Benign Growth For Chongqing Jianshe Vehicle System Co., Ltd. (SZSE:200054) Underpins Stock's 27% Plummet

The Chongqing Jianshe Vehicle System Co., Ltd. (SZSE:200054) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

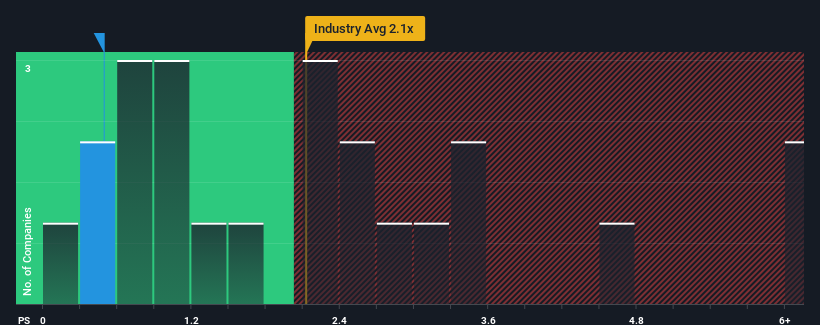

After such a large drop in price, when close to half the companies operating in China's Auto industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider Chongqing Jianshe Vehicle System as an enticing stock to check out with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Chongqing Jianshe Vehicle System

What Does Chongqing Jianshe Vehicle System's P/S Mean For Shareholders?

The revenue growth achieved at Chongqing Jianshe Vehicle System over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Chongqing Jianshe Vehicle System, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Chongqing Jianshe Vehicle System's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chongqing Jianshe Vehicle System's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 40% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 55% shows it's an unpleasant look.

In light of this, it's understandable that Chongqing Jianshe Vehicle System's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Chongqing Jianshe Vehicle System's P/S

Chongqing Jianshe Vehicle System's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Chongqing Jianshe Vehicle System confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - Chongqing Jianshe Vehicle System has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:200054

Chongqing Jianshe Vehicle System

Chongqing Jianshe Vehicle System Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026