Investors Don't See Light At End Of China CSSC Holdings Limited's (SHSE:600150) Tunnel

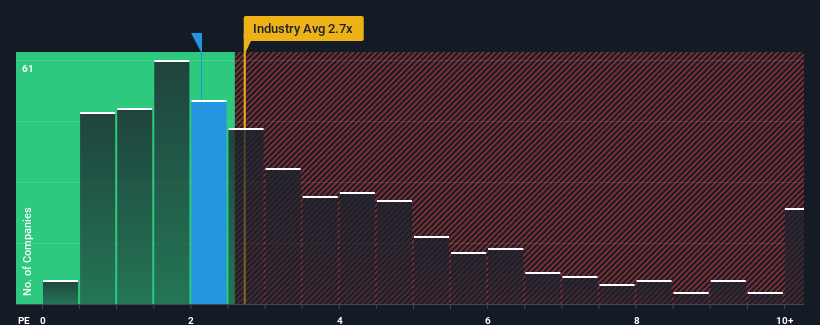

With a price-to-sales (or "P/S") ratio of 2.1x China CSSC Holdings Limited (SHSE:600150) may be sending bullish signals at the moment, given that almost half of all the Machinery companies in China have P/S ratios greater than 2.7x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for China CSSC Holdings

What Does China CSSC Holdings' P/S Mean For Shareholders?

China CSSC Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on China CSSC Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For China CSSC Holdings?

China CSSC Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The strong recent performance means it was also able to grow revenue by 34% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 12% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 28%, which is noticeably more attractive.

In light of this, it's understandable that China CSSC Holdings' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From China CSSC Holdings' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of China CSSC Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 1 warning sign for China CSSC Holdings that you need to take into consideration.

If these risks are making you reconsider your opinion on China CSSC Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600150

China CSSC Holdings

Engages in the shipbuilding and repair businesses in China.

Proven track record with adequate balance sheet and pays a dividend.