As global markets navigate a period of economic uncertainty, with major indices showing mixed performance and central banks adjusting interest rates, investors are increasingly looking for stability and income in their portfolios. In such an environment, dividend stocks can be appealing due to their potential to provide consistent income streams even when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.20% | ★★★★★★ |

Click here to see the full list of 1858 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

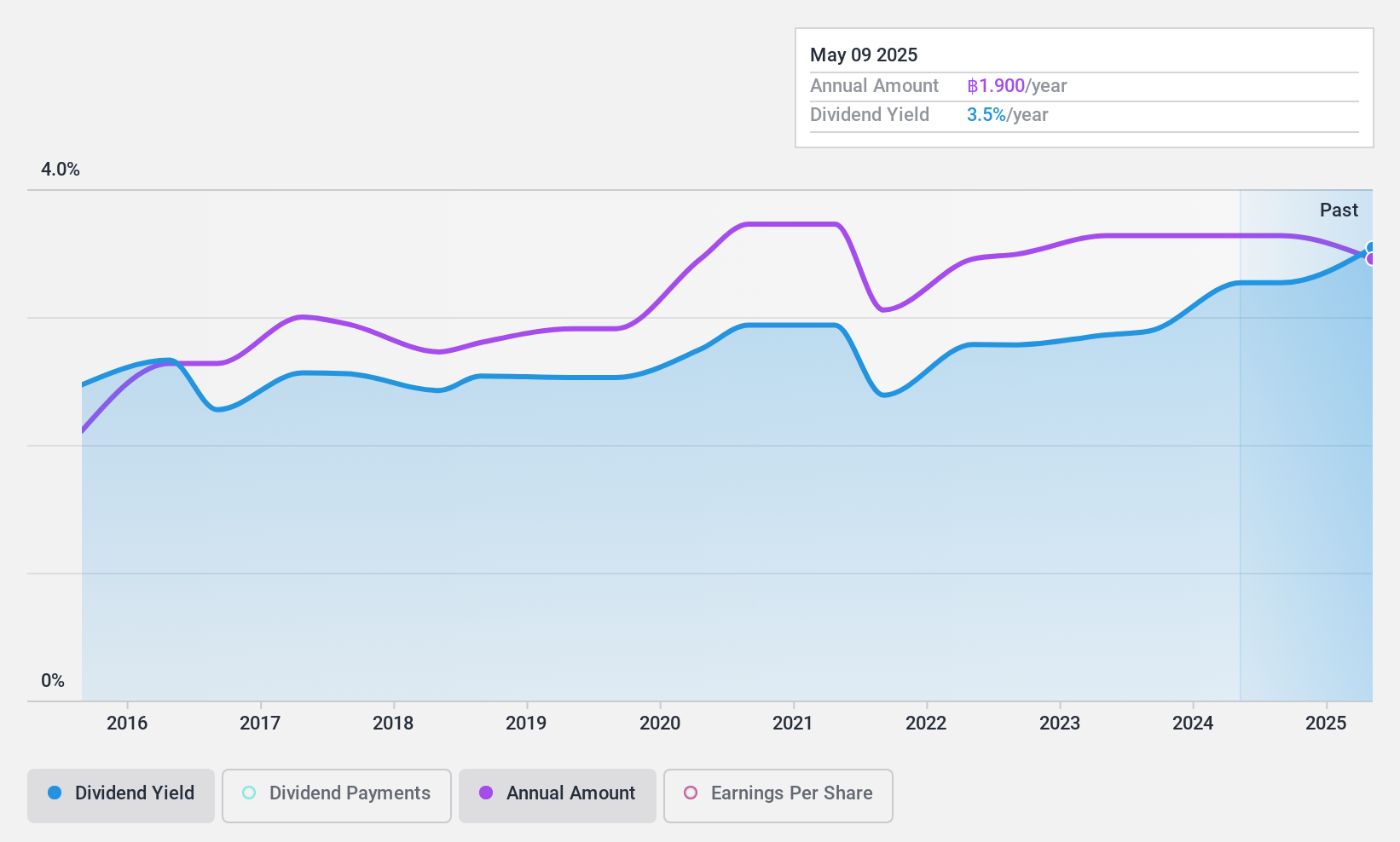

President Bakery (SET:PB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: President Bakery Public Company Limited manufactures and sells bakery products in Thailand with a market cap of THB27 billion.

Operations: President Bakery's revenue from the manufacture and sales of bakery products amounts to THB7.60 billion.

Dividend Yield: 3.3%

President Bakery's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 54.1% and 58.6%, respectively. The company has consistently increased its dividends over the past decade, maintaining stability without significant volatility. However, its current dividend yield of 3.33% is lower than the top tier in Thailand's market. Recent executive changes and slightly declining earnings could impact future performance but have not yet affected dividend reliability or coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of President Bakery.

- Our expertly prepared valuation report President Bakery implies its share price may be lower than expected.

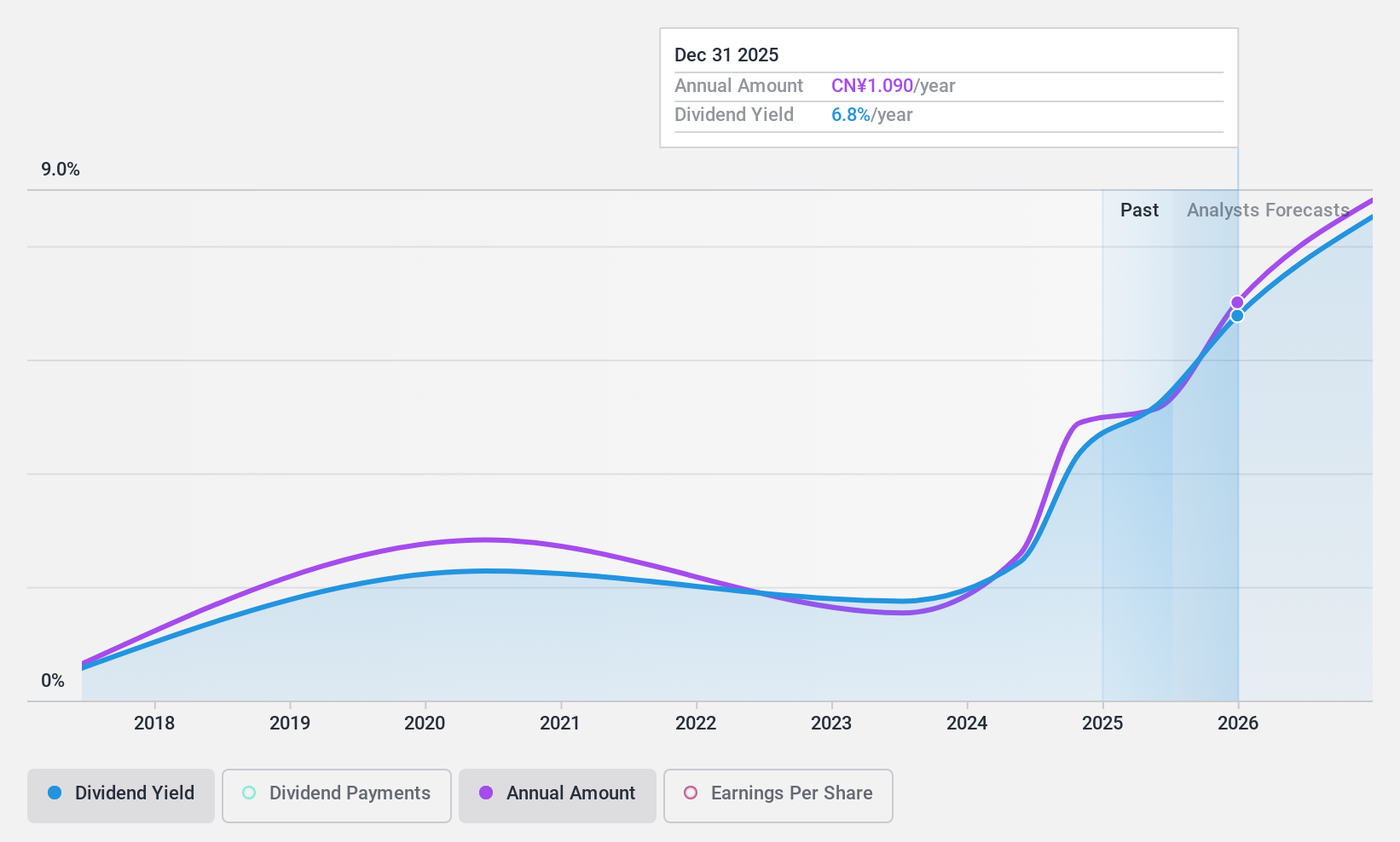

Zhejiang Qianjiang Motorcycle (SZSE:000913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Qianjiang Motorcycle Co., Ltd. is engaged in the research, development, manufacturing, and sale of motorcycles, engines, and components in China with a market cap of CN¥9.10 billion.

Operations: Zhejiang Qianjiang Motorcycle Co., Ltd. generates its revenue through the production and sale of motorcycles, engines, and components within China.

Dividend Yield: 4.4%

Zhejiang Qianjiang Motorcycle offers a high dividend yield of 4.4%, ranking in the top 25% within China's market. Despite this, its dividend history is marked by volatility and unreliability over its eight-year span, with significant annual drops. Recent earnings growth supports current payouts, with an 80.4% payout ratio covered by earnings and a cash payout ratio of 62.7%. The company announced an interim cash dividend for 2024, reflecting ongoing shareholder returns amidst fluctuating payments.

- Click here to discover the nuances of Zhejiang Qianjiang Motorcycle with our detailed analytical dividend report.

- The analysis detailed in our Zhejiang Qianjiang Motorcycle valuation report hints at an deflated share price compared to its estimated value.

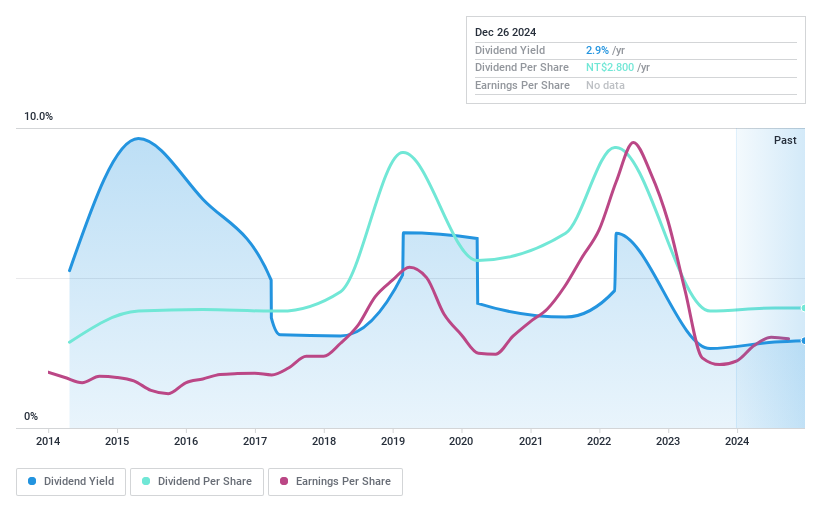

Sinopower Semiconductor (TPEX:6435)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinopower Semiconductor, Inc. is involved in the research, design, manufacture, and sale of power semiconductor components and related modules both in Taiwan and internationally, with a market cap of NT$3.48 billion.

Operations: Sinopower Semiconductor, Inc. generates its revenue primarily from the semiconductors segment, amounting to NT$2.72 billion.

Dividend Yield: 3%

Sinopower Semiconductor's dividend payments have been volatile over the past decade, despite recent earnings growth of 41.2% supporting current payouts. The company's payout ratio is 52.3%, indicating dividends are covered by earnings and cash flows, with a low cash payout ratio of 31.9%. However, its dividend yield is relatively low at 3%, below the top tier in Taiwan's market. Recent financial results show stable sales but a slight decline in quarterly net income year-on-year.

- Click to explore a detailed breakdown of our findings in Sinopower Semiconductor's dividend report.

- Our comprehensive valuation report raises the possibility that Sinopower Semiconductor is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1855 Top Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PB

Flawless balance sheet established dividend payer.