- China

- /

- Semiconductors

- /

- SZSE:300831

Undiscovered Gems And 2 Other Hidden Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced headwinds amid geopolitical tensions and consumer spending concerns, with key indices like the S&P 600 reflecting these challenges. Despite this backdrop, opportunities remain for investors to explore lesser-known small-cap companies that could potentially enhance portfolio diversification. Identifying a good stock often involves looking at companies with strong fundamentals and growth potential that can withstand economic pressures and capitalize on niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Top Union Electronics | 1.25% | 6.67% | 17.52% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Firich Enterprises | 34.24% | -2.31% | 25.41% | ★★★★★☆ |

| Advanced International Multitech | 36.42% | 6.79% | 4.08% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dalian Huarui Heavy Industry Group (SZSE:002204)

Simply Wall St Value Rating: ★★★★★☆

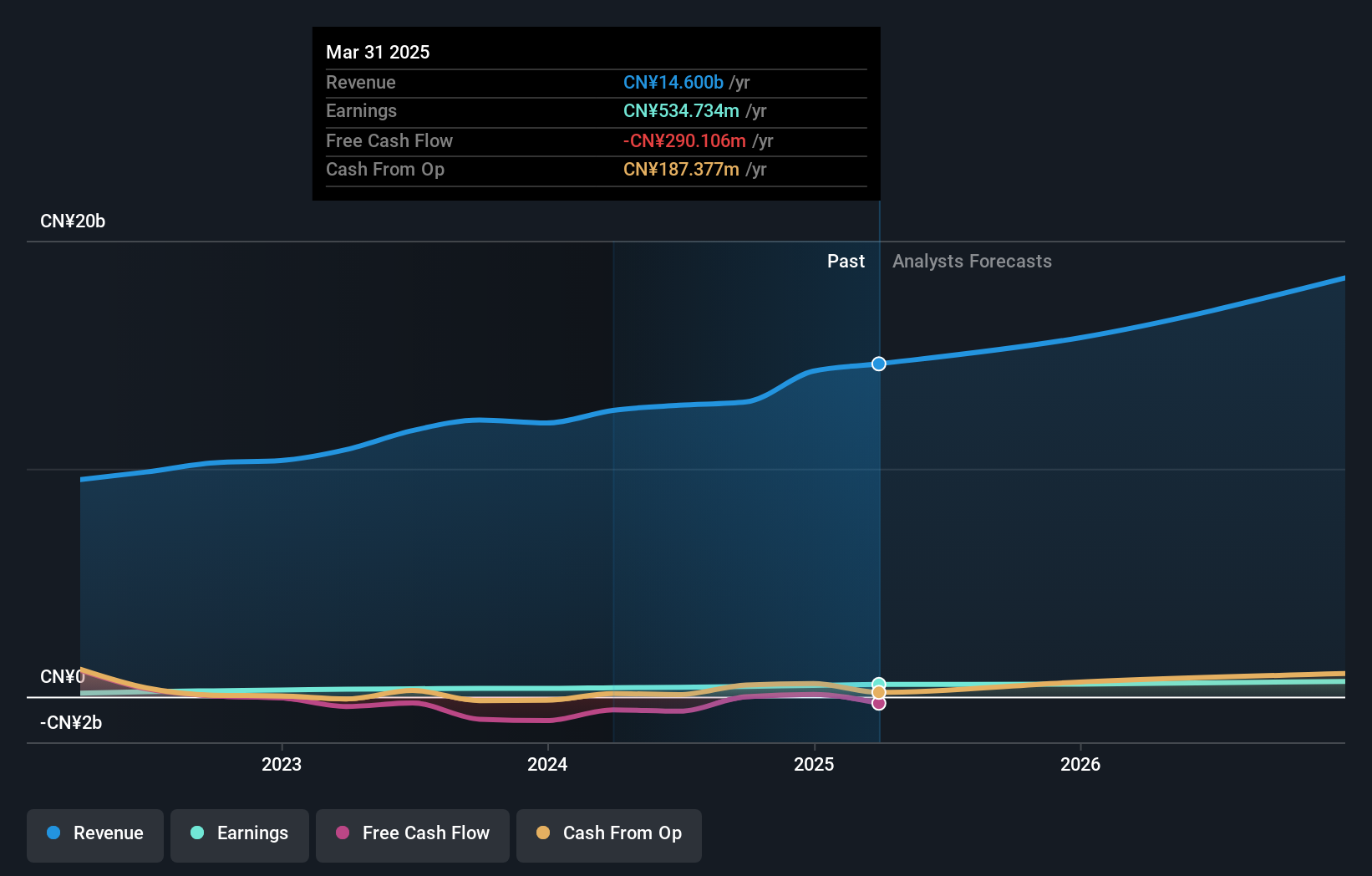

Overview: Dalian Huarui Heavy Industry Group Co., Ltd. operates in the heavy machinery and equipment manufacturing sector, with a market capitalization of approximately CN¥9.56 billion.

Operations: The company generates revenue primarily from its Special-Purpose Equipment Manufacturing segment, amounting to CN¥12.93 billion.

Dalian Huarui Heavy Industry Group, a smaller player in the machinery sector, showcases robust earnings growth of 20.3% over the past year, outpacing the broader industry's -0.06%. Its price-to-earnings ratio of 21.6x is attractive compared to the CN market's 38.1x, suggesting potential value for investors. Despite a rise in its debt-to-equity ratio from 7.6% to 20.7% over five years, it holds more cash than total debt and remains profitable with no immediate cash runway concerns. However, free cash flow is negative, indicating room for improvement in operational efficiency or capital management strategies moving forward.

Fuxin Dare Automotive Parts (SZSE:300473)

Simply Wall St Value Rating: ★★★★★☆

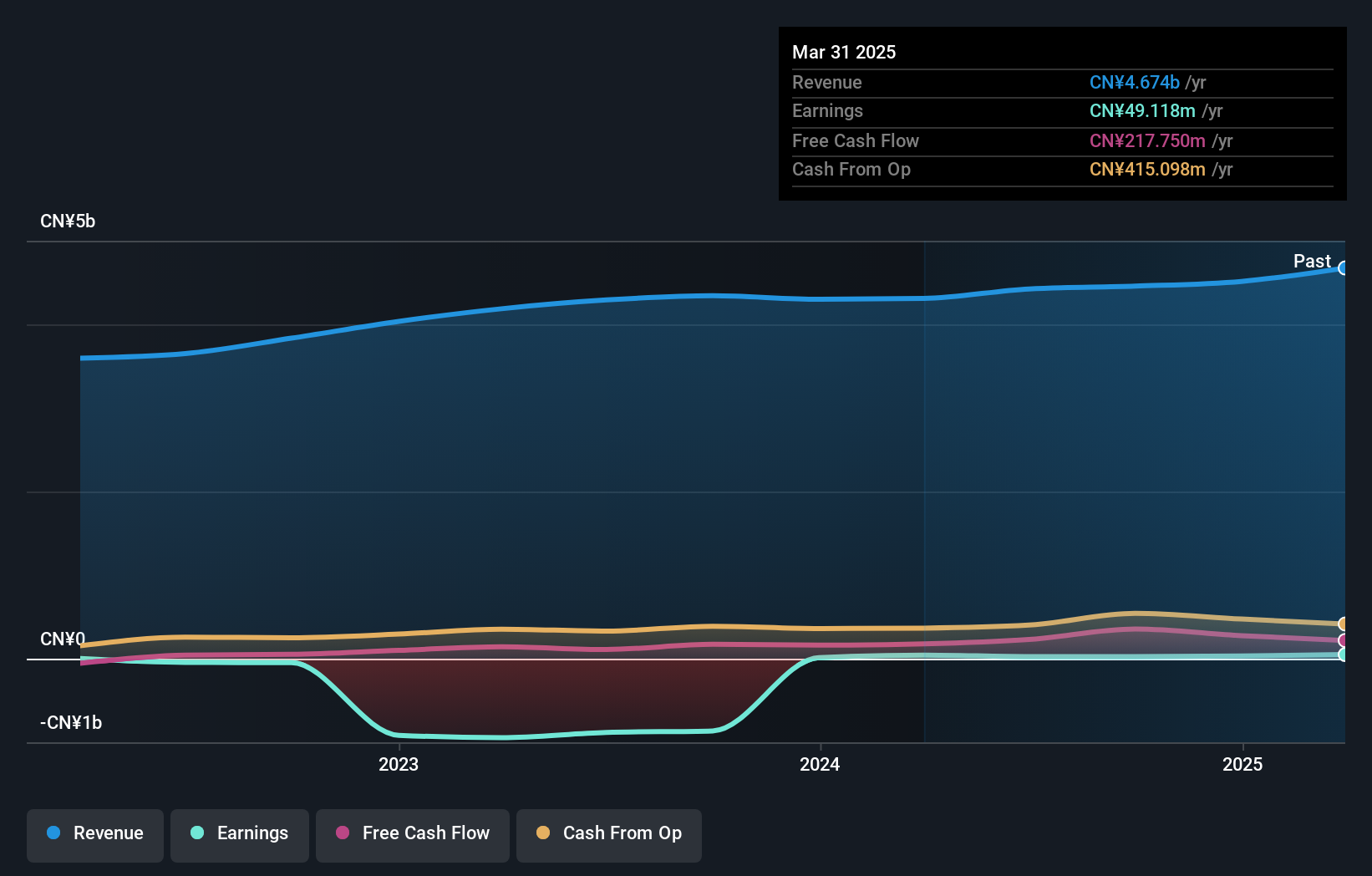

Overview: Fuxin Dare Automotive Parts Co., Ltd. is involved in the research, development, manufacture, and sale of automotive components both in China and internationally, with a market capitalization of CN¥3.83 billion.

Operations: Fuxin Dare Automotive Parts generates revenue through the manufacture and sale of automotive components. The company reports a market capitalization of CN¥3.83 billion.

Fuxin Dare Automotive Parts, a nimble player in the auto components sector, has recently turned profitable, outpacing the industry's 10.5% growth. Trading at 74.3% below its estimated fair value, it offers an intriguing valuation proposition. Despite high-quality earnings and positive free cash flow of US$355 million as of September 2024, interest coverage remains weak with EBIT covering only 1.5 times its debt payments. The company's net debt to equity ratio has improved significantly from 54.6% to a satisfactory 41.1% over five years, suggesting prudent financial management amidst evolving operational dynamics following recent bylaw amendments in December 2024.

Xi'an Peri Power Semiconductor Converting TechnologyLtd (SZSE:300831)

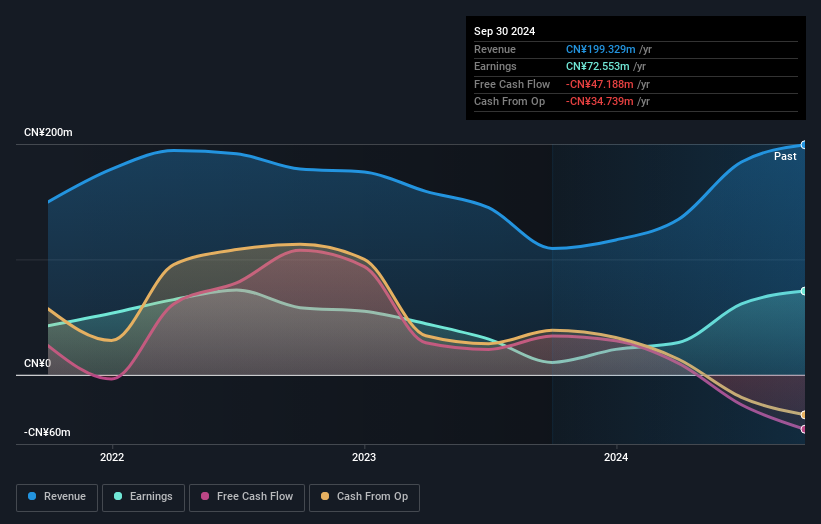

Simply Wall St Value Rating: ★★★★★★

Overview: Xi'an Peri Power Semiconductor Converting Technology Co., Ltd. operates in the semiconductor industry, focusing on converting technology, with a market cap of CN¥4.96 billion.

Operations: Xi'an Peri Power Semiconductor Converting Technology Co., Ltd. generates its revenue primarily from semiconductor converting technology, with a market cap of CN¥4.96 billion. The company's net profit margin has shown fluctuations, reflecting changes in operational efficiency and cost management over time.

Xi'an Peri Power Semiconductor Converting Technology Ltd, a nimble player in the semiconductor space, showcases impressive figures with earnings growth of 575.5% over the past year, outpacing the industry's 13.9%. The company operates debt-free, marking a significant shift from five years ago when its debt-to-equity ratio was 19.2%. Despite not being free cash flow positive recently, it has maintained high-quality non-cash earnings. Its price-to-earnings ratio stands at 68.4x, slightly below the industry average of 69.8x, suggesting potential value for investors seeking opportunities in this sector.

Summing It All Up

- Navigate through the entire inventory of 4747 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300831

Xi'an Peri Power Semiconductor Converting TechnologyLtd

Xi'an Peri Power Semiconductor Converting Technology Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives