- China

- /

- Construction

- /

- SHSE:600463

Optimistic Investors Push Beijing Airport High-Tech Park Co., Ltd. (SHSE:600463) Shares Up 45% But Growth Is Lacking

Beijing Airport High-Tech Park Co., Ltd. (SHSE:600463) shareholders have had their patience rewarded with a 45% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

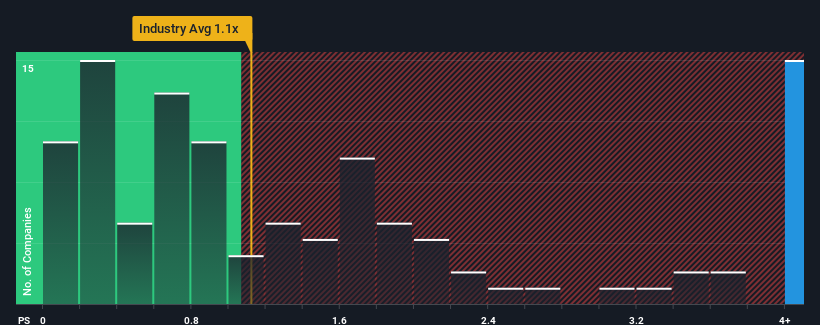

Since its price has surged higher, given around half the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Beijing Airport High-Tech Park as a stock to avoid entirely with its 6.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Beijing Airport High-Tech Park

What Does Beijing Airport High-Tech Park's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Beijing Airport High-Tech Park over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Beijing Airport High-Tech Park, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Beijing Airport High-Tech Park's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 62% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 15% shows it's an unpleasant look.

In light of this, it's alarming that Beijing Airport High-Tech Park's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Beijing Airport High-Tech Park's P/S Mean For Investors?

The strong share price surge has lead to Beijing Airport High-Tech Park's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Beijing Airport High-Tech Park currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Plus, you should also learn about these 3 warning signs we've spotted with Beijing Airport High-Tech Park (including 2 which are a bit concerning).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Airport High-Tech Park might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600463

Beijing Airport High-Tech Park

Engages in the development and construction of industrial real estate in China.

Adequate balance sheet minimal.

Market Insights

Community Narratives