- China

- /

- Auto Components

- /

- SZSE:002765

Top Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility and shifting economic policies, investors are keenly observing how these factors influence various sectors. As markets adjust to new political landscapes and economic signals, identifying growth companies with substantial insider ownership can offer insights into potential resilience and confidence in future prospects. In this context, stocks with high insider ownership often reflect management's belief in the company’s long-term value, making them noteworthy candidates for those monitoring growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's take a closer look at a couple of our picks from the screened companies.

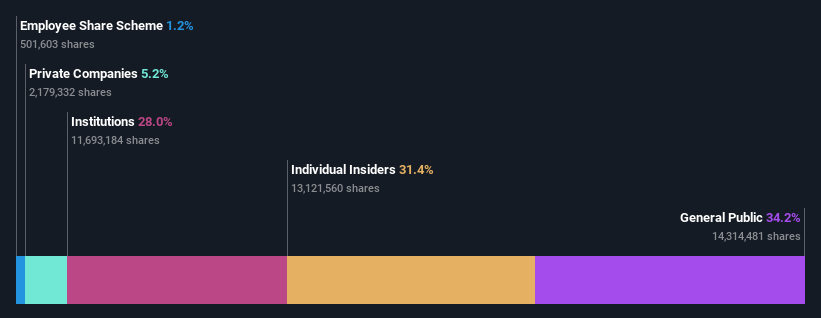

GreenTech Environmental (SHSE:688466)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GreenTech Environmental Co., Ltd. operates in the water treatment and waste-to-resources sectors in China, with a market cap of approximately CN¥2.04 billion.

Operations: Revenue segments for GreenTech Environmental Co., Ltd. are not provided in the available text.

Insider Ownership: 28.8%

GreenTech Environmental shows strong growth potential with forecasted revenue and earnings growth rates of 36.1% and 44.1% per year, respectively, outpacing the Chinese market averages. However, recent financial results indicate a decline in net income to CNY 45.27 million for the nine months ended September 2024 from CNY 62.4 million a year ago, impacting profit margins negatively from 13.6% to 9.4%. The company's dividend yield of 2.62% is not well-covered by earnings or free cash flow, suggesting potential sustainability issues despite its competitive price-to-earnings ratio of 35.6x compared to the market average of 36x.

- Take a closer look at GreenTech Environmental's potential here in our earnings growth report.

- According our valuation report, there's an indication that GreenTech Environmental's share price might be on the expensive side.

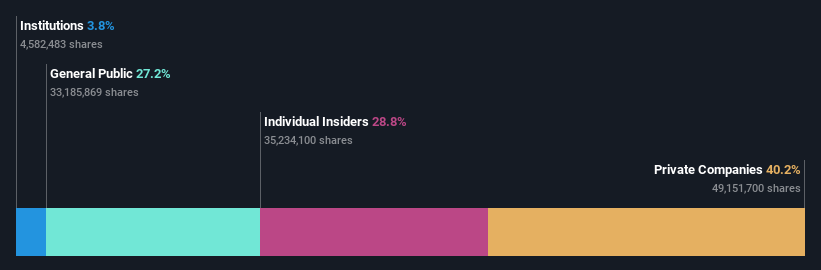

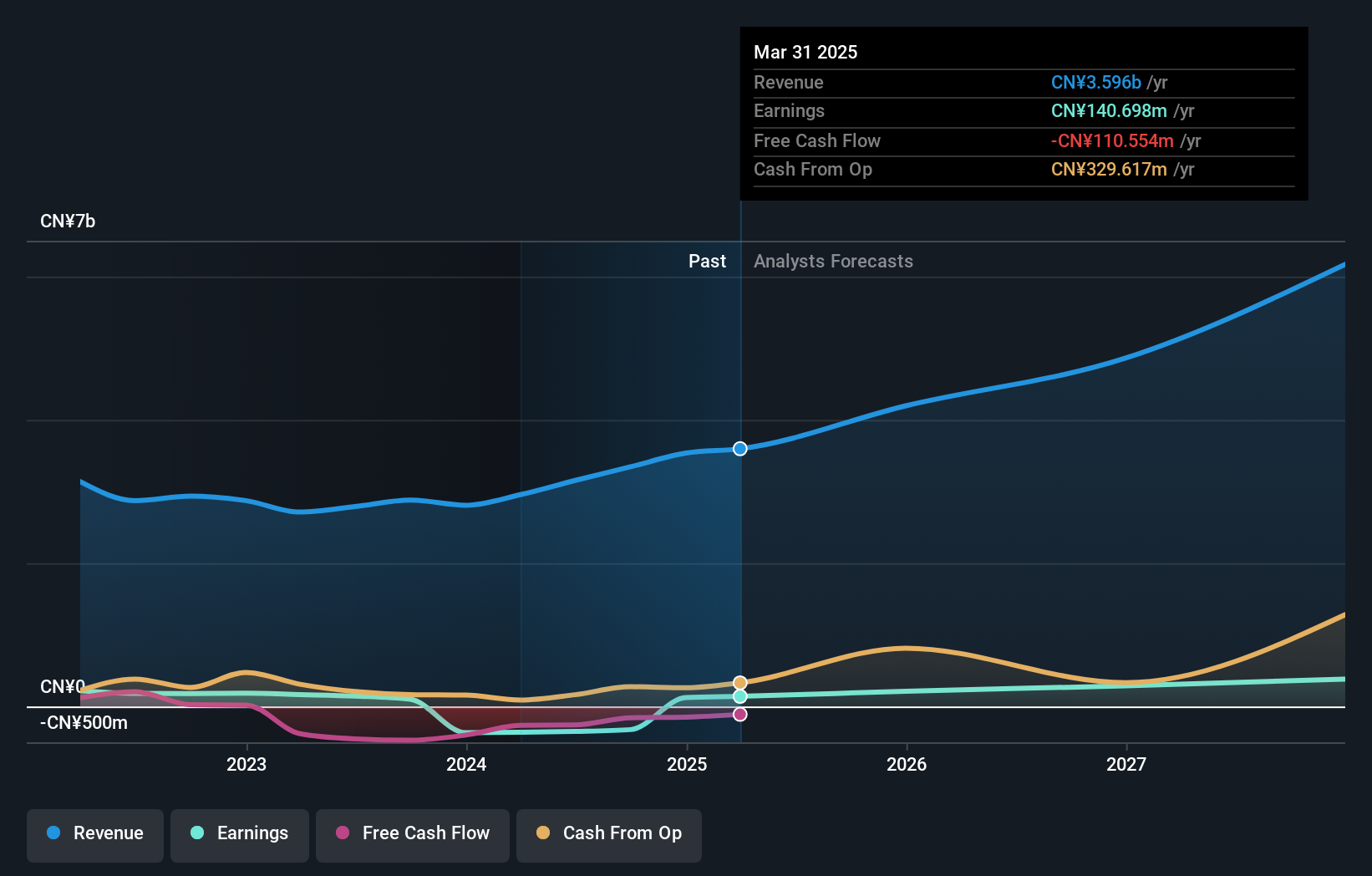

Landai Technology Group (SZSE:002765)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Landai Technology Group Corp., Ltd. focuses on the research, development, manufacture, and sale of power transmission assemblies, transmission parts, and die-casting products for the automotive, textile machinery, and general machinery markets in China with a market cap of CN¥5.93 billion.

Operations: The company generates revenue from the production and sale of power transmission assemblies, transmission parts, and die-casting products across automotive, textile machinery, and general machinery sectors in China.

Insider Ownership: 31.3%

Landai Technology Group's recent earnings report shows significant growth, with sales rising to CNY 2.61 billion and net income increasing to CNY 103.62 million for the nine months ended September 2024. Despite a highly volatile share price, the company is expected to outpace market revenue growth at 16.3% annually and achieve profitability within three years, though its return on equity is forecasted to be low at 9.2%. No substantial insider trading activity was noted recently.

- Get an in-depth perspective on Landai Technology Group's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Landai Technology Group implies its share price may be too high.

M31 Technology (TPEX:6643)

Simply Wall St Growth Rating: ★★★★★★

Overview: M31 Technology Corporation offers silicon intellectual property design services within the integrated circuit industry and has a market capitalization of NT$29.85 billion.

Operations: The company generates revenue of NT$1.67 billion from its semiconductor equipment and services segment.

Insider Ownership: 31.2%

M31 Technology's recent USB4 IP validation on TSMC's 5nm process highlights its focus on advanced IP solutions, though recent earnings show a decline with Q3 sales at TWD 381.88 million and net income down to TWD 28.01 million. Despite this, M31 is projected to achieve robust earnings growth of 47.79% annually, outpacing the TW market average of 19.5%. The company’s share price remains volatile, with no significant insider trading activity noted recently.

- Dive into the specifics of M31 Technology here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of M31 Technology shares in the market.

Summing It All Up

- Delve into our full catalog of 1535 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Landai Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002765

Landai Technology Group

Engages in the research and development, manufacture, and sale of power transmission assemblies, transmission parts, and die-casting products for the automotive, textile machinery, and general machinery industries in China.

Reasonable growth potential with adequate balance sheet.