- China

- /

- Auto Components

- /

- SZSE:300580

Even With A 35% Surge, Cautious Investors Are Not Rewarding Wuxi Best Precision Machinery Co., Ltd.'s (SZSE:300580) Performance Completely

Wuxi Best Precision Machinery Co., Ltd. (SZSE:300580) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

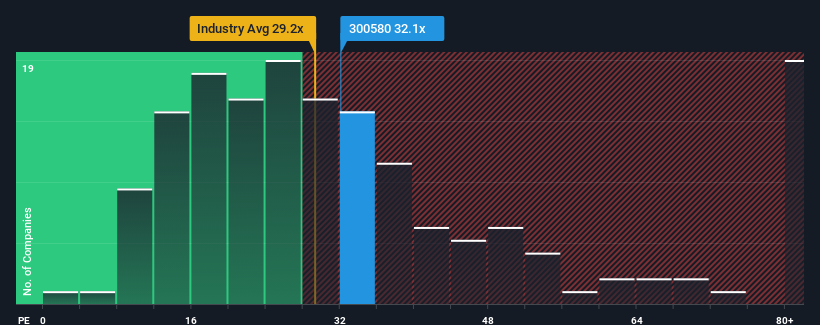

Although its price has surged higher, it's still not a stretch to say that Wuxi Best Precision Machinery's price-to-earnings (or "P/E") ratio of 32.1x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Wuxi Best Precision Machinery has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Wuxi Best Precision Machinery

Does Growth Match The P/E?

Wuxi Best Precision Machinery's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. Regardless, EPS has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 24% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 19% per year growth forecast for the broader market.

With this information, we find it interesting that Wuxi Best Precision Machinery is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Wuxi Best Precision Machinery's P/E?

Wuxi Best Precision Machinery's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Wuxi Best Precision Machinery currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Wuxi Best Precision Machinery is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Best Precision Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300580

Wuxi Best Precision Machinery

Engages in the research, development, production, and sale of precision parts, intelligent equipment, and tooling products in China and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives