- Austria

- /

- Construction

- /

- WBAG:POS

3 Reliable Dividend Stocks Yielding Up To 8.1%

Reviewed by Simply Wall St

In a week marked by cautious commentary from the Federal Reserve and political uncertainty, global markets faced broad-based declines, with U.S. stocks experiencing notable volatility. Amidst this backdrop, investors are increasingly turning to dividend stocks as a potential source of stability and income, particularly those with reliable yields that can offer some cushion against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

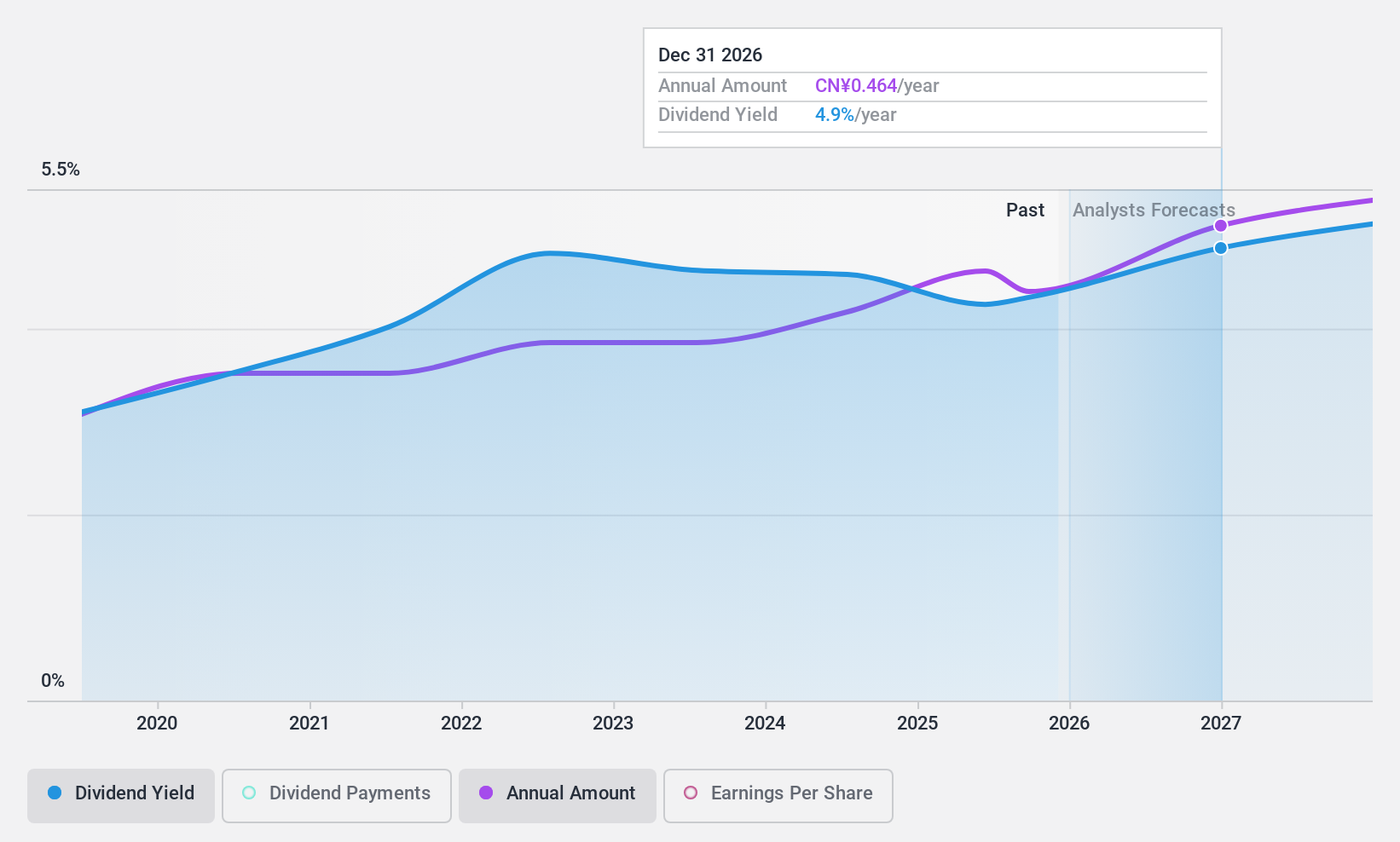

Bank of Changsha (SHSE:601577)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Changsha Co., Ltd. offers a range of commercial banking products and services to individual and corporate clients in China, with a market capitalization of approximately CN¥35.47 billion.

Operations: Bank of Changsha Co., Ltd.'s revenue is derived from its diverse range of commercial banking products and services provided to both personal and business customers in China.

Dividend Yield: 4.3%

Bank of Changsha's dividend yield of 4.31% ranks in the top quarter among Chinese dividend payers, supported by a low payout ratio of 19.5%, indicating strong coverage by earnings. Despite only six years of dividend history, payments have been stable and growing with minimal volatility. Recent earnings show net income growth to CNY 6.19 billion for the first nine months of 2024, suggesting continued financial health and potential for sustainable dividends.

- Navigate through the intricacies of Bank of Changsha with our comprehensive dividend report here.

- Our valuation report here indicates Bank of Changsha may be undervalued.

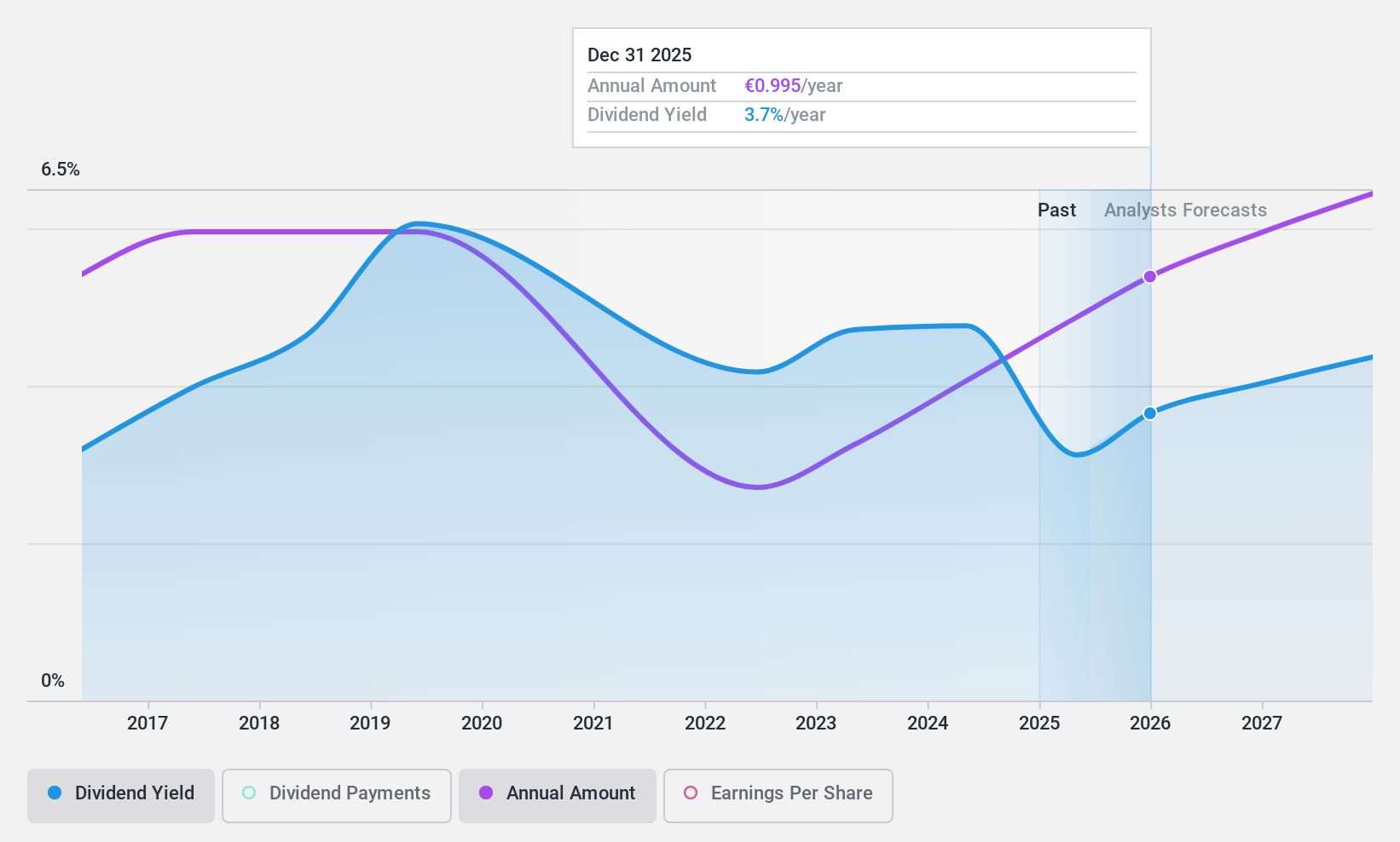

PORR (WBAG:POS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PORR AG is a construction company with operations in Austria, Germany, Poland, and various other countries internationally, and it has a market cap of approximately €673.66 million.

Operations: PORR AG generates its revenue primarily from Austria and Switzerland (€3.07 billion), followed by Poland (€1.02 billion), Germany (€962.46 million), and Infrastructure International (€425.83 million).

Dividend Yield: 4.3%

PORR's dividend yield of 4.26% is below the Austrian market's top 25%, but a low payout ratio of 32% ensures dividends are well-covered by earnings and cash flows. Despite past volatility, dividends have grown over the last decade. Recent earnings show stable performance, with EUR 1,702.27 million in Q3 sales and net income slightly down to EUR 28.07 million from last year, indicating potential for continued dividend sustainability amidst growth forecasts.

- Click here to discover the nuances of PORR with our detailed analytical dividend report.

- According our valuation report, there's an indication that PORR's share price might be on the expensive side.

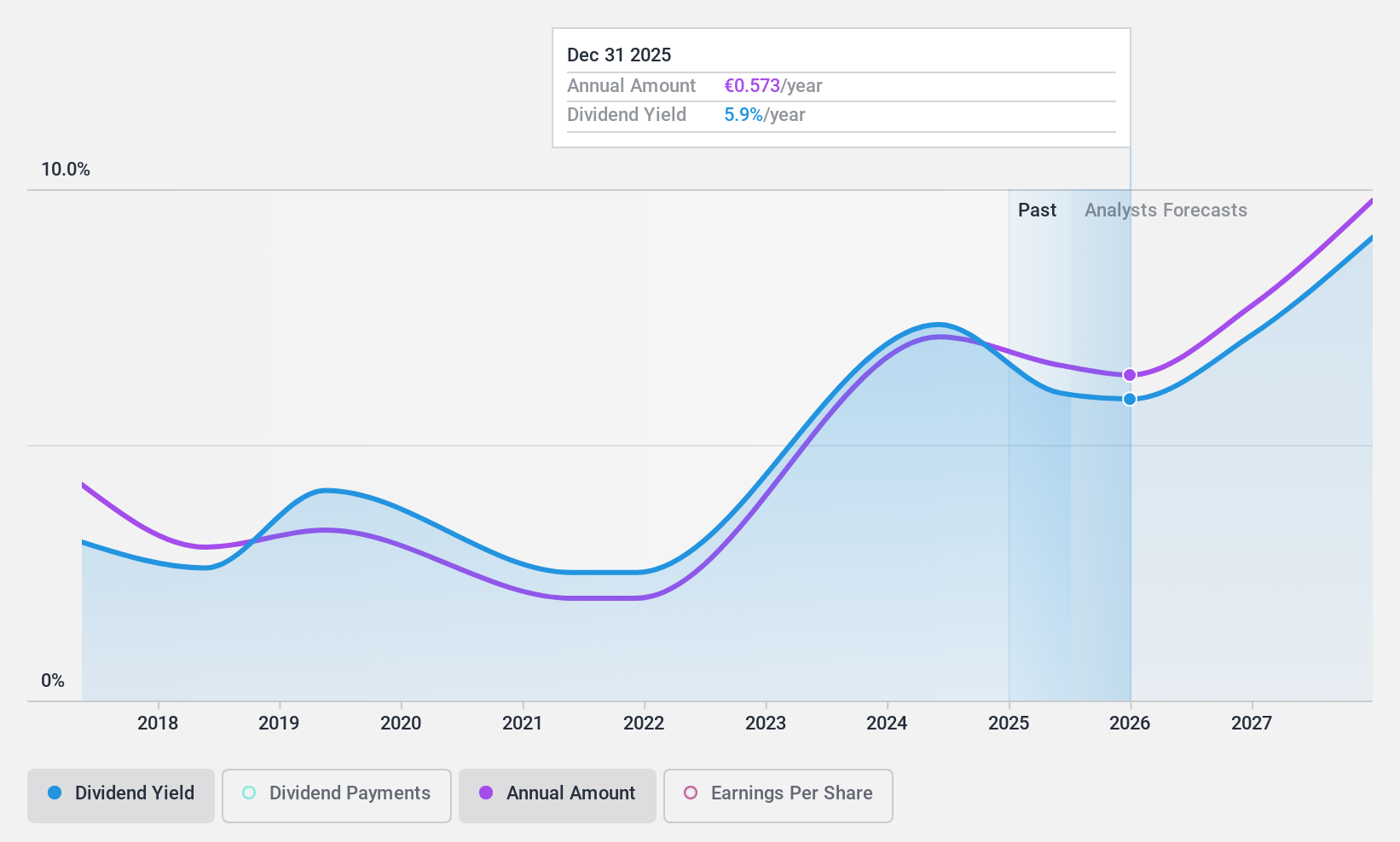

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €465.30 million, operates commercial banking services for small and medium enterprises and private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates revenue primarily from its banking segment, which amounts to €433.86 million.

Dividend Yield: 8.1%

ProCredit Holding's dividend yield of 8.1% is among the top 25% in the German market, supported by a low payout ratio of 36.2%, ensuring coverage by earnings. However, dividends have been unreliable and volatile over the past eight years. Despite trading at a significant discount to fair value and strong earnings growth forecasts, recent results show a decline in net income to €84.78 million for nine months ended September 2024 from €93.95 million previously.

- Delve into the full analysis dividend report here for a deeper understanding of ProCredit Holding.

- Upon reviewing our latest valuation report, ProCredit Holding's share price might be too pessimistic.

Where To Now?

- Delve into our full catalog of 1937 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:POS

PORR

Operates as a construction company in Austria, Germany, Poland, the Czech Republic, Qatar, Italy, Romania, Bulgaria, Switzerland, Serbia, Great Britain, Slovakia, Norway, Croatia, Belgium, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives