Does Chongqing Changan Automobile (SZSE:000625) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Chongqing Changan Automobile (SZSE:000625). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Chongqing Changan Automobile

Chongqing Changan Automobile's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Chongqing Changan Automobile has achieved impressive annual EPS growth of 39%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

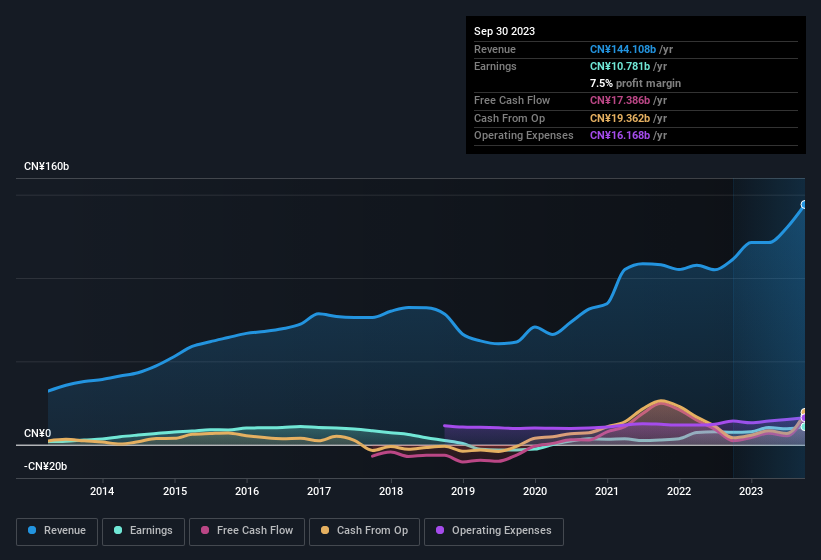

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Chongqing Changan Automobile's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Chongqing Changan Automobile remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 29% to CN¥144b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Chongqing Changan Automobile?

Are Chongqing Changan Automobile Insiders Aligned With All Shareholders?

Owing to the size of Chongqing Changan Automobile, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Indeed, they hold CN¥88m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.06% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Chongqing Changan Automobile To Your Watchlist?

Chongqing Changan Automobile's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Chongqing Changan Automobile very closely. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Chongqing Changan Automobile (at least 1 which is concerning) , and understanding these should be part of your investment process.

Although Chongqing Changan Automobile certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000625

Chongqing Changan Automobile

Manufactures and sells automobiles, automotive engines, supporting parts, and components in the People’s Republic of China.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives