Three Undiscovered Gems with Promising Potential This December 2024

Reviewed by Simply Wall St

In a week where major U.S. stock indexes reached record highs, the Russell 2000 Index experienced a decline after previously outperforming larger-cap peers, highlighting the mixed performance within small-cap stocks amidst broader market volatility. As investors navigate these dynamic conditions, identifying promising opportunities requires careful consideration of growth potential and resilience in the face of economic shifts. In this context, we explore three lesser-known stocks that exhibit strong fundamentals and adaptability, positioning them as intriguing prospects for December 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Tianjin Benefo Tejing Electric (SHSE:600468)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tianjin Benefo Tejing Electric Co., Ltd. operates in the power equipment industry with a market cap of CN¥5.83 billion.

Operations: Benefo Tejing Electric's primary revenue stream is derived from its operations in the power equipment industry. The company focuses on optimizing its cost structure to enhance profitability, with a particular emphasis on improving its net profit margin.

Tianjin Benefo Tejing Electric, a smaller player in the machinery sector, has shown resilience with earnings growth of 4.8% over the past year, surpassing the industry average of -0.4%. The company boasts high-quality past earnings and maintains a debt-to-equity ratio that has increased from 5.4 to 13.1 over five years, suggesting strategic leveraging. Despite sales slipping to CNY 1.42 billion from CNY 1.53 billion last year, net income rose to CNY 102.96 million from CNY 96.58 million, reflecting improved operational efficiency with basic earnings per share climbing to CNY 0.0947 from CNY 0.0888.

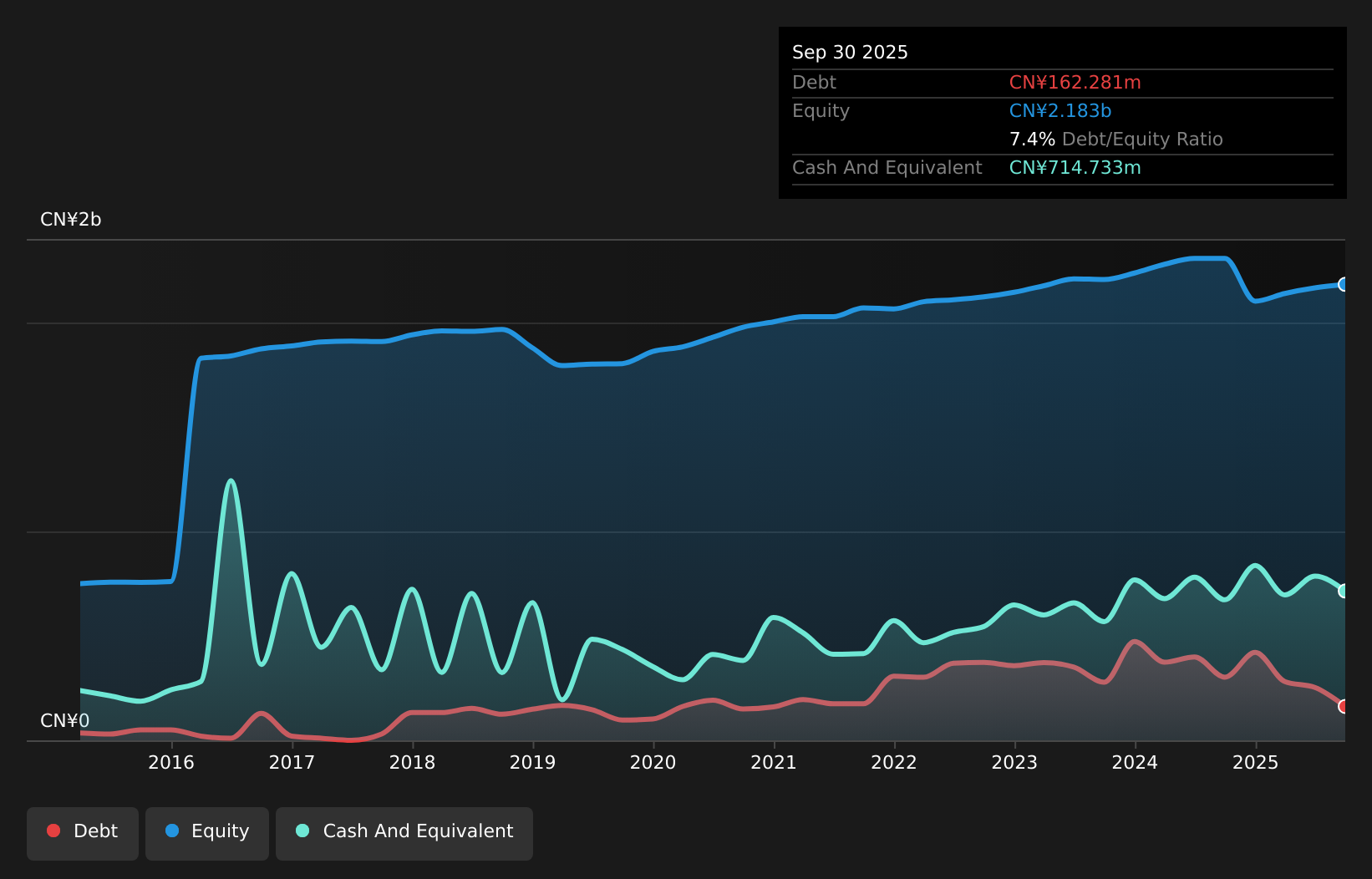

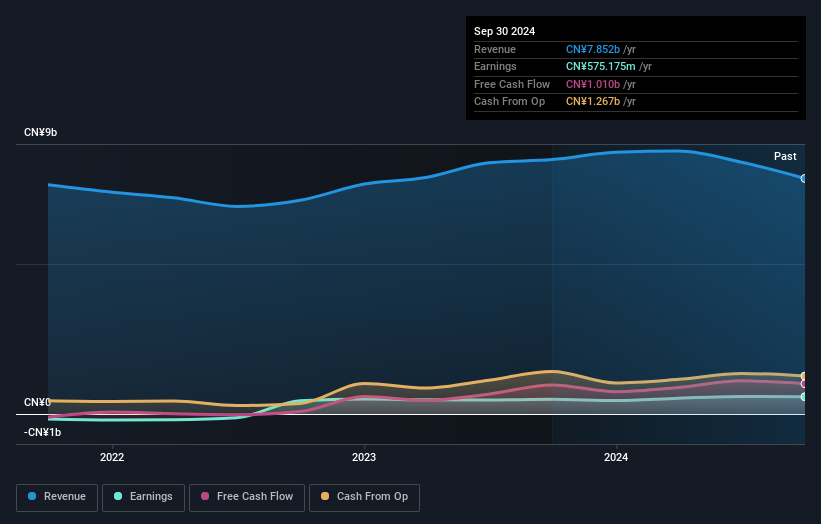

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the manufacturing sector, focusing on mould and plastic products, with a market cap of approximately CN¥7.09 billion.

Operations: Jiangnan Mould & Plastic Technology generates revenue primarily from the manufacturing of mould and plastic products. The company's financial performance is highlighted by its gross profit margin, which has shown variability over recent periods.

Jiangnan Mould & Plastic Technology, a player in the auto components sector, stands out with its earnings growth of 17.1% over the past year, surpassing industry growth of 10.5%. Trading at 41.4% below estimated fair value suggests potential undervaluation. The company's net debt to equity ratio is a satisfactory 10.5%, reflecting prudent financial management over five years as it reduced from 155.3% to 67.4%. Notably, recent financials include a one-off gain of CN¥103 million impacting results up to September 2024, and positive free cash flow further underscores its robust position despite sales dropping from CNY 6 billion to CNY 5 billion year-on-year.

- Click here to discover the nuances of Jiangnan Mould & Plastic Technology with our detailed analytical health report.

Understand Jiangnan Mould & Plastic Technology's track record by examining our Past report.

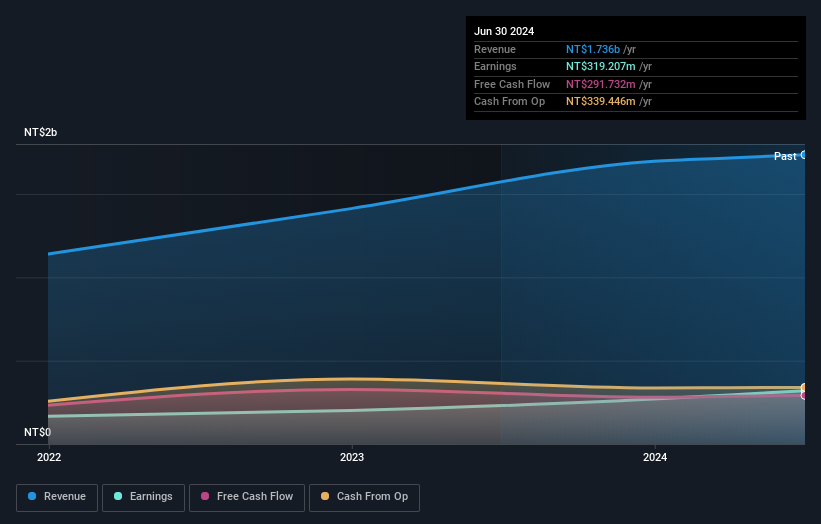

CHT Security (TPEX:7765)

Simply Wall St Value Rating: ★★★★★★

Overview: CHT Security Co., Ltd. offers cybersecurity services and has a market cap of NT$12.42 billion.

Operations: CHT Security generates revenue primarily from cybersecurity services. The company's net profit margin is 15%, reflecting its ability to convert a portion of its revenues into profit.

CHT Security has shown impressive growth, with earnings surging 36% over the past year, outpacing the IT sector's average. This small cap entity boasts high-quality earnings and operates debt-free, enhancing its financial stability. Levered free cash flow was US$292 million as of June 2024, indicating robust operational efficiency. Capital expenditures decreased to US$48 million, suggesting prudent investment management. The company’s profitability ensures a comfortable cash runway without concerns about interest payments due to its debt-free status. CHT Security's strategic position in the cybersecurity industry hints at promising future prospects amidst growing digital security needs.

- Unlock comprehensive insights into our analysis of CHT Security stock in this health report.

Examine CHT Security's past performance report to understand how it has performed in the past.

Taking Advantage

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4648 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:7765

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives