- China

- /

- Healthcare Services

- /

- SHSE:600713

Undiscovered Gems with Potential To Explore This December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by record highs in major indices like the S&P 500 and Nasdaq Composite, small-cap stocks have seen mixed performance, with the Russell 2000 Index experiencing a decline after recent outperformance. This environment of dispersed sector performance and economic data releases highlights the importance of identifying stocks with strong fundamentals and growth potential, particularly those that may be overlooked amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 37.70% | 48.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Guangxi Wuzhou Communications (SHSE:600368)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Wuzhou Communications Co., Ltd. operates toll roads and has a market cap of CN¥6.52 billion.

Operations: The company generates revenue primarily through the operation of toll roads. Its financial performance is influenced by factors such as traffic volume and toll rates. The business model heavily relies on infrastructure management to drive income, with costs associated with road maintenance and operations impacting overall profitability.

Guangxi Wuzhou, a modestly sized player in the infrastructure sector, has shown steady financial health with earnings growing 1.3% annually over the past five years. The company's debt situation looks promising as its net debt to equity ratio stands at a satisfactory 28.1%, down from 147.3% five years ago, indicating effective leverage management. Despite not surpassing industry growth rates last year, Guangxi Wuzhou's price-to-earnings ratio of 10.2x suggests it is undervalued compared to the broader CN market average of 37.6x, potentially offering attractive value for discerning investors seeking quality earnings and robust interest coverage.

NanJing Pharmaceutical (SHSE:600713)

Simply Wall St Value Rating: ★★★★☆☆

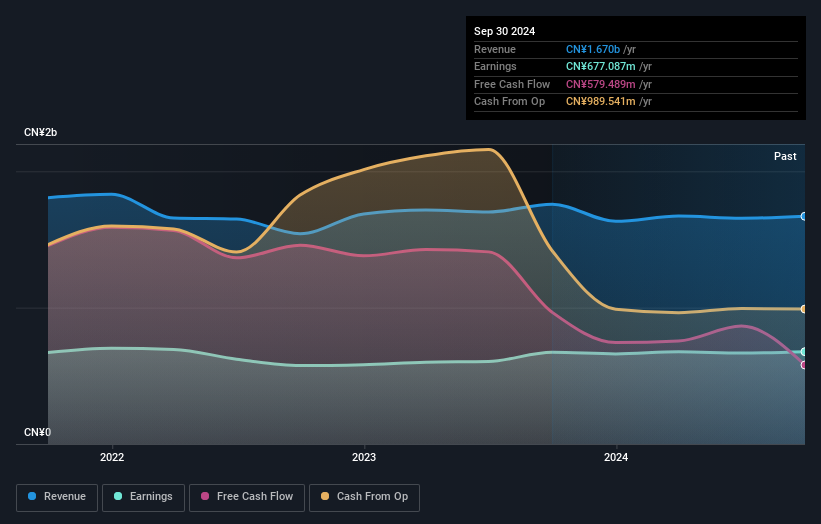

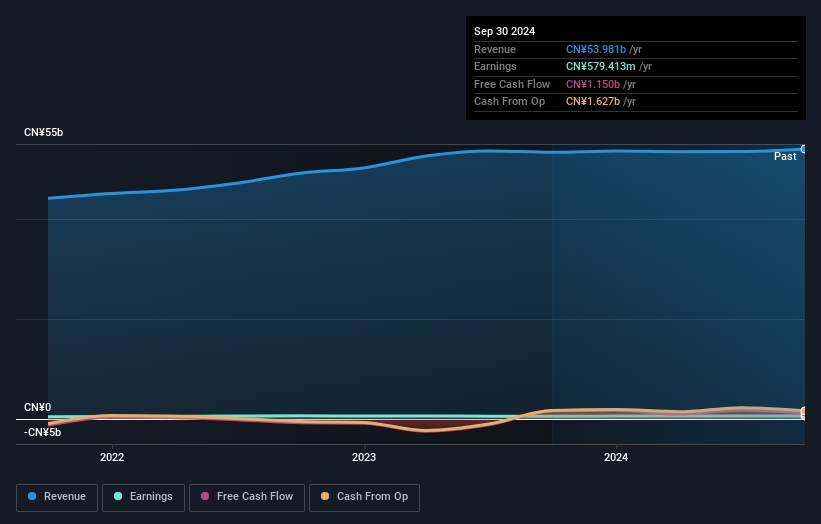

Overview: NanJing Pharmaceutical Company Limited operates in the pharmaceutical wholesale and retail sectors in China with a market cap of approximately CN¥6.98 billion.

Operations: The company generates revenue primarily from its pharmaceutical segment, totaling approximately CN¥53.98 billion. The focus on wholesale and retail operations in the pharmaceutical sector is a significant contributor to its financial performance.

NanJing Pharma, a smaller player in the healthcare sector, has been making strides with its earnings growth of 2.4% over the past year, outpacing the industry average of -5.7%. Despite a high net debt to equity ratio at 132%, it has improved from 188.2% five years ago, indicating better financial management over time. The company trades at a significant discount to its estimated fair value by nearly 65%, suggesting potential undervaluation. Recent earnings show stable performance with net income reaching CNY 441 million for nine months ending September 2024, reflecting consistent profitability amidst industry challenges.

VT Industrial TechnologyLtd (SZSE:300707)

Simply Wall St Value Rating: ★★★★★☆

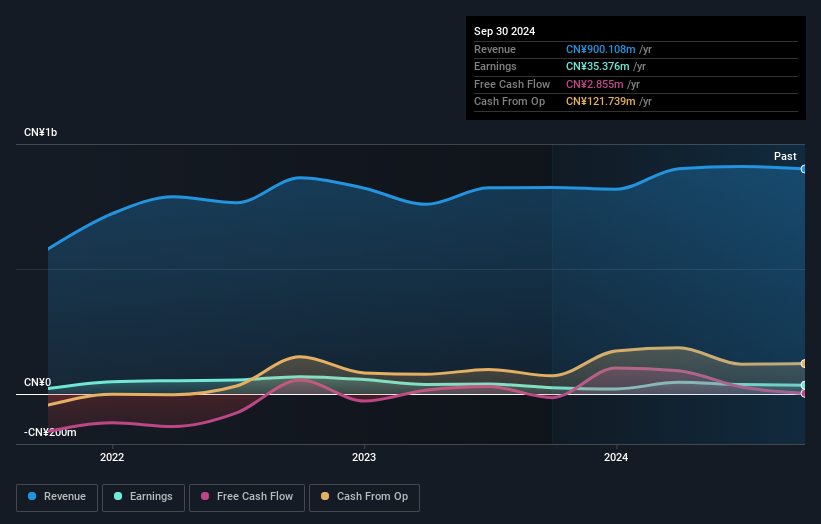

Overview: VT Industrial Technology Ltd specializes in the research, design, production, and sale of automotive tools and dies, metal parts fixtures, automotive metal parts, battery pack housing, and industrial automation equipment and services with a market capitalization of approximately CN¥2.93 billion.

Operations: The primary revenue streams for VT Industrial Technology Ltd include automotive tools and dies, metal parts fixtures, automotive metal parts, battery pack housing, and industrial automation equipment. The company has a market capitalization of approximately CN¥2.93 billion.

VT Industrial Technology, a smaller player in the industrial tech space, has shown impressive financial growth with earnings rising 38.9% over the past year, outpacing the Auto Components industry average of 10.5%. The company's net income for the first nine months of 2024 reached CNY 29.75 million, more than double from CNY 14.69 million last year, reflecting strong performance and high-quality earnings. Despite a volatile share price recently, their debt is well-managed with interest payments covered by EBIT at a comfortable ratio of 4.6 times and cash exceeding total debt levels; however, shareholders experienced dilution over the past year.

Where To Now?

- Explore the 4629 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJing Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600713

NanJing Pharmaceutical

Engages in the pharmaceutical wholesale and retail businesses in China.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives