- China

- /

- Auto Components

- /

- SZSE:300432

Fulin Precision (SZSE:300432) shareholder returns have been massive, earning 331% in 5 years

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. For example, the Fulin Precision Co., Ltd. (SZSE:300432) share price is up a whopping 322% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 40% gain in the last three months.

Since it's been a strong week for Fulin Precision shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Fulin Precision

Given that Fulin Precision only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Fulin Precision can boast revenue growth at a rate of 35% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 33% per year in that time. It's never too late to start following a top notch stock like Fulin Precision, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

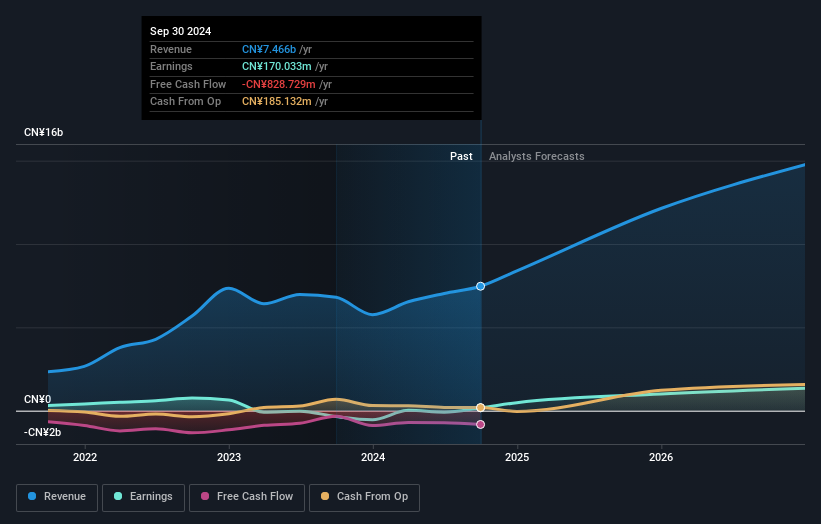

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Fulin Precision has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Fulin Precision will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Fulin Precision's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Fulin Precision's TSR of 331% over the last 5 years is better than the share price return.

A Different Perspective

It's good to see that Fulin Precision has rewarded shareholders with a total shareholder return of 93% in the last twelve months. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Fulin Precision better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Fulin Precision (of which 1 doesn't sit too well with us!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300432

Fulin Precision

Engages in the research and development, manufacture, and sale of automotive engine parts in China.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Community Narratives