- China

- /

- Aerospace & Defense

- /

- SHSE:600184

North Electro-Optic Co.,Ltd.'s (SHSE:600184) Price Is Right But Growth Is Lacking After Shares Rocket 25%

Despite an already strong run, North Electro-Optic Co.,Ltd. (SHSE:600184) shares have been powering on, with a gain of 25% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.3% over the last year.

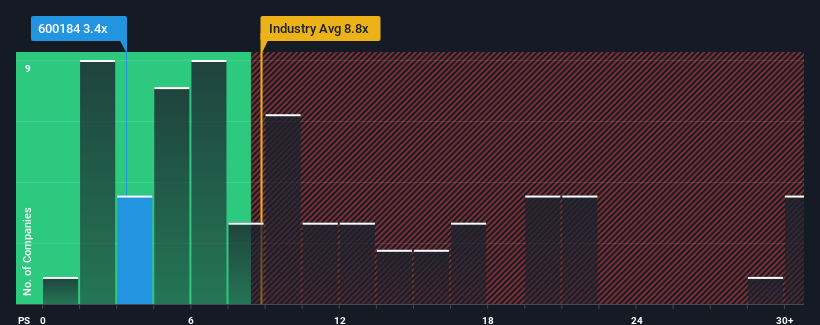

In spite of the firm bounce in price, North Electro-OpticLtd may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.4x, considering almost half of all companies in the Aerospace & Defense industry in China have P/S ratios greater than 8.8x and even P/S higher than 16x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for North Electro-OpticLtd

How Has North Electro-OpticLtd Performed Recently?

While the industry has experienced revenue growth lately, North Electro-OpticLtd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on North Electro-OpticLtd will help you uncover what's on the horizon.How Is North Electro-OpticLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as North Electro-OpticLtd's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 42% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 43%, which is noticeably more attractive.

With this in consideration, its clear as to why North Electro-OpticLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

North Electro-OpticLtd's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that North Electro-OpticLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for North Electro-OpticLtd that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if North Electro-OpticLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600184

North Electro-OpticLtd

Researches, develops, produces, and sells optoelectronic materials and devices in China and internationally.

Flawless balance sheet and good value.