Undiscovered Gems And 2 Other Promising Small Caps Backed By Strong Fundamentals

Reviewed by Simply Wall St

As global markets experience a surge, buoyed by cooling inflation and robust bank earnings, small-cap stocks are capturing increased attention with the S&P MidCap 400 and Russell 2000 indices posting notable gains. In this environment of optimism, identifying stocks with strong fundamentals becomes crucial for investors seeking potential opportunities amid the broader market rally.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Atlantic China Welding Consumables (SHSE:600558)

Simply Wall St Value Rating: ★★★★★★

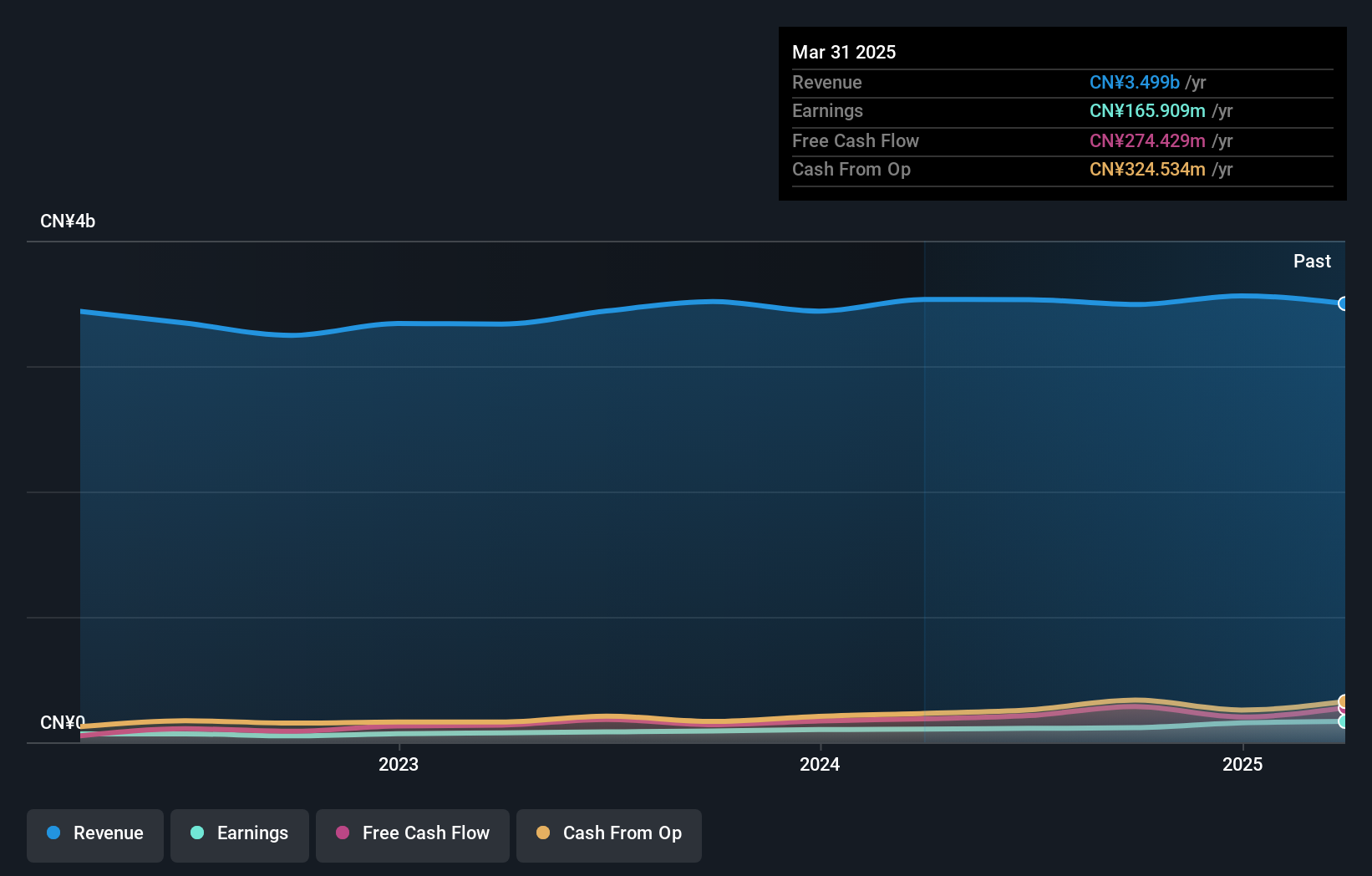

Overview: Atlantic China Welding Consumables, Inc. focuses on the research, development, production, and sale of welding rods, wires, and fluxes both in China and globally with a market cap of CN¥3.66 billion.

Operations: The primary revenue stream for Atlantic China Welding Consumables comes from raw materials, amounting to CN¥3.49 billion. The company's financial performance is impacted by the cost of these materials and its gross profit margin trends over time.

Atlantic China Welding Consumables showcases a promising profile with its debt to equity ratio dropping from 14.1% to 3.8% over five years, indicating improved financial stability. The company's earnings surged by 27.9% in the past year, surpassing the machinery industry's average growth rate of -0.2%. Despite a notable CN¥29.6 million one-off gain affecting past earnings, it remains undervalued at 72.4% below estimated fair value and has positive free cash flow of CNY 284M as of September 2024.. Recent reports highlight sales reaching CN¥2,748 million and net income climbing to CN¥86 million for nine months ending September 2024, reflecting steady performance improvements.

Sinfonia TechnologyLtd (TSE:6507)

Simply Wall St Value Rating: ★★★★★★

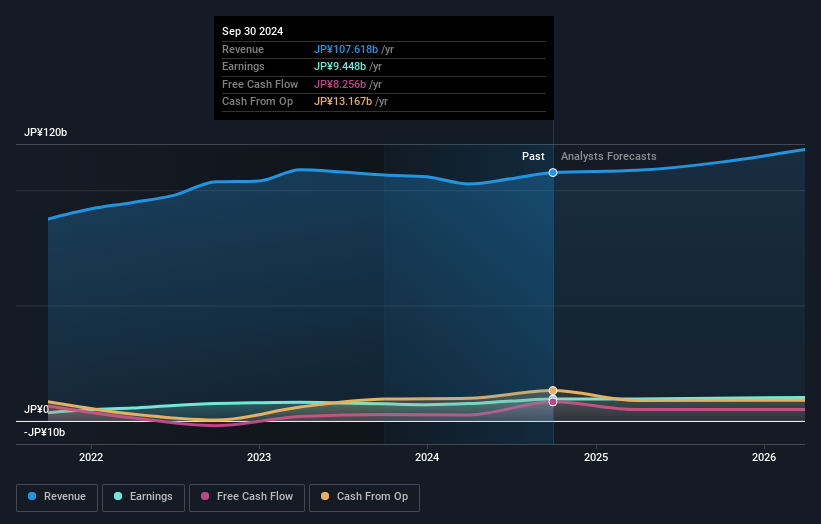

Overview: Sinfonia Technology Co., Ltd. is a company that manufactures and sells various equipment, with a market capitalization of ¥169.84 billion.

Operations: Sinfonia Technology generates revenue primarily from Motion Equipment, Engineering & Services, Clean Conveyance System, and Power Electronics Equipment segments, with the Motion Equipment segment leading at ¥38.58 billion. The company does not allocate any amounts to unlisted categories in its financials.

Sinfonia Technology, a smaller player in the electrical sector, showcases promising financial health with a net debt to equity ratio of 13.2%, deemed satisfactory. Over the past five years, its debt to equity ratio has impressively decreased from 53.5% to 23.9%. The company's earnings have soared by 27.9% in the last year, outpacing the industry average of 16%. With high-quality past earnings and positive free cash flow evident at US$8.26 million as of September 2024, Sinfonia seems well-positioned for continued growth despite recent share price volatility over three months.

- Click here to discover the nuances of Sinfonia TechnologyLtd with our detailed analytical health report.

Assess Sinfonia TechnologyLtd's past performance with our detailed historical performance reports.

Seiko Group (TSE:8050)

Simply Wall St Value Rating: ★★★★★☆

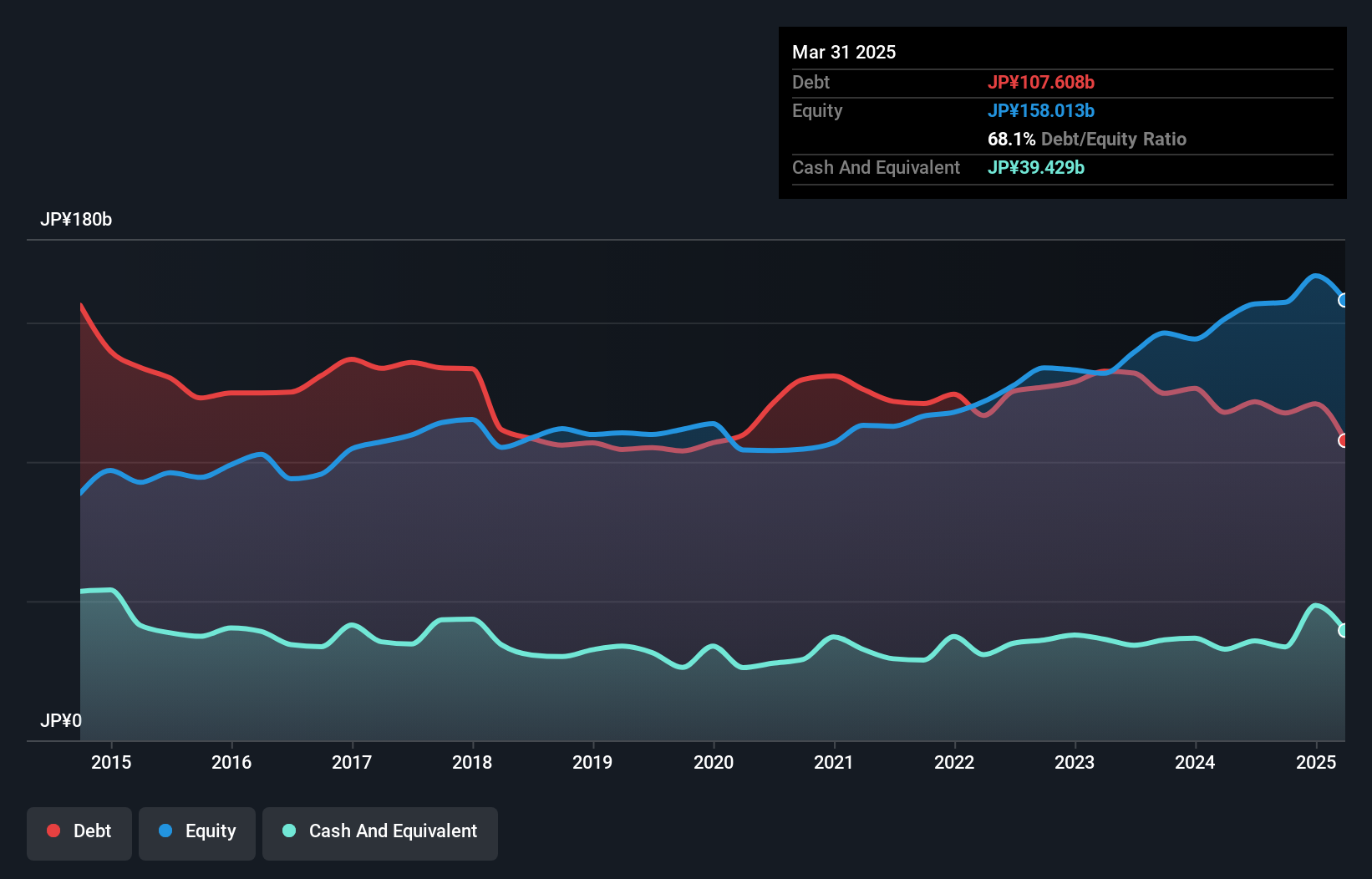

Overview: Seiko Group Corporation operates in various sectors including watches, device solutions, system solutions, apparel, clocks, and fashion accessories both in Japan and internationally with a market capitalization of approximately ¥195.44 billion.

Operations: The primary revenue streams for Seiko Group Corporation include Emotional Value Solutions Business and Device Solutions, generating ¥200.09 billion and ¥61.11 billion respectively. System Solution Business contributes an additional ¥45.09 billion to the company's revenue profile.

Seiko Group, a smaller player in the luxury sector, has shown robust financial health with earnings surging by 107% over the past year. The company’s debt-to-equity ratio stands at 53%, which is considered high but has decreased from 93% five years ago. Impressively, Seiko's interest payments are well-covered by EBIT at a staggering 193 times coverage. Recent guidance suggests net sales of JPY 306 billion and operating profit of JPY 18 billion for fiscal year ending March 2025. Additionally, Seiko announced an increased dividend to JPY 45 per share for Q2, reflecting confidence in its ongoing performance.

- Delve into the full analysis health report here for a deeper understanding of Seiko Group.

Evaluate Seiko Group's historical performance by accessing our past performance report.

Make It Happen

- Embark on your investment journey to our 4651 Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600558

Atlantic China Welding Consumables

Engages in the research and development, production, and sale of welding rods, welding wires, and fluxes in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives