As global markets grapple with trade policy uncertainties and inflationary pressures, Asian economies continue to navigate these challenges with mixed outcomes. Amid this backdrop, dividend stocks in Asia offer a potential avenue for investors seeking stability and income, as they often provide regular payouts that can cushion against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.53% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.24% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1136 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

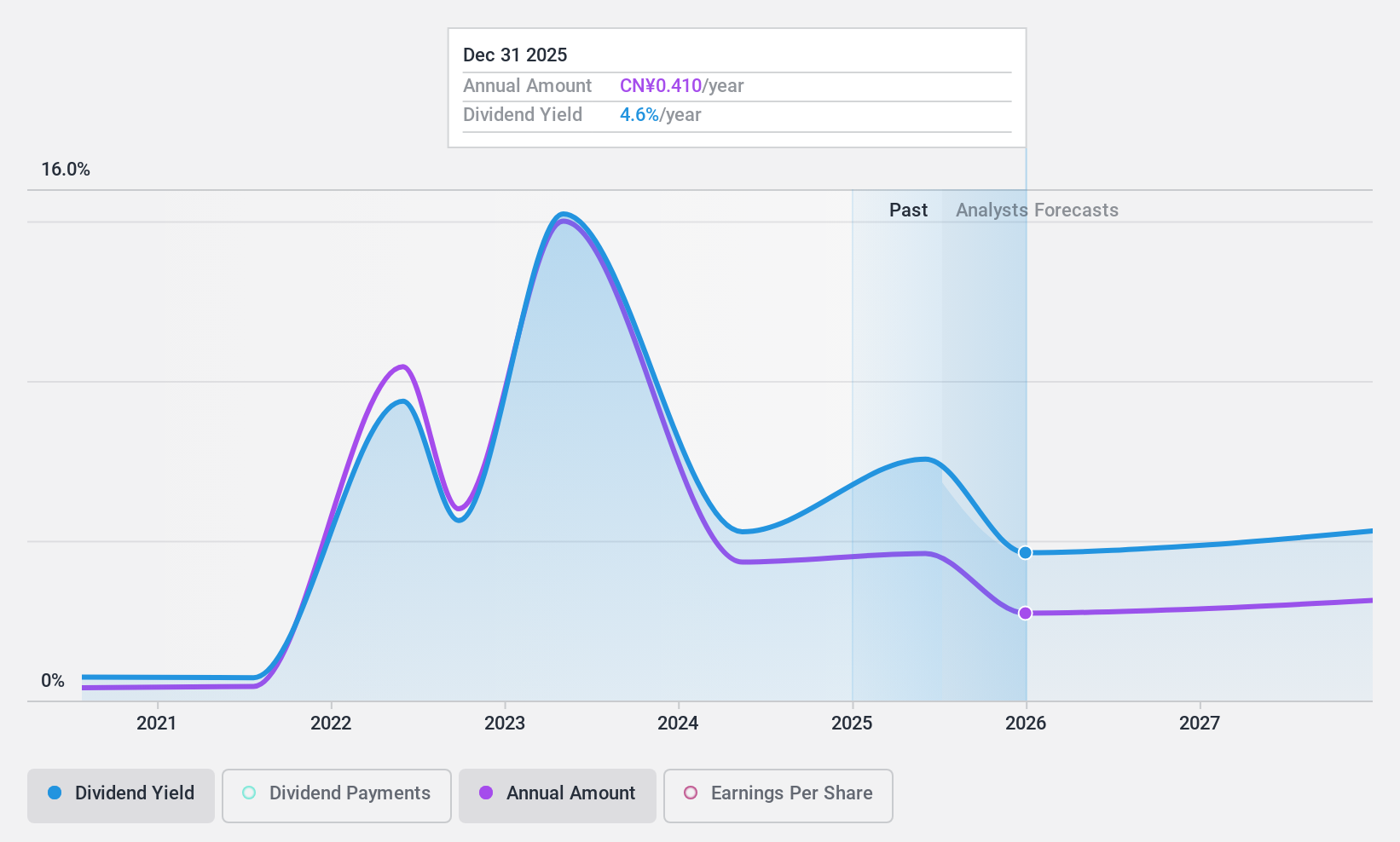

Shanxi Coal International Energy GroupLtd (SHSE:600546)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanxi Coal International Energy Group Co., Ltd is involved in coal production both within China and internationally, with a market capitalization of CN¥21.91 billion.

Operations: Shanxi Coal International Energy Group Co., Ltd's revenue segments are not specified in the provided text.

Dividend Yield: 5.9%

Shanxi Coal International Energy Group Ltd. offers a compelling dividend yield of 5.88%, placing it in the top 25% of CN market payers, supported by a sustainable payout ratio of 55% and a cash payout ratio of 51.7%. Despite trading at an attractive P/E ratio of 9.3x, below the CN market average, its dividend history is marred by volatility and unreliability over the past decade, with recent profit margins declining to 7.7%.

- Get an in-depth perspective on Shanxi Coal International Energy GroupLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Shanxi Coal International Energy GroupLtd's shares may be trading at a discount.

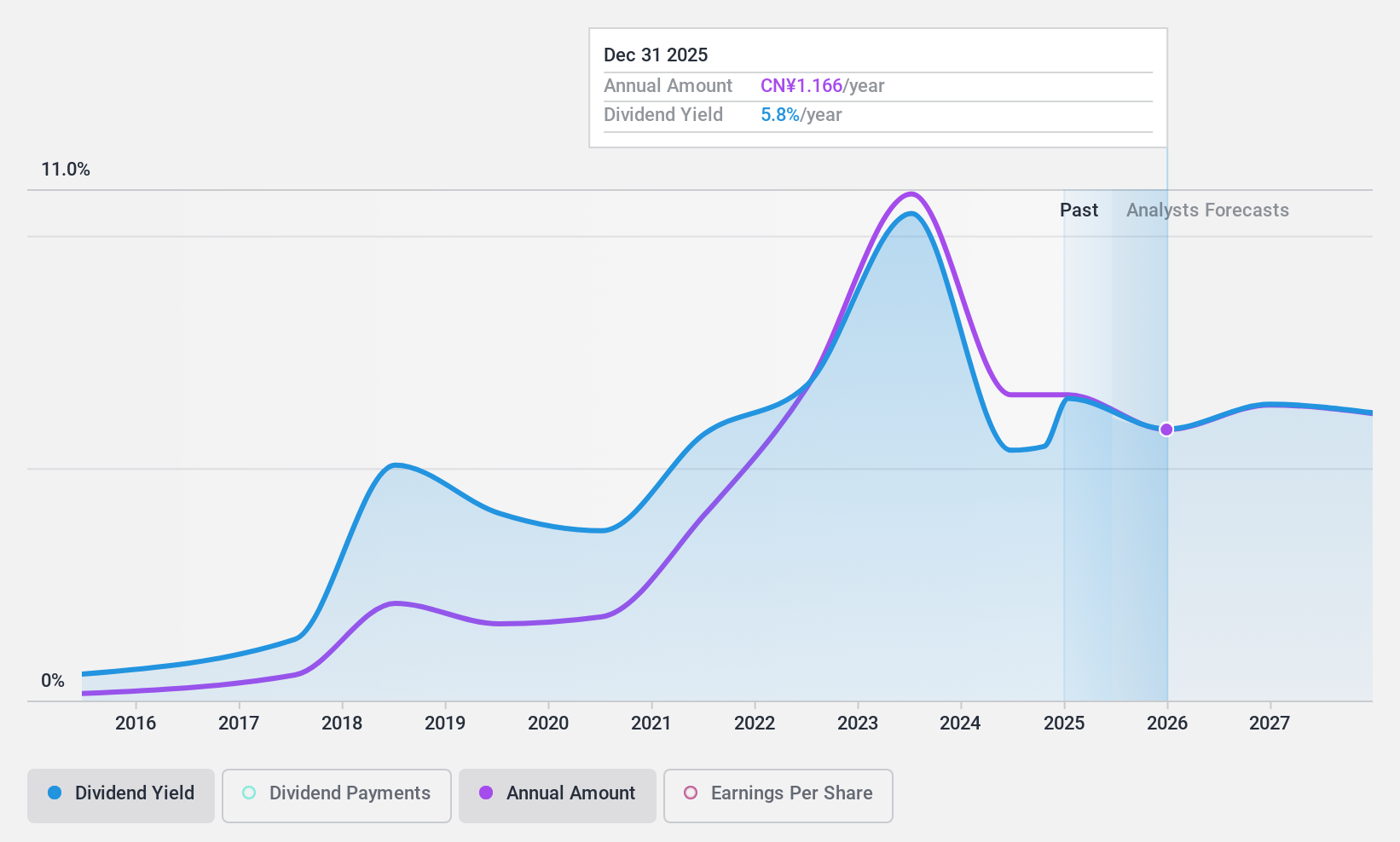

Shaanxi Coal Industry (SHSE:601225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited, along with its subsidiaries, is engaged in the mining, production, washing, processing, and sale of coal both in China and internationally, with a market cap of CN¥195.45 billion.

Operations: Shaanxi Coal Industry's revenue segments include mining, production, washing, processing, and sales of coal.

Dividend Yield: 6.5%

Shaanxi Coal Industry's dividend yield of 6.52% ranks in the top 25% of CN market payers, supported by a sustainable payout ratio of 70.7% and a cash payout ratio of 41.3%. Despite trading at good value, the company's dividend history shows volatility and unreliability over the past decade. Earnings are expected to grow modestly at 3.01% per year, but recent shareholder meetings indicate potential strategic shifts that could impact future dividends.

- Click to explore a detailed breakdown of our findings in Shaanxi Coal Industry's dividend report.

- The analysis detailed in our Shaanxi Coal Industry valuation report hints at an deflated share price compared to its estimated value.

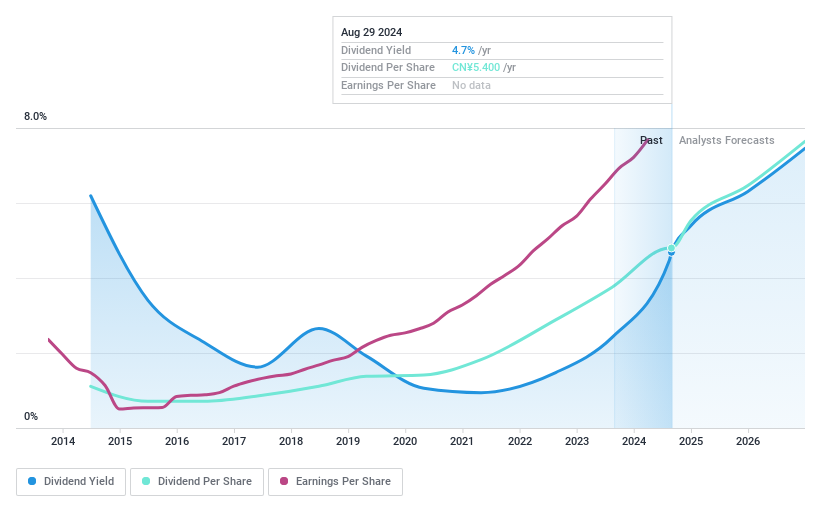

Luzhou LaojiaoLtd (SZSE:000568)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzhou Laojiao Co., Ltd is a Chinese company that produces liquor products and has a market capitalization of approximately CN¥199.10 billion.

Operations: Luzhou Laojiao Co., Ltd generates its revenue primarily from the sale of liquor products within China.

Dividend Yield: 4%

Luzhou Laojiao's dividend yield of 3.99% is among the top 25% in the CN market, with a sustainable payout ratio of 69.5% and cash payout ratio of 62%. Despite trading at a significant discount to its estimated fair value, the dividend history has been volatile over the past decade. Recent approval of a CNY 13.58 per 10 shares cash dividend for Q3 2024 highlights ongoing shareholder returns amid amendments to company bylaws that may influence future distributions.

- Click here and access our complete dividend analysis report to understand the dynamics of Luzhou LaojiaoLtd.

- The valuation report we've compiled suggests that Luzhou LaojiaoLtd's current price could be quite moderate.

Next Steps

- Embark on your investment journey to our 1136 Top Asian Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000568

Undervalued with excellent balance sheet and pays a dividend.