- China

- /

- Auto Components

- /

- SZSE:300507

Even With A 33% Surge, Cautious Investors Are Not Rewarding Jiangsu Olive Sensors High-Tech Co., Ltd.'s (SZSE:300507) Performance Completely

Those holding Jiangsu Olive Sensors High-Tech Co., Ltd. (SZSE:300507) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

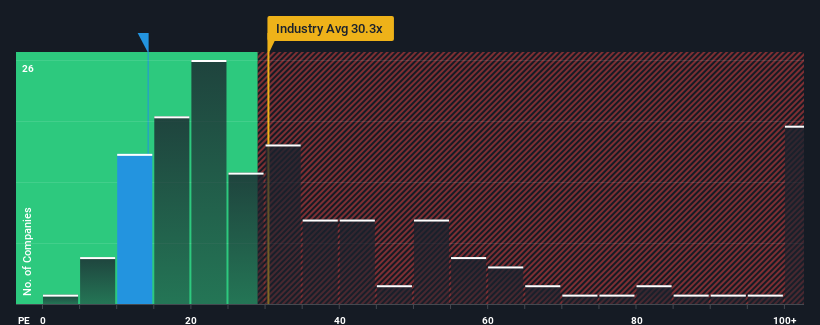

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Jiangsu Olive Sensors High-Tech as a highly attractive investment with its 14.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, Jiangsu Olive Sensors High-Tech has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Jiangsu Olive Sensors High-Tech

Does Growth Match The Low P/E?

Jiangsu Olive Sensors High-Tech's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 156% gain to the company's bottom line. The latest three year period has also seen an excellent 172% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Jiangsu Olive Sensors High-Tech's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Shares in Jiangsu Olive Sensors High-Tech are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Jiangsu Olive Sensors High-Tech revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Jiangsu Olive Sensors High-Tech (1 is a bit unpleasant) you should be aware of.

If you're unsure about the strength of Jiangsu Olive Sensors High-Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300507

Jiangsu Olive Sensors High-Tech

Jiangsu Olive Sensors High-Tech Co., Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026