Here's Why We Think Jiangsu Changshu Rural Commercial Bank (SHSE:601128) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Jiangsu Changshu Rural Commercial Bank (SHSE:601128). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Jiangsu Changshu Rural Commercial Bank

Jiangsu Changshu Rural Commercial Bank's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Jiangsu Changshu Rural Commercial Bank's EPS has grown 23% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

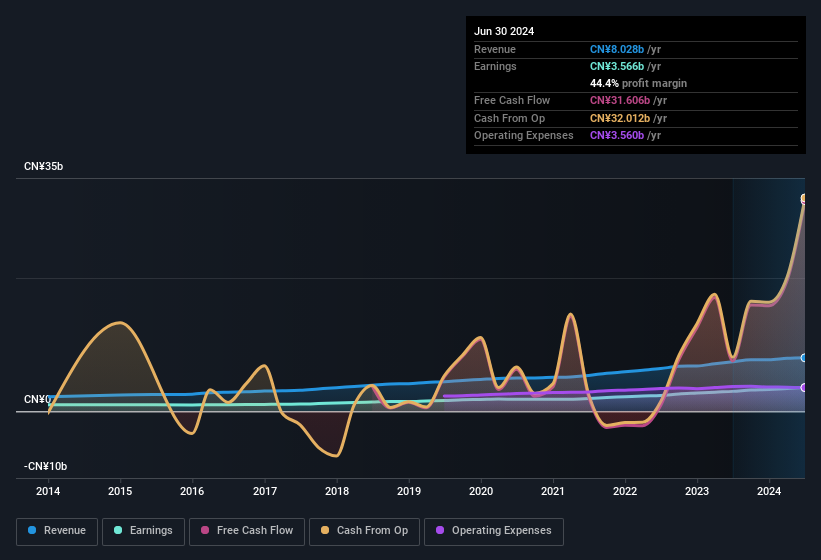

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Jiangsu Changshu Rural Commercial Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Jiangsu Changshu Rural Commercial Bank maintained stable EBIT margins over the last year, all while growing revenue 7.9% to CN¥8.0b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Jiangsu Changshu Rural Commercial Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Jiangsu Changshu Rural Commercial Bank Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. Our analysis has discovered that the median total compensation for the CEOs of companies like Jiangsu Changshu Rural Commercial Bank with market caps between CN¥14b and CN¥45b is about CN¥1.7m.

Jiangsu Changshu Rural Commercial Bank's CEO only received compensation totalling CN¥150k in the year to December 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Jiangsu Changshu Rural Commercial Bank To Your Watchlist?

You can't deny that Jiangsu Changshu Rural Commercial Bank has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. We think that based on its merits alone, this stock is worth watching into the future. You still need to take note of risks, for example - Jiangsu Changshu Rural Commercial Bank has 1 warning sign we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601128

Jiangsu Changshu Rural Commercial Bank

Jiangsu Changshu Rural Commercial Bank Co., Ltd.

Very undervalued with flawless balance sheet and pays a dividend.