- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Top Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets react to the Trump administration's emerging policies and AI investments, U.S. stocks are reaching new heights with major indexes closing the week on a positive note. In this buoyant market environment, identifying strong dividend stocks can be particularly appealing for investors seeking steady income streams amidst economic optimism and potential trade developments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics and has a market cap of €524.36 million.

Operations: Clínica Baviera, S.A. generates its revenue primarily from its ophthalmology segment, which accounted for €252.47 million.

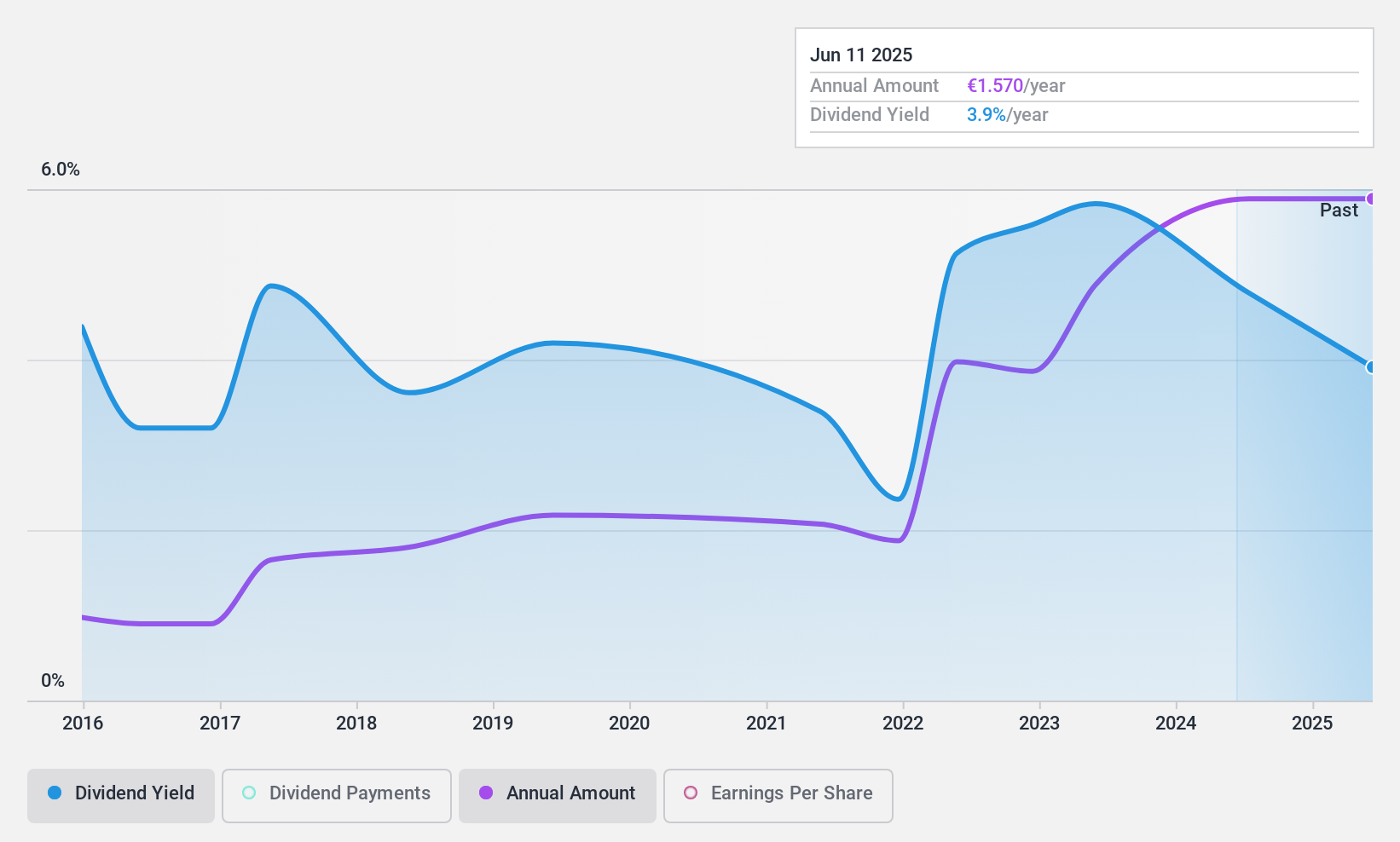

Dividend Yield: 4.7%

Clínica Baviera's dividend payments are covered by earnings and cash flows, with payout ratios of 66.6% and 69%, respectively. Despite a recent earnings growth of €28.02 million for the first nine months of 2024, its dividend yield at 4.7% is low compared to top Spanish payers. The dividends have grown over the past decade but remain volatile and unreliable, reflecting an unstable track record amidst a highly volatile share price environment.

- Click here to discover the nuances of Clínica Baviera with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Clínica Baviera is trading behind its estimated value.

Jiangsu Changshu Rural Commercial Bank (SHSE:601128)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Changshu Rural Commercial Bank Co., Ltd. operates as a regional commercial bank providing financial services in China, with a market cap of CN¥22.34 billion.

Operations: Jiangsu Changshu Rural Commercial Bank Co., Ltd. generates its revenue from various financial services within China.

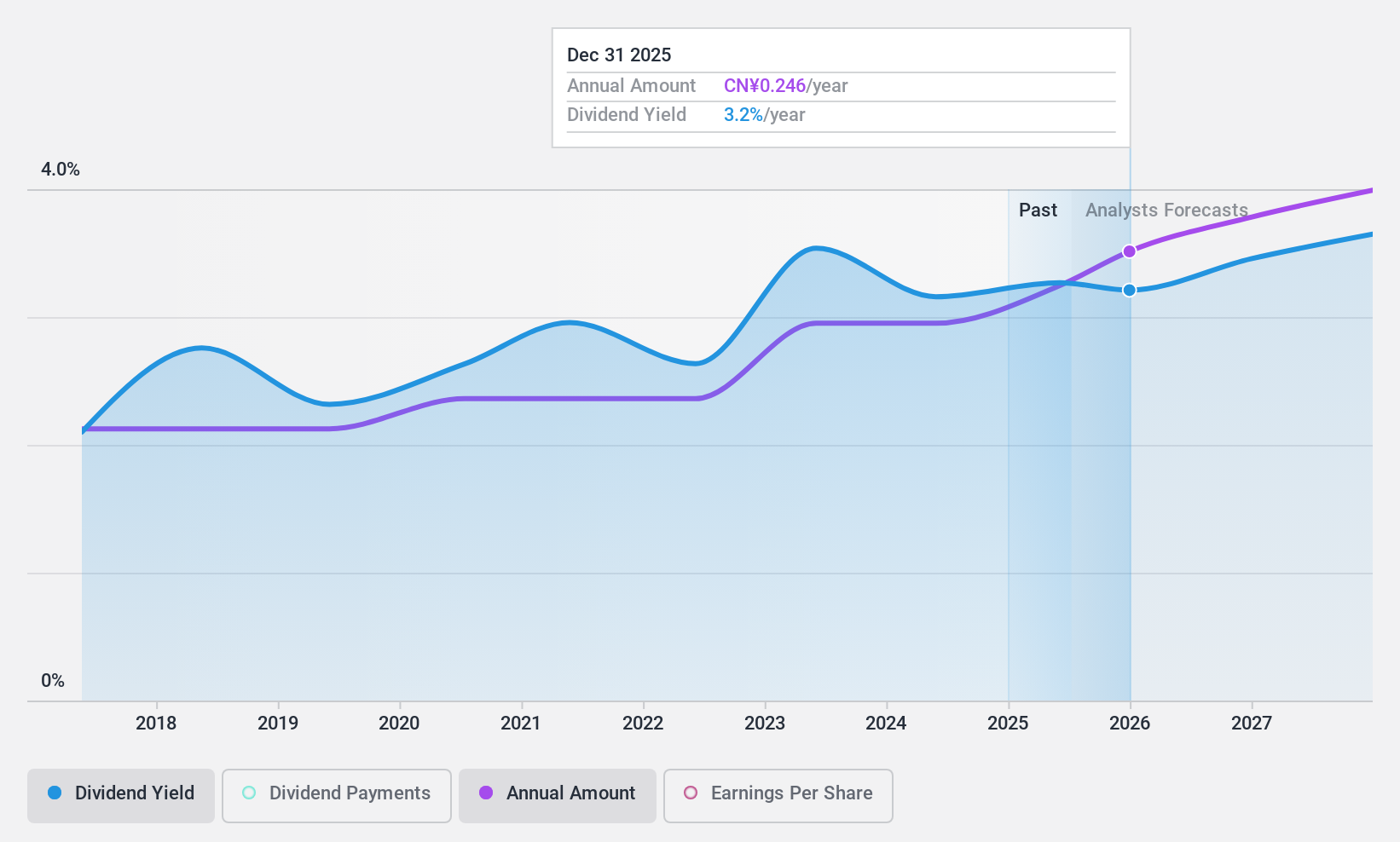

Dividend Yield: 3.1%

Jiangsu Changshu Rural Commercial Bank's dividends are well-covered by earnings, with a low payout ratio of 18.4%, and are expected to remain sustainable over the next three years. The bank has maintained stable and reliable dividend payments for eight years, although its track record is relatively short. Trading significantly below estimated fair value, the stock offers a competitive dividend yield of 3.07%, ranking in the top 25% within China's market.

- Dive into the specifics of Jiangsu Changshu Rural Commercial Bank here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Jiangsu Changshu Rural Commercial Bank is priced lower than what may be justified by its financials.

Prestige International (TSE:4290)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prestige International Inc. offers business process outsourcing services both in Japan and globally, with a market cap of ¥83.92 billion.

Operations: Prestige International Inc. generates revenue from various regions, with ¥57.53 billion from Japan, ¥2.11 billion from Asia/Oceania, and ¥3.59 billion from the Americas/Europe.

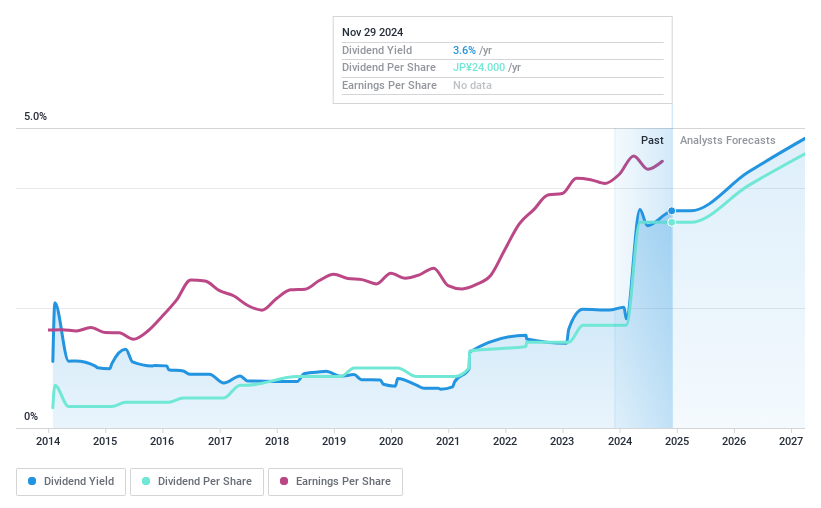

Dividend Yield: 3.6%

Prestige International's dividend payments have grown over the past decade, supported by a low earnings payout ratio of 40.5%, though cash flow coverage is tighter at 84.5%. Despite this growth, dividends have been volatile, with an annual drop exceeding 20% in some years. The stock trades at a significant discount to its estimated fair value and offers a yield slightly below the top quartile in Japan's market. Recent share buybacks aim to enhance shareholder returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Prestige International.

- The analysis detailed in our Prestige International valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Explore the 1962 names from our Top Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives