- China

- /

- Auto Components

- /

- SZSE:300998

Subdued Growth No Barrier To Ningbo Fangzheng Automobile Mould Co.,Ltd. (SZSE:300998) With Shares Advancing 33%

Those holding Ningbo Fangzheng Automobile Mould Co.,Ltd. (SZSE:300998) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

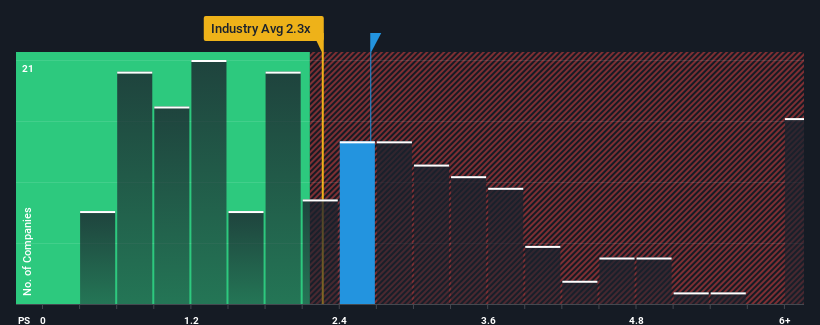

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Ningbo Fangzheng Automobile MouldLtd's P/S ratio of 2.6x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is also close to 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ningbo Fangzheng Automobile MouldLtd

What Does Ningbo Fangzheng Automobile MouldLtd's Recent Performance Look Like?

Recent times have been quite advantageous for Ningbo Fangzheng Automobile MouldLtd as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ningbo Fangzheng Automobile MouldLtd's earnings, revenue and cash flow.How Is Ningbo Fangzheng Automobile MouldLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Ningbo Fangzheng Automobile MouldLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 43% gain to the company's top line. The latest three year period has also seen an excellent 48% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 25% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Ningbo Fangzheng Automobile MouldLtd's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Ningbo Fangzheng Automobile MouldLtd's P/S Mean For Investors?

Its shares have lifted substantially and now Ningbo Fangzheng Automobile MouldLtd's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Ningbo Fangzheng Automobile MouldLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Ningbo Fangzheng Automobile MouldLtd (2 can't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Ningbo Fangzheng Automobile MouldLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ningbo Fangzheng Automobile MouldLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300998

Ningbo Fangzheng Automobile MouldLtd

Ningbo Fangzheng Automobile Mould Co.,Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)