- Germany

- /

- Hospitality

- /

- XTRA:HTG

3 Growth Companies With Insider Ownership As High As 33%

Reviewed by Simply Wall St

Amidst a backdrop of record highs in major U.S. indices and shifting economic policies following the recent election, investors are keenly evaluating growth opportunities that align with current market dynamics. In this environment, companies with substantial insider ownership often stand out as they can signal confidence from those closest to the business, making them attractive candidates for those seeking potential growth investments.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.6% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Ratos (OM:RATO B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ratos AB (publ) is a private equity firm that focuses on buyouts, turnarounds, add-on acquisitions, and middle market transactions with a market cap of SEK10.83 billion.

Operations: The company's revenue is derived from three primary segments: Consumer (SEK5.46 billion), Industry (SEK10.41 billion), and Construction & Services (SEK16.49 billion).

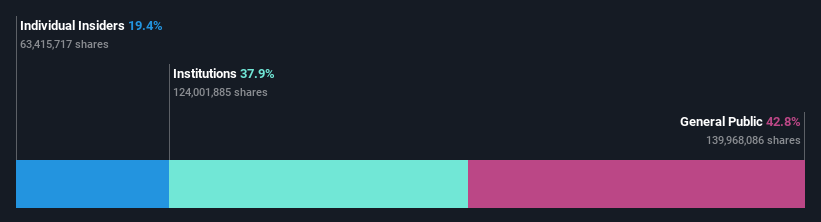

Insider Ownership: 19.3%

Ratos AB shows potential for growth with its forecasted earnings increase of 23.9% annually, surpassing the Swedish market average. Despite a recent net loss in Q3 2024, insider buying has been substantial, indicating confidence in future prospects. However, revenue growth is modest at 4.5% per year and return on equity is expected to remain low at 9.1%. Trading below estimated fair value suggests possible investment appeal despite an unstable dividend history and large one-off items affecting results.

- Navigate through the intricacies of Ratos with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Ratos' share price might be too pessimistic.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Growth Rating: ★★★★☆☆

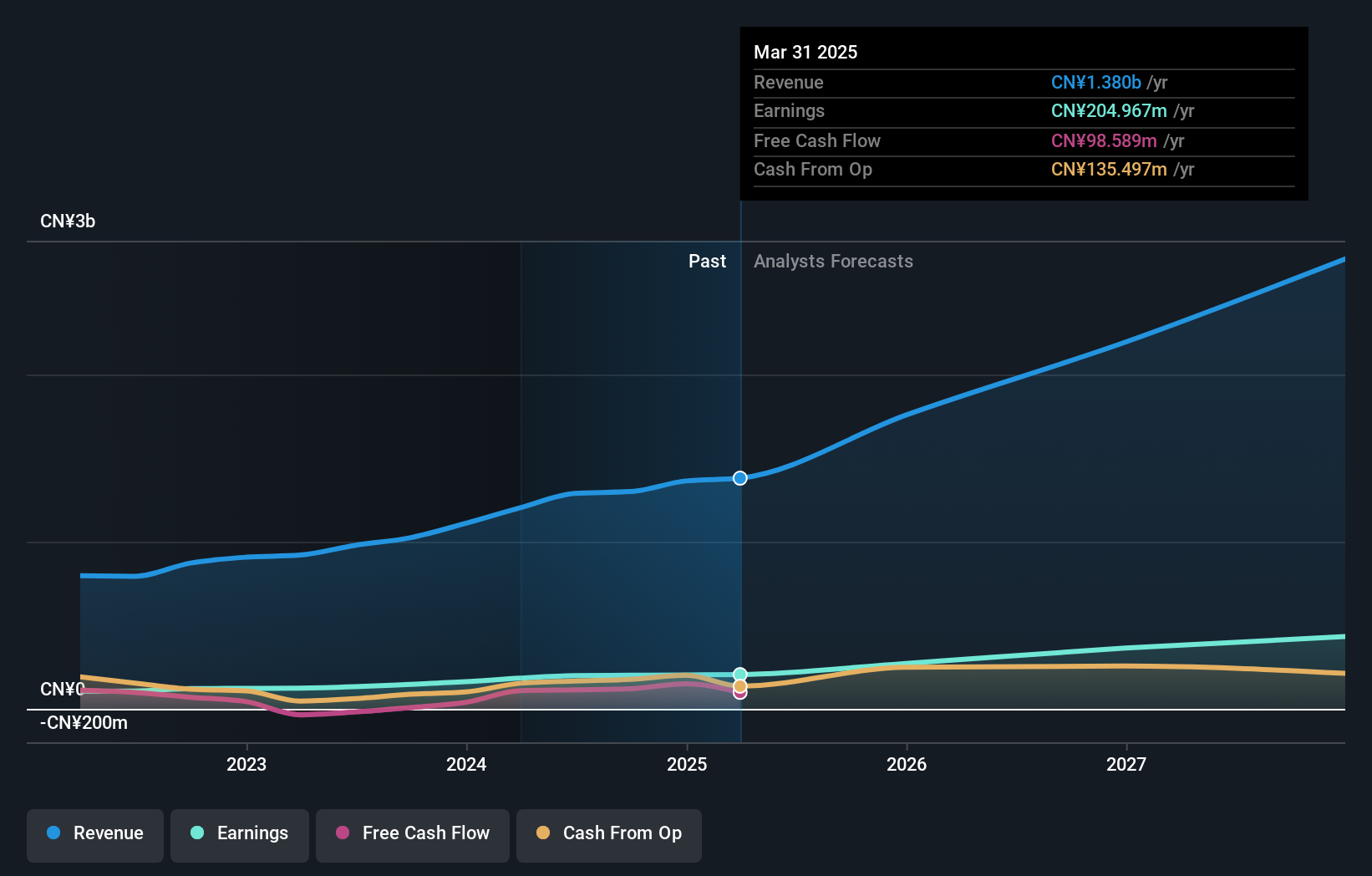

Overview: Sichuan Chuanhuan Technology Co., Ltd. focuses on the research, development, production, and sale of automotive rubber hose series products in China and has a market cap of CN¥4.43 billion.

Operations: The company generates revenue from its Non-Tire Rubber Products segment, amounting to CN¥1.30 billion.

Insider Ownership: 33.9%

Sichuan Chuanhuan Technology Ltd. demonstrates strong growth potential, with revenue forecasted to grow at 21% annually, outpacing the Chinese market average. Recent earnings increased by 37.1% year-over-year, reflecting robust performance despite a volatile share price and past shareholder dilution. The company maintains a competitive position with a lower price-to-earnings ratio of 22.2x compared to the market's 36.8x, although its return on equity is projected to remain relatively low at 19.6%.

- Delve into the full analysis future growth report here for a deeper understanding of Sichuan Chuanhuan TechnologyLtd.

- In light of our recent valuation report, it seems possible that Sichuan Chuanhuan TechnologyLtd is trading beyond its estimated value.

HomeToGo (XTRA:HTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HomeToGo SE operates a marketplace for vacation rentals, connecting users searching for accommodations in Luxembourg and internationally, with a market cap of €257.10 million.

Operations: HomeToGo SE generates revenue primarily through its international vacation rental marketplace, facilitating connections between users and accommodations.

Insider Ownership: 11.5%

HomeToGo SE is navigating growth with a forecasted revenue increase of 13.6% annually, surpassing the German market's growth rate. The company recently reported third-quarter sales of €87.38 million, up from €73.86 million last year, and a net income rise to €23.84 million from €21.36 million previously. Despite being unprofitable in the past nine months, HomeToGo is expected to become profitable within three years and trades significantly below its estimated fair value while engaging in strategic M&A discussions with Interhome Group.

- Get an in-depth perspective on HomeToGo's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that HomeToGo's share price might be on the cheaper side.

Where To Now?

- Navigate through the entire inventory of 1528 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HomeToGo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HTG

HomeToGo

Operates a marketplace for vacation rentals that connects users searching for a place to stay in Luxembourg and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives