- China

- /

- Food and Staples Retail

- /

- SZSE:301078

Asian Growth Leaders With High Insider Ownership October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed U.S.-China trade tensions and geopolitical uncertainties, Asian economies are closely monitoring these developments while seeking growth opportunities. In this environment, companies with strong insider ownership often stand out as they can signal confidence in a firm's long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.4% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 26.3% | 98.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 30.7% | 87.1% |

Underneath we present a selection of stocks filtered out by our screen.

Ningbo PIA Automation Holding (SHSE:688306)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo PIA Automation Holding Corp. specializes in the R&D, production, sale, and service of intelligent manufacturing equipment and software for various sectors globally, including new energy smart cars and medical health, with a market cap of approximately CN¥16.94 billion.

Operations: The company generates revenue from its Machinery & Industrial Equipment segment, amounting to CN¥2.57 billion.

Insider Ownership: 13.2%

Revenue Growth Forecast: 15.7% p.a.

Ningbo PIA Automation Holding, with substantial insider ownership, is poised for significant earnings growth, forecasted at 138.86% annually over the next three years—outpacing the Chinese market average. Despite a net loss of CNY 27.77 million in H1 2025 and volatile share prices recently, its revenue is expected to grow at 15.7% per year, surpassing the market's average growth rate of 13.7%. Recent events include an earnings call on October 13 and an extended buyback plan until May 2026.

- Click to explore a detailed breakdown of our findings in Ningbo PIA Automation Holding's earnings growth report.

- Our valuation report here indicates Ningbo PIA Automation Holding may be overvalued.

Xinzhi Group (SZSE:002664)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xinzhi Group Co., Ltd. focuses on the research, development, manufacturing, and sale of various motors and their core components both in China and internationally, with a market cap of CN¥13.11 billion.

Operations: The company generates revenue primarily from its manufacturing segment, totaling CN¥5.91 billion.

Insider Ownership: 25.7%

Revenue Growth Forecast: 29.9% p.a.

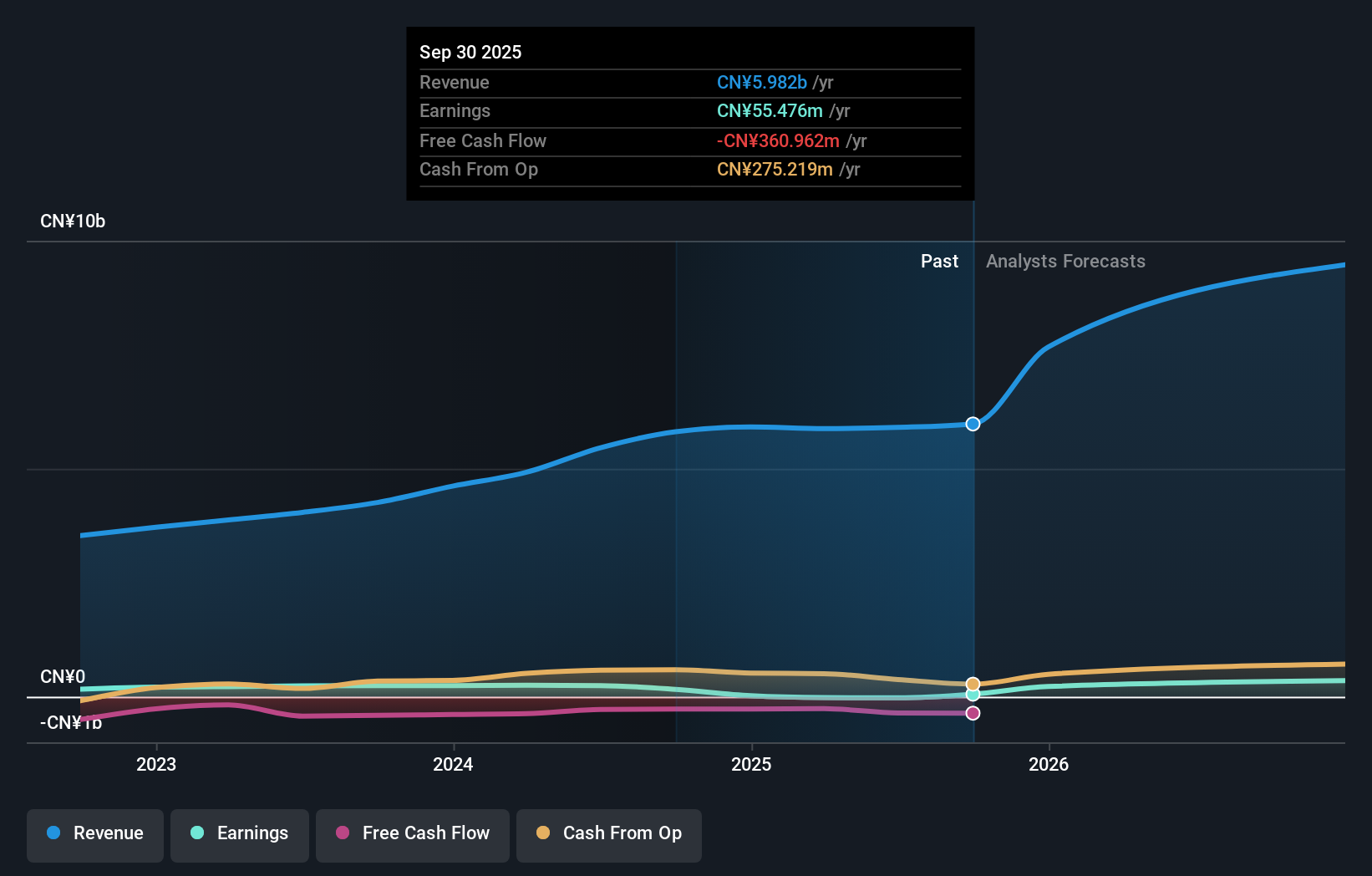

Xinzhi Group, with high insider ownership, shows promising growth potential. Its earnings are forecasted to grow 116.49% annually, outpacing the market average. Recent earnings reported a net income increase to CNY 121.51 million for the nine months ending September 2025, up from CNY 87.11 million a year ago. Despite recent share price volatility, it trades at good value compared to peers and is expected to become profitable in three years with strong revenue growth projections of 29.9% annually.

- Navigate through the intricacies of Xinzhi Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Xinzhi Group's share price might be on the cheaper side.

Kidswant Children ProductsLtd (SZSE:301078)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kidswant Children Products Co., Ltd. operates in China, focusing on the retail of maternal, infant, and child products, with a market cap of CN¥14.15 billion.

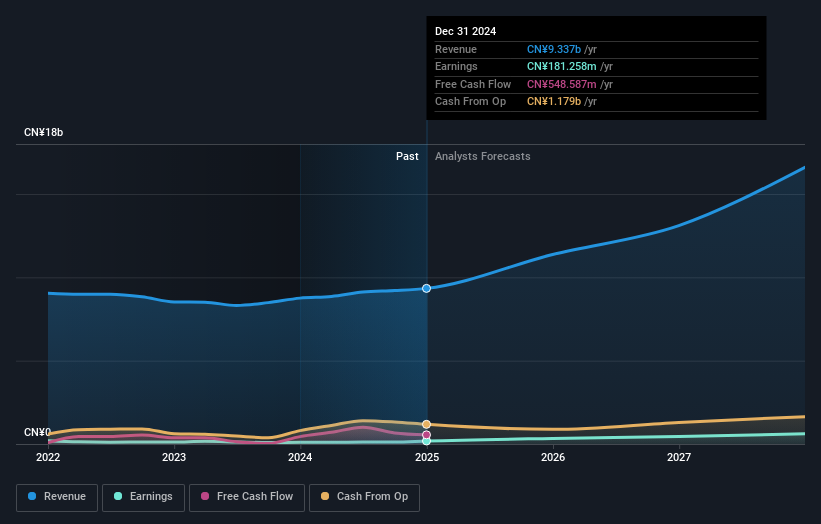

Operations: The company generates revenue of CN¥9.73 billion from its retail segment focused on mother and baby products in China.

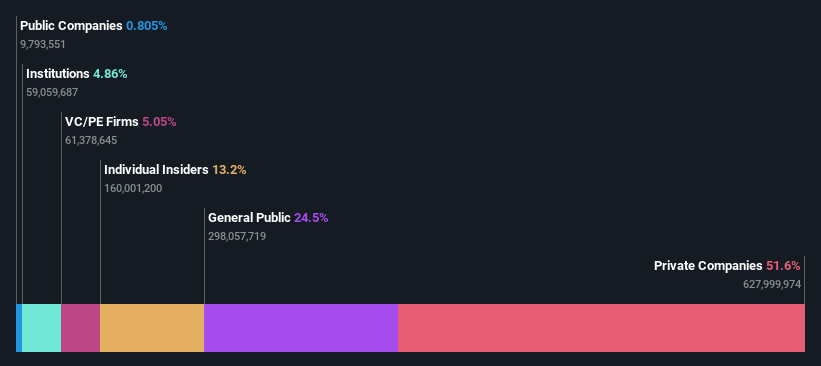

Insider Ownership: 27%

Revenue Growth Forecast: 19.7% p.a.

Kidswant Children Products Ltd. demonstrates strong growth potential, with earnings forecasted to grow 36.3% annually, surpassing the Chinese market average of 26.3%. Recent financials show a significant increase in net income to CNY 143.1 million for the first half of 2025, up from CNY 79.76 million the previous year. Despite an unstable dividend track record and a low future return on equity forecast of 12.1%, analysts expect a stock price rise by 47.1%.

- Delve into the full analysis future growth report here for a deeper understanding of Kidswant Children ProductsLtd.

- The analysis detailed in our Kidswant Children ProductsLtd valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Get an in-depth perspective on all 615 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kidswant Children ProductsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301078

Kidswant Children ProductsLtd

Engages in the retail of maternal, infant, and child products in China.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026