- China

- /

- Auto Components

- /

- SZSE:301186

Top Chinese Dividend Stocks For October 2024

Reviewed by Simply Wall St

As China's central bank introduces more support measures amidst deflationary pressures, Chinese equities have shown resilience with notable gains in the Shanghai Composite and CSI 300 indices. In this context of economic adjustment and growth surprises, dividend stocks become an attractive option for investors seeking stability and income.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 3.97% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.22% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.28% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.36% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.19% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.21% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.56% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.13% | ★★★★★★ |

Click here to see the full list of 196 stocks from our Top Chinese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

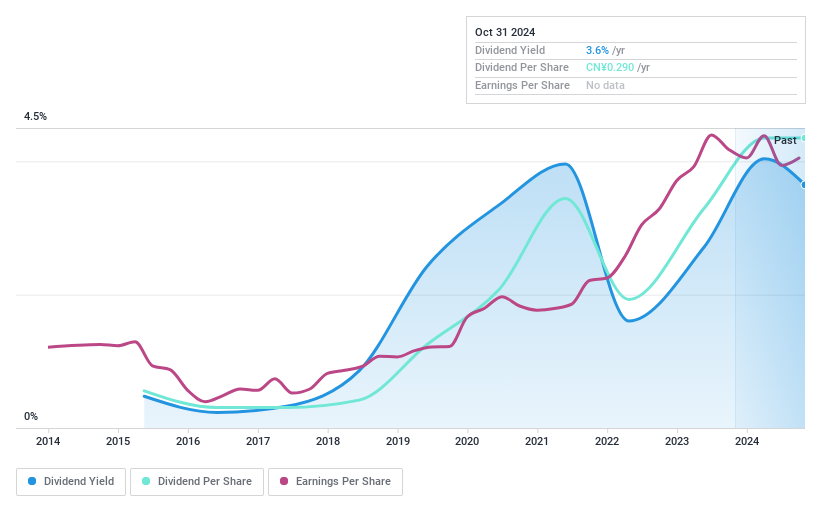

JDM JingDaMachine (Ningbo)Ltd (SHSE:603088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JDM JingDaMachine (Ningbo) Co.Ltd is engaged in the manufacturing, production, and sale of precision stamping press, HVAC equipment, and automation equipment both in China and internationally, with a market cap of CN¥3.20 billion.

Operations: JDM JingDaMachine (Ningbo) Ltd generates revenue from its Metal Forming Machine Tool Manufacturing segment, which amounts to CN¥747.42 million.

Dividend Yield: 4%

JDM JingDaMachine (Ningbo) Ltd offers a compelling dividend profile with its 3.97% yield ranking in the top 25% of Chinese dividend payers. The company's dividends are covered by both earnings and cash flows, with payout ratios at 82.8% and 81.3%, respectively, indicating sustainability despite an unreliable track record over nine years due to volatility. Recent earnings showed stable sales growth but a slight decline in net income, highlighting potential challenges ahead for consistent dividend performance.

- Navigate through the intricacies of JDM JingDaMachine (Ningbo)Ltd with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, JDM JingDaMachine (Ningbo)Ltd's share price might be too pessimistic.

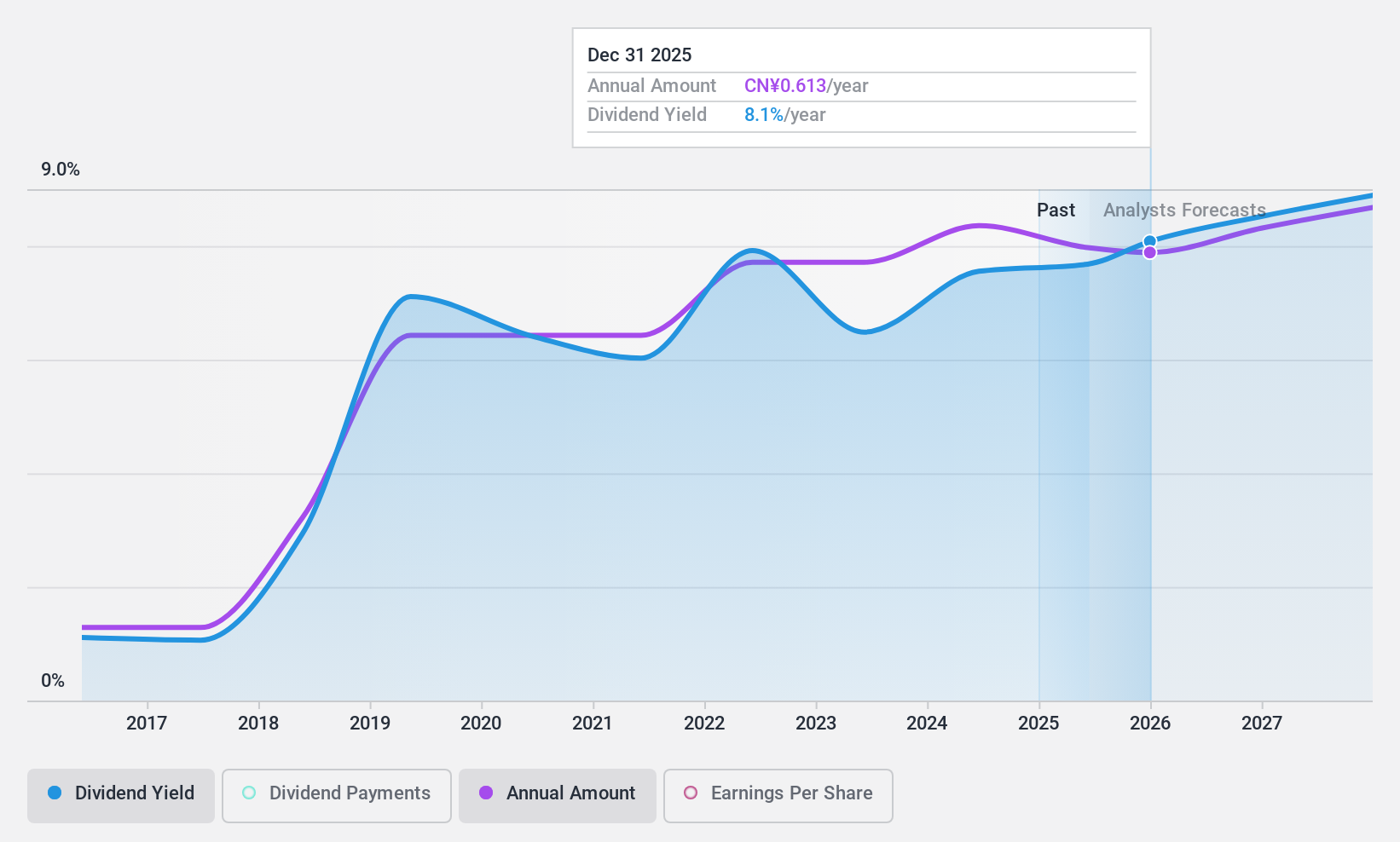

Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Fuanna Bedding and Furnishing Co., Ltd focuses on the R&D, design, production, and sales of textile home furnishing and living products both in China and internationally, with a market cap of CN¥7.70 billion.

Operations: Shenzhen Fuanna Bedding and Furnishing Co., Ltd generates revenue through its core activities of developing, designing, manufacturing, and selling textile home furnishings and living products domestically and abroad.

Dividend Yield: 7.1%

Shenzhen Fuanna Bedding and Furnishing Ltd offers a notable dividend yield of 7.06%, placing it in the top 25% of Chinese dividend payers. Despite stable and growing dividends over the past decade, the high payout ratio of 95.9% suggests limited coverage by earnings and cash flows, raising sustainability concerns. Recent results show modest revenue growth but stagnant net income, while recent board changes may impact future strategic directions related to dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Shenzhen Fuanna Bedding and FurnishingLtd.

- In light of our recent valuation report, it seems possible that Shenzhen Fuanna Bedding and FurnishingLtd is trading behind its estimated value.

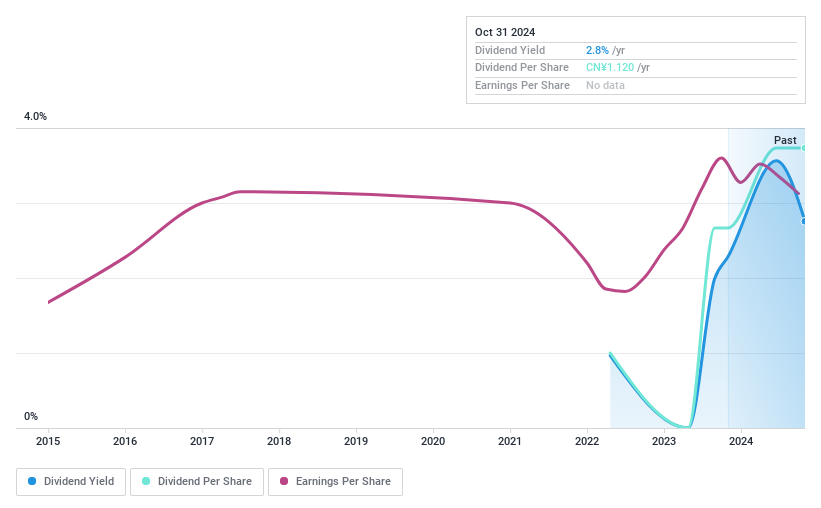

Nantong Chaoda EquipmentLtd (SZSE:301186)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nantong Chaoda Equipment Co., Ltd. specializes in designing and selling automotive interior and exterior molds in China, with a market cap of CN¥2.69 billion.

Operations: Nantong Chaoda Equipment Co., Ltd.'s revenue primarily comes from its Machinery & Industrial Equipment segment, totaling CN¥657.52 million.

Dividend Yield: 3.1%

Nantong Chaoda Equipment Ltd. trades significantly below its estimated fair value, which may appeal to value-focused investors. Despite a top-tier dividend yield of 3.09% in China, the company's short dividend history is marked by volatility and unreliability over the past three years. Dividends are well-covered by earnings with a payout ratio of 41.8%, though cash flow coverage is tighter at 78.9%. Recent earnings show growth in revenue and net income, indicating potential financial stability improvements.

- Click here to discover the nuances of Nantong Chaoda EquipmentLtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Nantong Chaoda EquipmentLtd's current price could be quite moderate.

Key Takeaways

- Delve into our full catalog of 196 Top Chinese Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nantong Chaoda EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301186

Nantong Chaoda EquipmentLtd

Designs and sells automotive interior and exterior molds in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives