- China

- /

- Trade Distributors

- /

- SHSE:600421

Investors in Hubei Huarong HoldingLtd (SHSE:600421) from three years ago are still down 44%, even after 13% gain this past week

It's nice to see the Hubei Huarong Holding Co.,Ltd. (SHSE:600421) share price up 13% in a week. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 44% in the last three years, falling well short of the market return.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Hubei Huarong HoldingLtd

Because Hubei Huarong HoldingLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Hubei Huarong HoldingLtd's revenue dropped 4.9% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 13%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

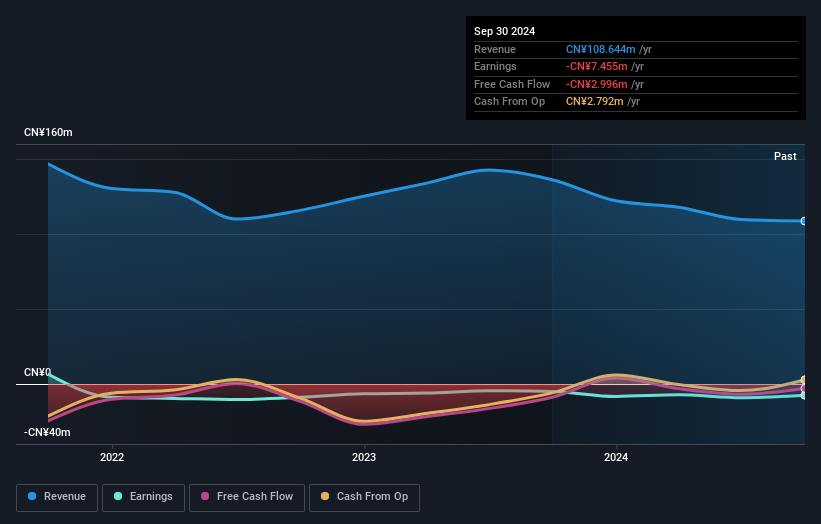

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Hubei Huarong HoldingLtd shareholders gained a total return of 8.4% during the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Hubei Huarong HoldingLtd (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Huarong HoldingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600421

Hubei Huarong HoldingLtd

Through its subsidiaries, provides molds, mold tables, and various tooling shelves for prefabricated concrete (PC) components used in housing construction application.

Adequate balance sheet very low.

Market Insights

Community Narratives