- Japan

- /

- Auto Components

- /

- TSE:5101

Top Dividend Stocks Including China Merchants Bank

Reviewed by Simply Wall St

In the current global market landscape, major stock indexes have shown mixed results with growth stocks outperforming value stocks significantly, while geopolitical events and economic data continue to influence investor sentiment. As investors navigate these dynamic conditions, dividend stocks like China Merchants Bank offer a potential avenue for income generation and portfolio diversification. A good dividend stock typically combines consistent payout history with a robust financial foundation, making it an attractive option in both stable and fluctuating markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.40% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

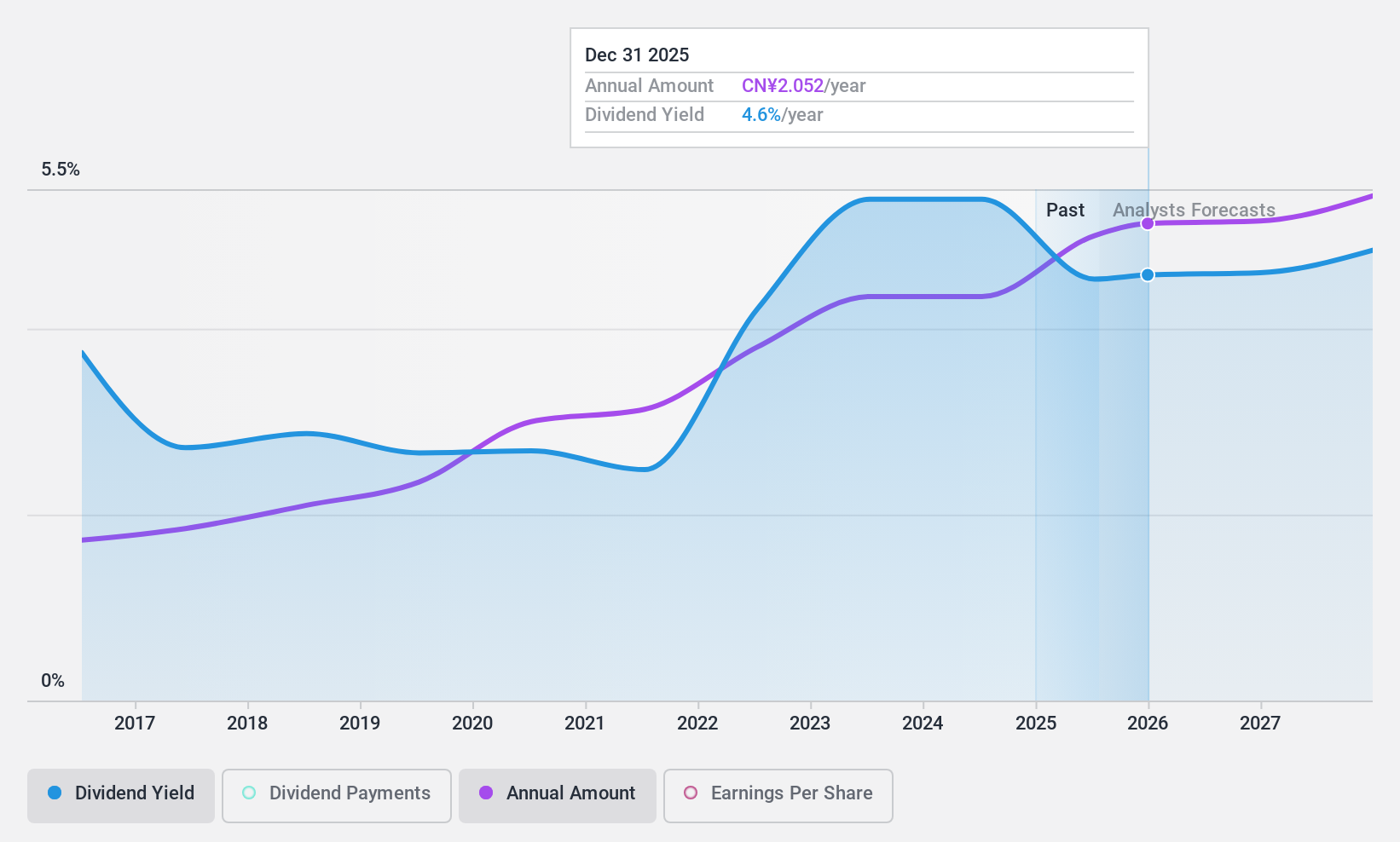

China Merchants Bank (SHSE:600036)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China Merchants Bank Co., Ltd., along with its subsidiaries, offers a range of banking products and services, with a market cap of CN¥954.11 billion.

Operations: China Merchants Bank Co., Ltd. generates revenue through diverse banking products and services, with its operations spanning various financial segments.

Dividend Yield: 5.1%

China Merchants Bank offers a stable dividend profile, with dividends reliably covered by earnings due to a low payout ratio of 35.2%. The bank's dividends have been consistent over the past decade and are in the top 25% of CN market payers. Recent board changes and a CNY 30 billion fixed-income offering highlight ongoing strategic adjustments. Earnings have shown slight fluctuations, but overall financial health supports continued dividend reliability.

- Take a closer look at China Merchants Bank's potential here in our dividend report.

- Our expertly prepared valuation report China Merchants Bank implies its share price may be too high.

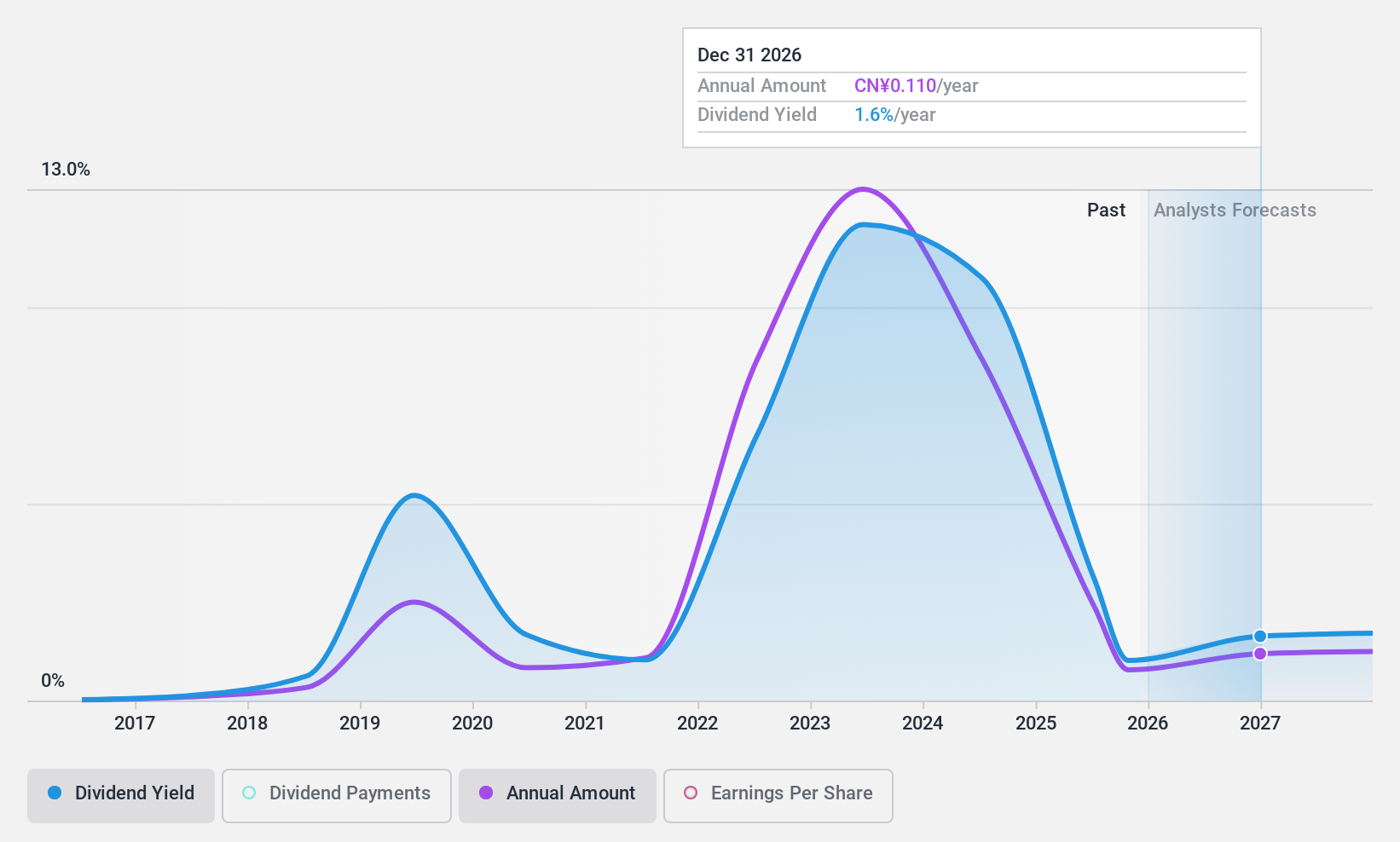

Shanxi Coking Coal Energy Group (SZSE:000983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanxi Coking Coal Energy Group Co., Ltd. operates in the coal mining industry and has a market cap of CN¥48.43 billion.

Operations: Shanxi Coking Coal Energy Group Co., Ltd. generates revenue primarily from its operations in the coal mining industry.

Dividend Yield: 9.4%

Shanxi Coking Coal Energy Group's dividend yield of 9.38% ranks in the top 25% of the CN market, yet its sustainability is questionable due to a high payout ratio of 114%, not well covered by earnings. Although dividends have increased over the past decade, they remain volatile and unreliable. The company trades at a favorable P/E ratio of 12.2x compared to peers but faces declining sales and net income, impacting future dividend stability.

- Get an in-depth perspective on Shanxi Coking Coal Energy Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shanxi Coking Coal Energy Group's current price could be quite moderate.

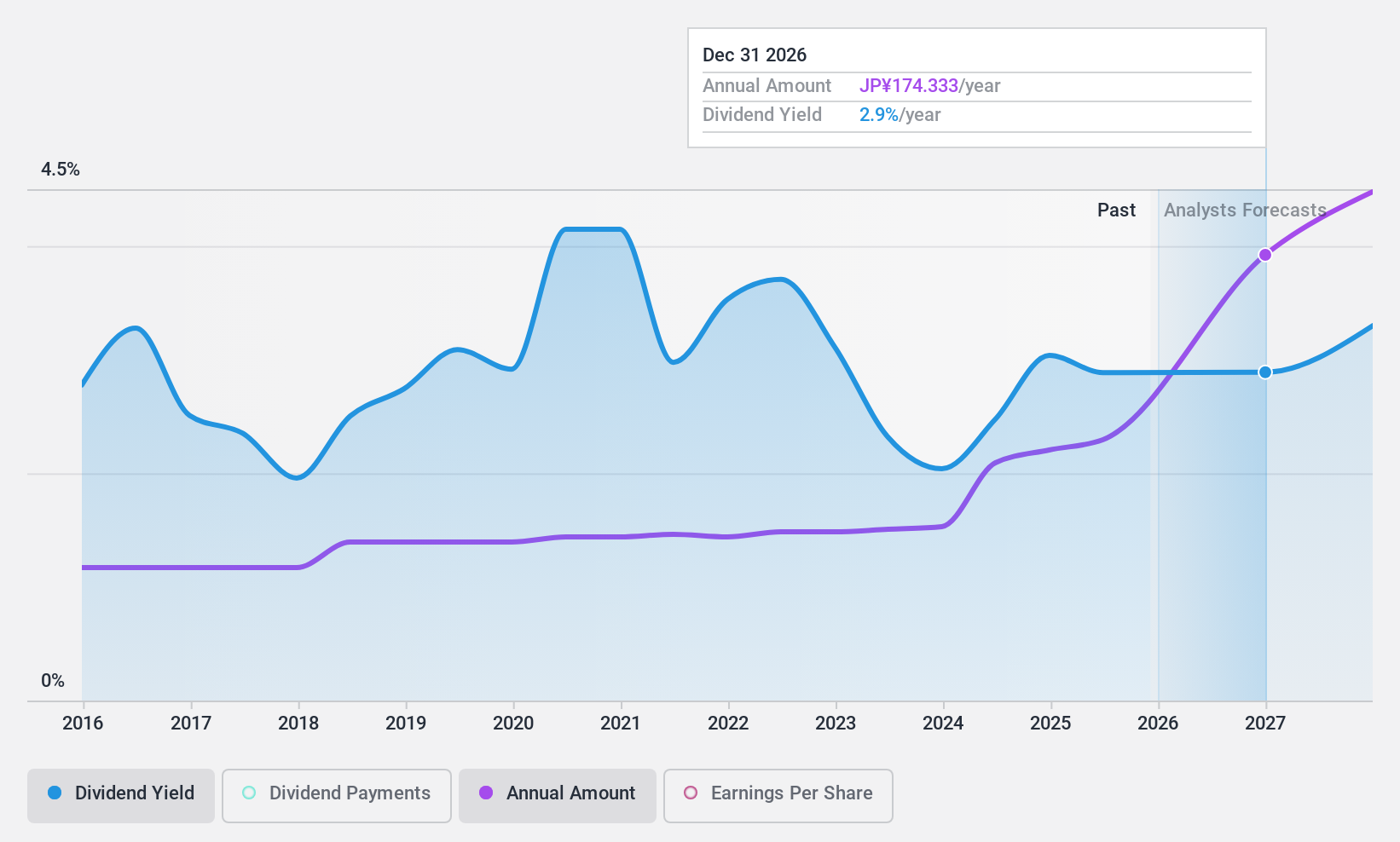

Yokohama Rubber Company (TSE:5101)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Yokohama Rubber Company, Limited manufactures and sells tires both in Japan and internationally, with a market cap of ¥506.83 billion.

Operations: The Yokohama Rubber Company, Limited generates revenue primarily from its Tire segment at ¥964.37 billion and its Multiple Business (MB) segment at ¥103.92 billion.

Dividend Yield: 3.1%

Yokohama Rubber Company offers a dividend yield of 3.08%, below the top 25% in Japan, with dividends well-covered by earnings due to a low payout ratio of 18.4%. However, its dividend history is unstable and volatile over the past decade. The company trades at a significant discount to its estimated fair value and has recently completed a share buyback program worth ¥3.92 billion, aiming to enhance capital efficiency amidst solid earnings growth.

- Navigate through the intricacies of Yokohama Rubber Company with our comprehensive dividend report here.

- According our valuation report, there's an indication that Yokohama Rubber Company's share price might be on the cheaper side.

Summing It All Up

- Explore the 1928 names from our Top Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5101

Yokohama Rubber Company

Engages in the manufacture and sale of tires in Japan and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives