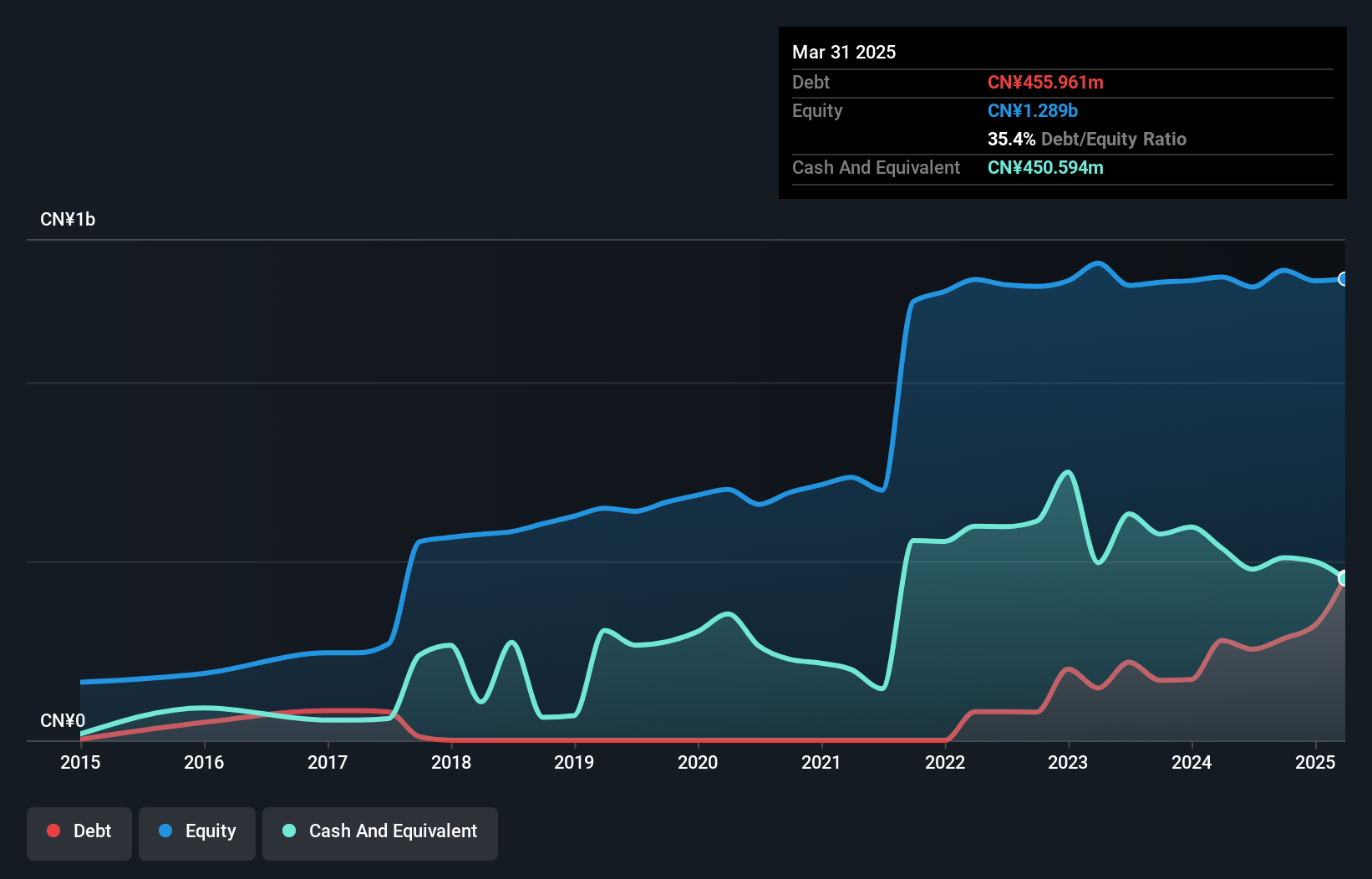

Keli Motor Group (SZSE:002892)

Simply Wall St Value Rating: ★★★★★☆

Overview: Keli Motor Group Co., Ltd. focuses on the research, development, manufacture, and sale of micro motors in China with a market capitalization of CN¥12.09 billion.

Operations: Keli Motor Group generates revenue primarily through the sale of micro motors. The company's net profit margin is 10.5%, reflecting its profitability in the sector.

Keli Motor Group, a small cap player in the electrical industry, shows an intriguing mix of financial dynamics. Despite a volatile share price recently, its earnings growth of 28.5% over the past year outpaced the industry average of 1.3%. The company's debt to equity ratio has risen to 21.7% from zero over five years, yet interest payments are well covered by EBIT at 4.4 times coverage. A notable CN¥18.9M one-off gain impacted recent results, suggesting potential volatility in earnings quality but also highlighting its profitability and cash position exceeding total debt levels, providing some financial cushion moving forward.

- Take a closer look at Keli Motor Group's potential here in our health report.

Gain insights into Keli Motor Group's past trends and performance with our Past report.

Key Takeaways

- Delve into our full catalog of 3211 Global Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keli Motor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002892

Keli Motor Group

Engages in the research and development, manufacture, and sale of micro motors in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives