- China

- /

- Auto Components

- /

- SZSE:002448

ZYNP's (SZSE:002448) Shareholders Have More To Worry About Than Only Soft Earnings

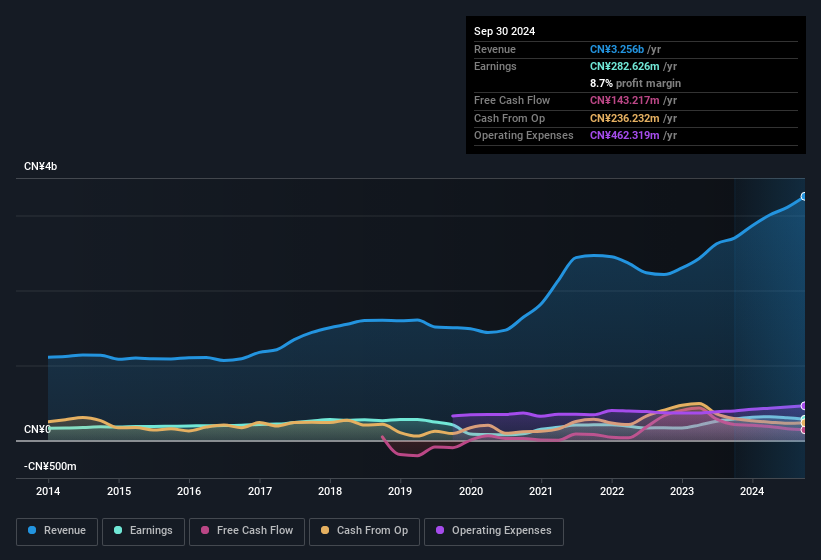

The subdued market reaction suggests that ZYNP Corporation's (SZSE:002448) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for ZYNP

The Impact Of Unusual Items On Profit

For anyone who wants to understand ZYNP's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥30m worth of unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ZYNP.

Our Take On ZYNP's Profit Performance

We'd posit that ZYNP's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that ZYNP's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 40% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. While earnings are important, another area to consider is the balance sheet. You can see our latest analysis on ZYNP's balance sheet health here.

Today we've zoomed in on a single data point to better understand the nature of ZYNP's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZYNP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002448

ZYNP

Designs, develops, manufactures, tests, and supplies cylinder liners and power piston assembly systems in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion