- Hong Kong

- /

- Communications

- /

- SEHK:303

Discovering Hidden Gems In Asia May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, small-cap stocks in Asia present intriguing opportunities for investors seeking growth potential amid uncertainty. Identifying promising companies often involves looking for those with strong fundamentals and resilience to broader market fluctuations, making them potential hidden gems in the current environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 2.62% | 7.38% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| QuickLtd | 0.67% | 10.29% | 16.51% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| Luyin Investment GroupLtd | 40.20% | 6.14% | 18.68% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Lemtech Holdings | 48.75% | -1.28% | -3.58% | ★★★★★★ |

| Grade Upon Technology | NA | 10.27% | 66.81% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| YagiLtd | 38.98% | -8.93% | 16.36% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Vtech Holdings (SEHK:303)

Simply Wall St Value Rating: ★★★★★★

Overview: Vtech Holdings Limited is a company that designs, manufactures, and distributes electronic products globally, with a market cap of approximately HK$14.12 billion.

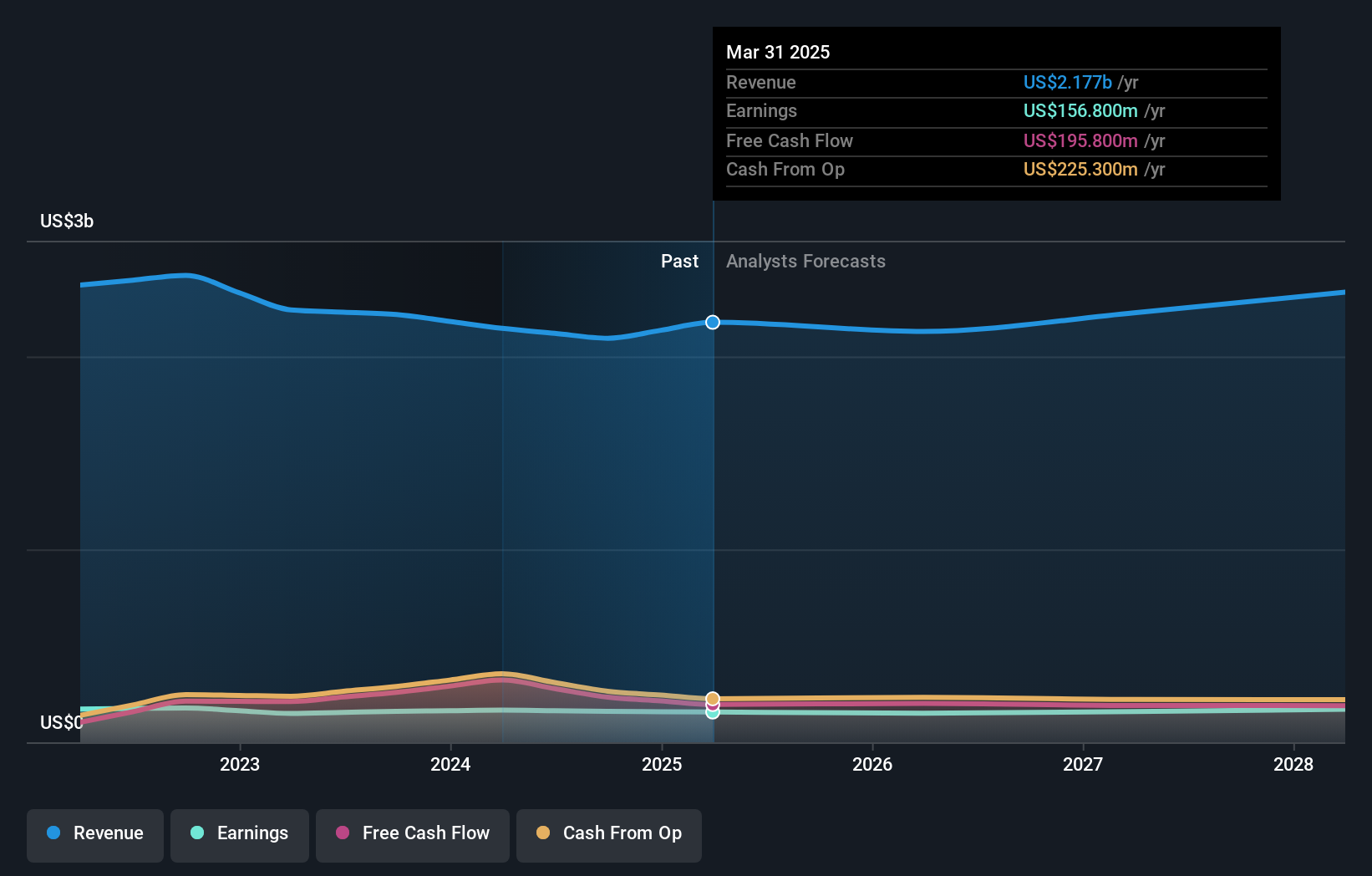

Operations: The primary revenue stream for Vtech Holdings comes from the design, manufacture, and distribution of consumer electronic products, generating approximately $2.09 billion.

VTech Holdings, a small player in the communications industry, is trading at 50% below its estimated fair value. Despite facing negative earnings growth of 0.2% last year and a 5-year annual decline of 5.9%, the company remains debt-free, eliminating concerns over interest payments. With high-quality past earnings and positive free cash flow, VTech seems to be managing its financials effectively despite industry challenges. Recent board changes might indicate strategic shifts which could impact future performance positively or negatively depending on execution.

- Take a closer look at Vtech Holdings' potential here in our health report.

Understand Vtech Holdings' track record by examining our Past report.

Lubair Aviation Technology (SZSE:001316)

Simply Wall St Value Rating: ★★★★★★

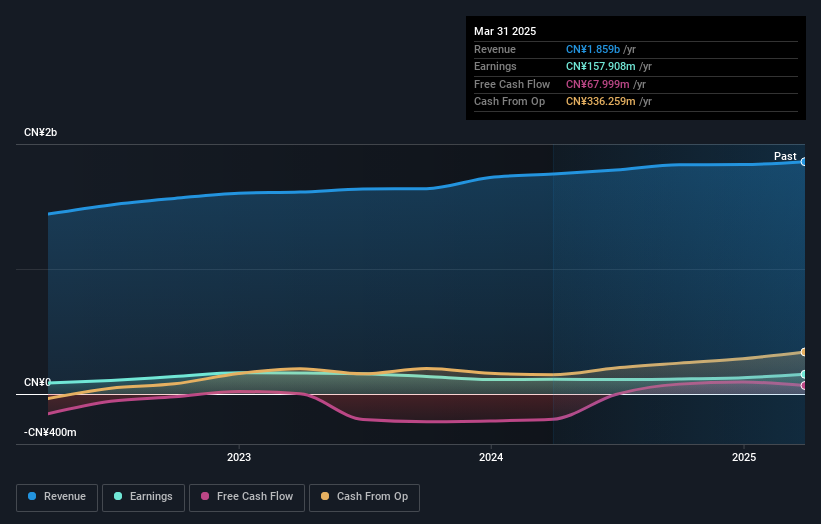

Overview: Lubair Aviation Technology Co., Ltd. offers aviation materials solutions on a global scale and has a market capitalization of CN¥4.29 billion.

Operations: Lubair Aviation Technology generates revenue primarily through its aviation materials solutions offered globally. The company has a market capitalization of CN¥4.29 billion.

Lubair Aviation Technology, a smaller player in the Aerospace & Defense industry, has shown promising growth with earnings up 17% over the past year, surpassing the industry's -12.4%. The company's debt to equity ratio improved from 3.6 to 3.2 over five years, indicating better financial health. Recent reports highlight a rise in Q1 sales to CNY 238.39 million from CNY 196.46 million last year, with net income climbing to CNY 34.04 million from CNY 20.27 million previously. Despite some volatility in share price and a slight dip in annual net income for 2024, Lubair's P/E ratio of 41.9x remains attractive compared to industry peers at an average of 94.4x.

- Click here and access our complete health analysis report to understand the dynamics of Lubair Aviation Technology.

Gain insights into Lubair Aviation Technology's past trends and performance with our Past report.

Qingdao CHOHO IndustrialLtd (SZSE:003033)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingdao CHOHO Industrial Co., Ltd. develops, manufactures, and sells automobile chains worldwide with a market capitalization of CN¥4.36 billion.

Operations: The company generates revenue primarily through the development, manufacturing, and sale of automobile chains. Its financial performance is characterized by a focus on optimizing production costs to enhance profitability. The net profit margin provides insight into its overall efficiency in converting revenue into actual profit.

Qingdao CHOHO Industrial, a smaller player in the auto components sector, showcases robust growth with earnings surging 34.7% over the past year, outpacing industry norms of 6.5%. The company's net debt to equity ratio stands at a satisfactory 20.5%, while its interest payments are well-covered by EBIT at 14.1 times coverage. Recent financials reveal an impressive jump in Q1 net income to CNY 53.84 million from CNY 26.91 million last year, reflecting high-quality earnings and a competitive price-to-earnings ratio of 27.6x against the market's average of 37.7x CN¥.

Summing It All Up

- Reveal the 2680 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:303

Vtech Holdings

Designs, manufactures, and distributes electronic products in Hong Kong, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives