- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3132

3 Prominent Dividend Stocks Offering Up To 4.3% Yield

Reviewed by Simply Wall St

As global markets react to the Trump administration's policy shifts, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI investments, pushing major indexes like the S&P 500 to new highs. In this environment of economic fluctuations and investor sentiment shifts, dividend stocks stand out as a potentially stable choice for investors seeking income through reliable yields.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

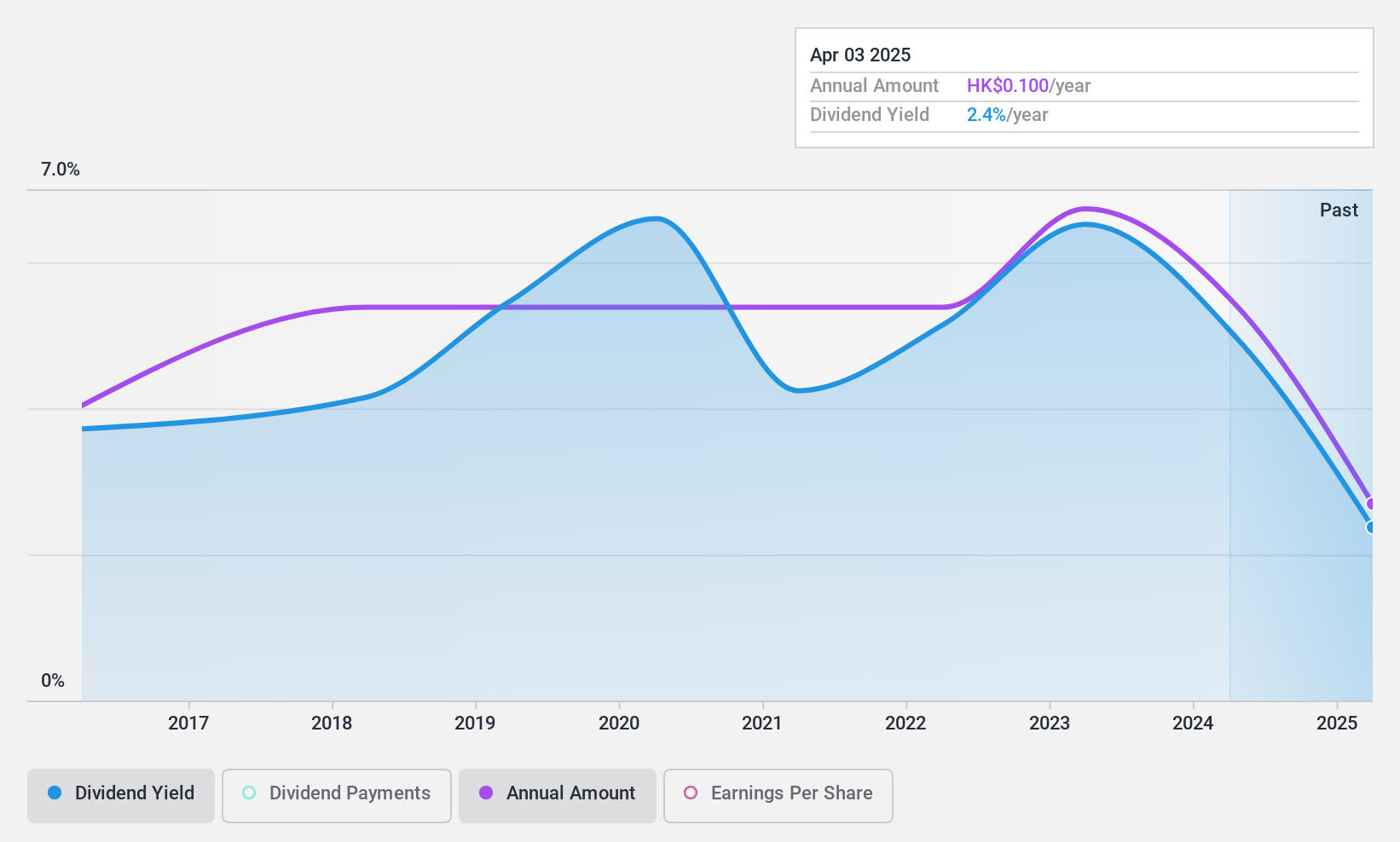

Tian An China Investments (SEHK:28)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market cap of HK$6.74 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily from Property Development (HK$1.10 billion) and Property Investment (HK$581.17 million).

Dividend Yield: 4.3%

Tian An China Investments offers a stable dividend profile with consistent payments over the past decade, supported by a payout ratio of 40.8% from earnings and 41.2% from cash flows, indicating sustainability. However, its 4.35% yield is below the top quartile in Hong Kong's market. Recent corporate governance changes include Ms. Lau Tung Ni's appointment as Company Secretary, enhancing management stability and succession planning efforts for continued reliability in dividend distribution.

- Click here to discover the nuances of Tian An China Investments with our detailed analytical dividend report.

- Our valuation report unveils the possibility Tian An China Investments' shares may be trading at a premium.

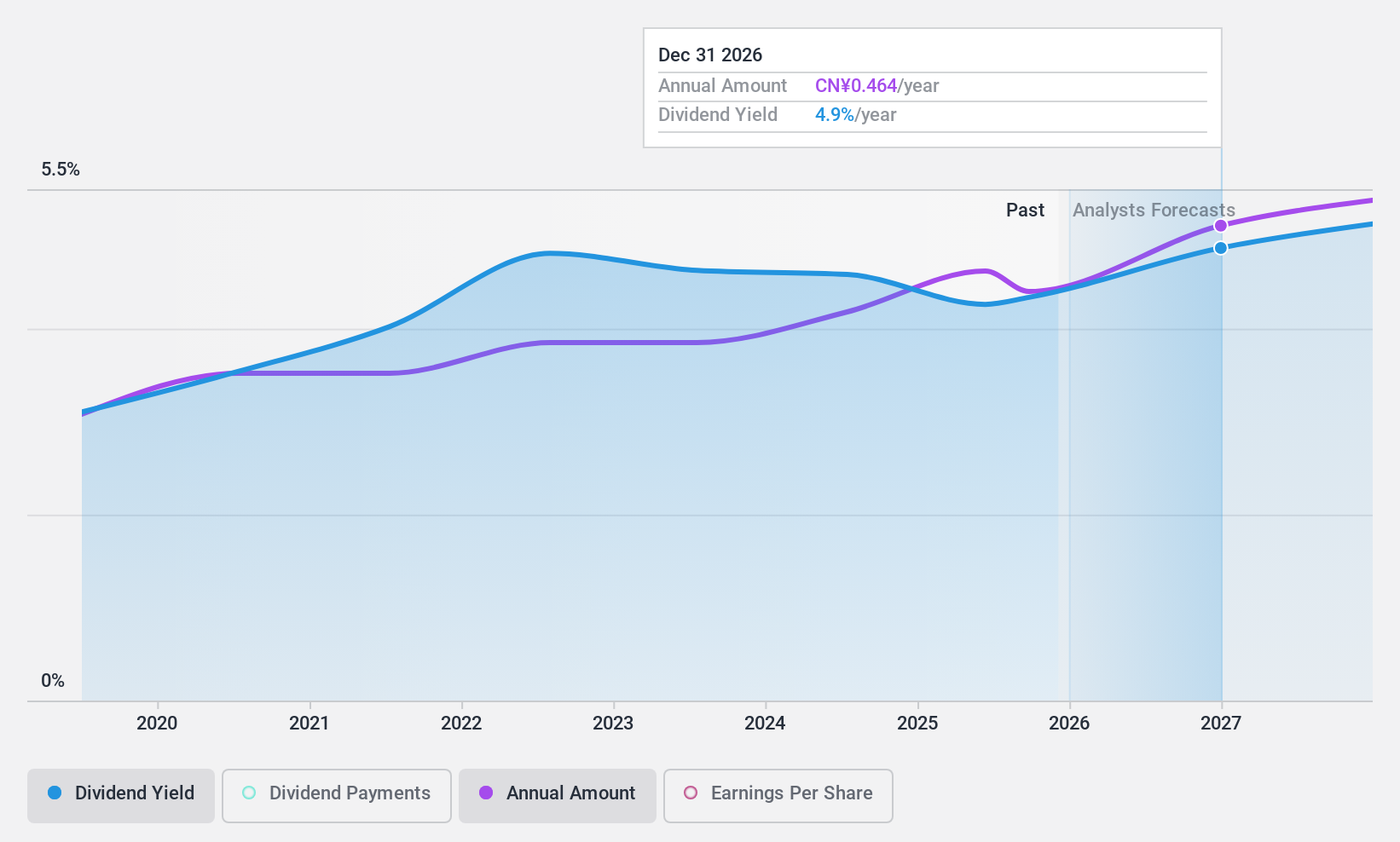

Bank of Changsha (SHSE:601577)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Changsha Co., Ltd. offers a range of commercial banking products and services to both personal and business customers in China, with a market cap of CN¥36.80 billion.

Operations: Bank of Changsha Co., Ltd. generates revenue through its diverse offerings in commercial banking products and services tailored for both individual and corporate clients in China.

Dividend Yield: 4.2%

Bank of Changsha's dividend is well-supported by a low payout ratio of 19.5%, ensuring sustainability. Although dividends have been reliable, the company has only paid them for six years. Its yield of 4.15% ranks in the top 25% in China, presenting an attractive option for income-focused investors. Recent earnings showed net income growth to ¥6.19 billion, up from ¥5.84 billion, indicating solid financial health and potential for continued dividend support.

- Navigate through the intricacies of Bank of Changsha with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Bank of Changsha's share price might be too pessimistic.

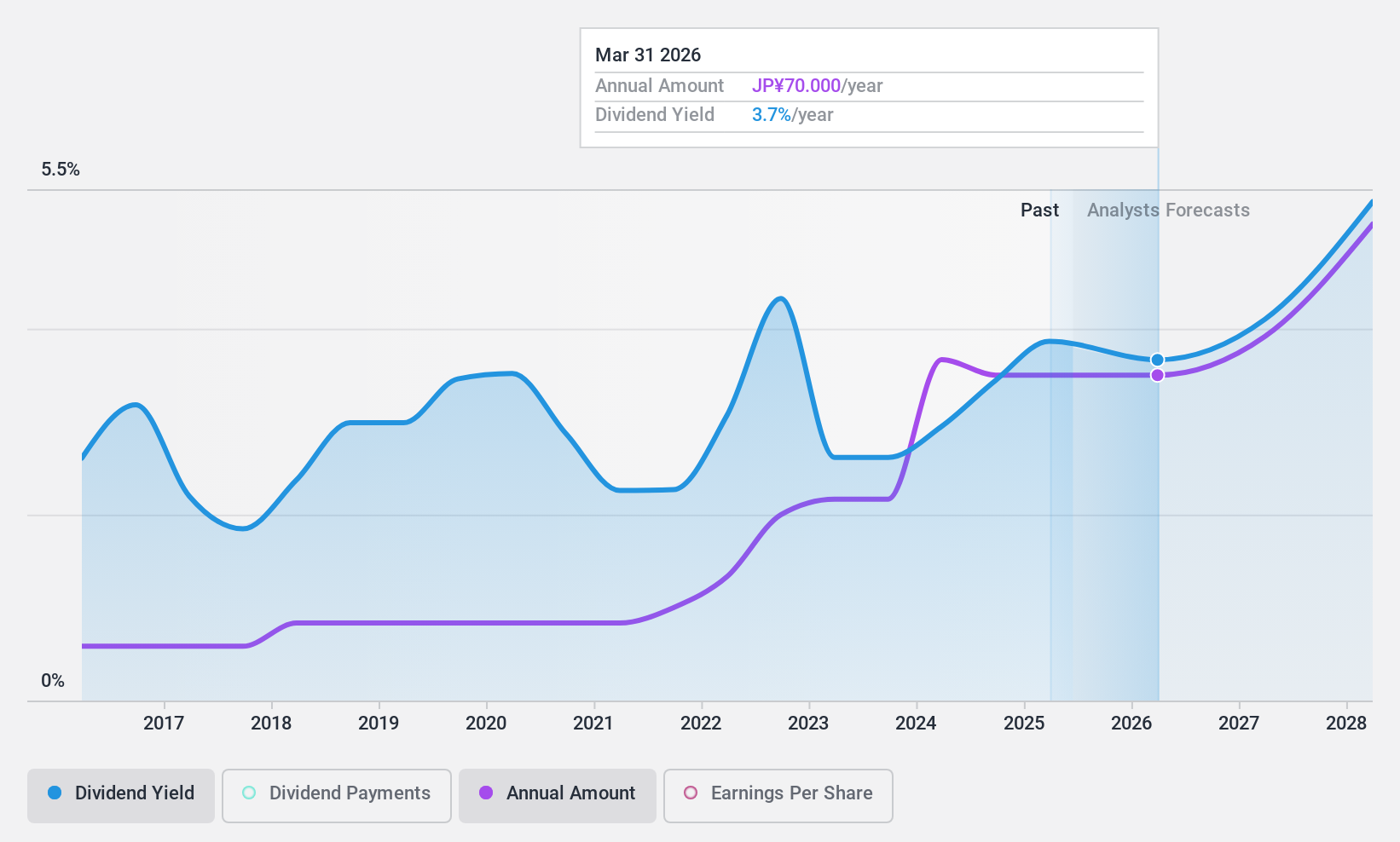

Macnica Holdings (TSE:3132)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Macnica Holdings, Inc. imports, sells, and exports electronic components in Japan and has a market cap of ¥325.70 billion.

Operations: Macnica Holdings generates revenue from its Network Business, which accounts for ¥139.96 million, and its Integrated Circuits, Electronic Devices and Other Businesses segment, contributing ¥860.76 million.

Dividend Yield: 3.8%

Macnica Holdings offers a dividend yield of 3.83%, ranking in the top 25% of Japanese dividend payers, with payments covered by earnings and cash flows due to a payout ratio of 69.9% and a cash payout ratio of 37.8%. However, dividends have been volatile over the past decade despite recent increases. The company is actively pursuing acquisitions in Asia to enhance market presence amid industry consolidation pressures, while also executing share buybacks to boost shareholder returns.

- Get an in-depth perspective on Macnica Holdings' performance by reading our dividend report here.

- Our valuation report here indicates Macnica Holdings may be undervalued.

Seize The Opportunity

- Reveal the 1981 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Macnica Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3132

Macnica Holdings

Imports, sells, and exports electronic components in Japan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives