- China

- /

- Construction

- /

- SHSE:600133

Discovering Undiscovered Gems in China This September 2024

Reviewed by Simply Wall St

The Chinese stock market has recently faced challenges, with key indices like the Shanghai Composite and CSI 300 experiencing declines amid weak inflation data and ongoing economic concerns. Despite these headwinds, there are still compelling opportunities for discerning investors willing to explore lesser-known small-cap stocks. In this environment, a good stock often exhibits strong fundamentals, resilience in adverse conditions, and potential for growth driven by unique market positioning or innovative products.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shandong Link Science and TechnologyLtd | 2.65% | 15.68% | 10.94% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 6.14% | -1.34% | 69.26% | ★★★★★★ |

| Shenzhen TVT Digital Technology | 1.02% | 12.79% | 32.81% | ★★★★★★ |

| IFE Elevators | NA | 14.47% | 19.78% | ★★★★★★ |

| Beijing Foyou PharmaLTD | 1.91% | 1.16% | 18.67% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.00% | 5.87% | -14.07% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 22.46% | 0.77% | -3.26% | ★★★★☆☆ |

| Shenzhen Tongyi Industry | 72.24% | 13.41% | -16.34% | ★★★★☆☆ |

| Baoding Technology | 69.11% | 37.22% | 43.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Wuhan East Lake High Technology Group (SHSE:600133)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuhan East Lake High Technology Group Co., Ltd. operates in various high-tech industries and has a market cap of CN¥8.58 billion.

Operations: The company generates revenue from multiple high-tech industry segments. The net profit margin stands at 8.5%.

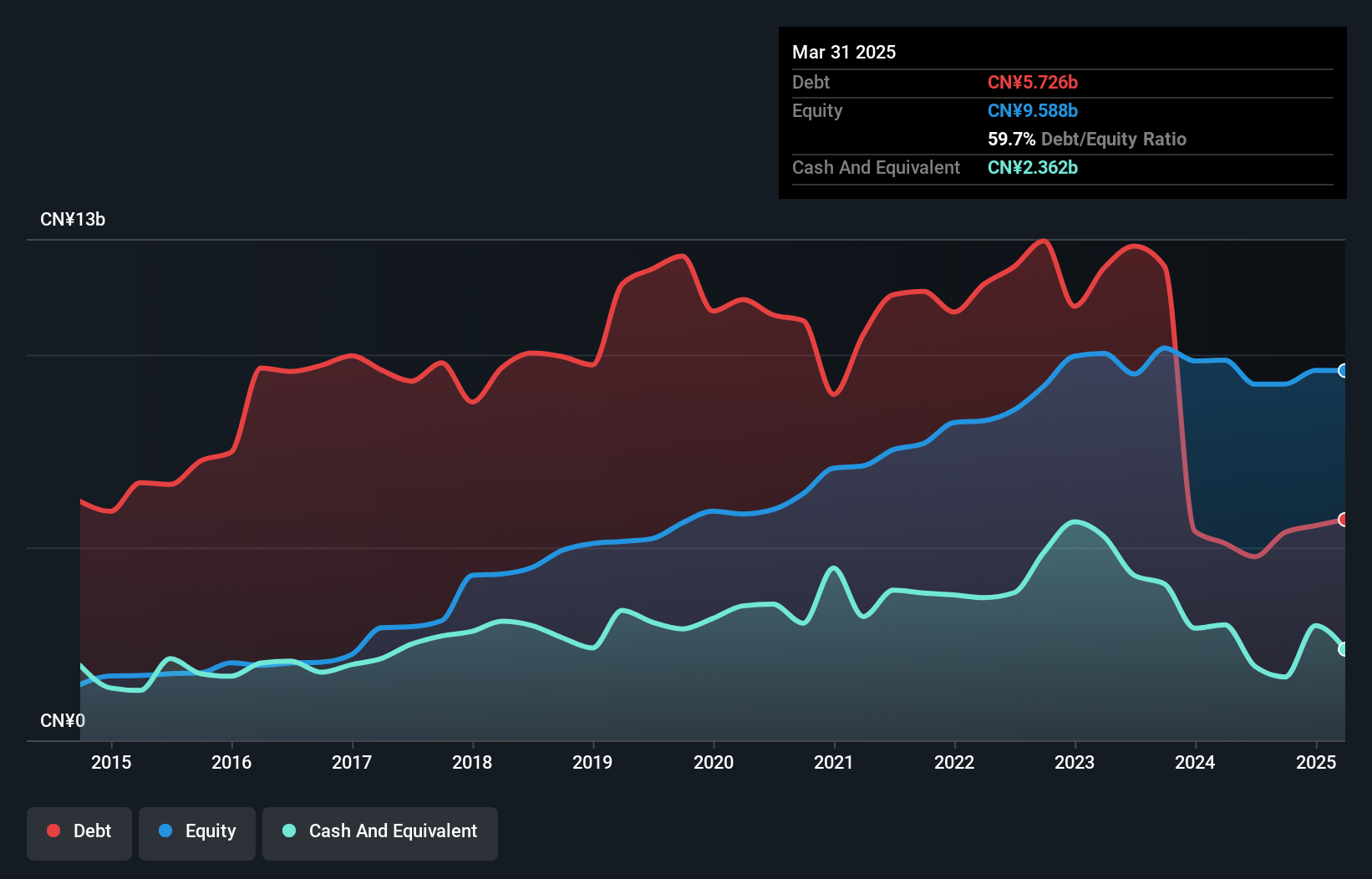

Wuhan East Lake High Technology Group's debt to equity ratio has impressively reduced from 233.7% to 51.5% over the last five years, showcasing improved financial health. The company boasts a low Price-To-Earnings ratio of 8.1x compared to the CN market average of 26.1x, indicating potential undervaluation. Recent earnings reveal sales of ¥811 million for the first half of 2024, down from ¥6.35 billion a year ago, with net income at ¥82 million compared to ¥103 million previously.

Sunshine Guojian Pharmaceutical (Shanghai) (SHSE:688336)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sunshine Guojian Pharmaceutical (Shanghai) Co., Ltd, a biopharmaceutical company with a market cap of CN¥11.85 billion, engages in the research and development, manufacturing, and commercialization of antibody drugs in China.

Operations: Sunshine Guojian Pharmaceutical generates its revenue primarily from the production and sales of pharmaceutical products, amounting to CN¥1.13 billion. The company focuses on antibody drugs within the biopharmaceutical sector.

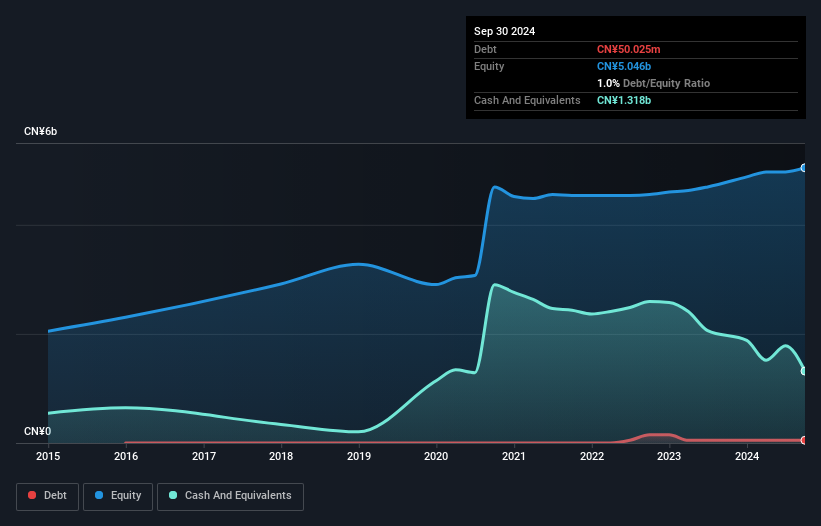

Sunshine Guojian Pharmaceutical (Shanghai) reported earnings growth of 117.8% over the past year, significantly outpacing the Biotech industry’s 7%. For the half-year ending June 30, 2024, sales reached CN¥588.98M from CN¥472.98M a year ago, while net income rose to CN¥129.51M from CN¥94.75M last year. Despite a one-off gain of CN¥92.6M impacting recent results, its debt-to-equity ratio has increased modestly from 0% to 1% over five years.

Hunan Valin Wire & CableLtd (SZSE:001208)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hunan Valin Wire & Cable Co., Ltd. engages in the research and development, production, and sales of wires and cables in China, with a market cap of CN¥4.20 billion.

Operations: Hunan Valin Wire & Cable Co., Ltd. generates revenue primarily from the production and sales of wires and cables in China, with a market cap of CN¥4.20 billion. The company's net profit margin stands at 5.23%.

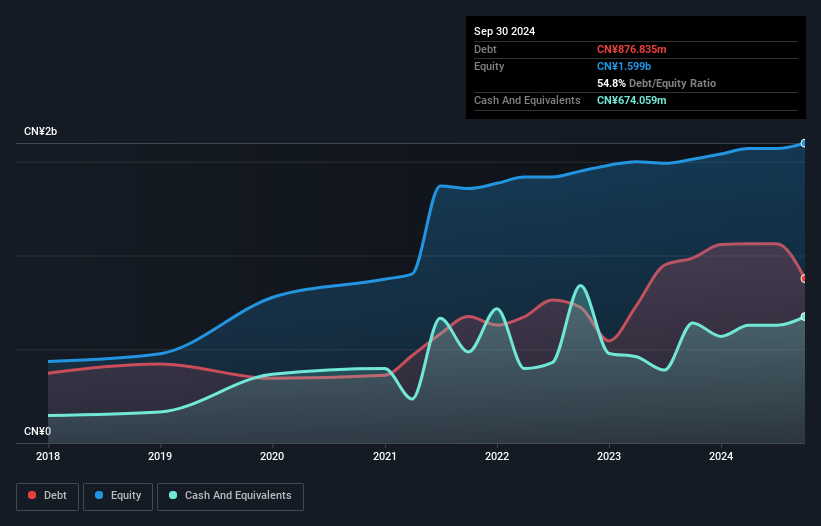

Hunan Valin Wire & Cable Ltd. has shown promising growth with earnings increasing by 27.6% over the past year, outpacing the Electrical industry’s 4.9%. Their recent half-year report reveals sales of CNY 1,949.52 million (US$267 million), up from CNY 1,679.14 million (US$230 million) last year, and net income rising to CNY 60.76 million (US$8.3 million). Despite a volatile share price recently, their debt to equity ratio stands at a satisfactory 28%.

Where To Now?

- Click through to start exploring the rest of the 919 Chinese Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan East Lake High Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600133

Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group Co., Ltd.

Solid track record with adequate balance sheet.