- China

- /

- Auto Components

- /

- SZSE:000559

Is Wanxiang Qianchao Co.,Ltd.'s (SZSE:000559) Stock Price Struggling As A Result Of Its Mixed Financials?

It is hard to get excited after looking at Wanxiang QianchaoLtd's (SZSE:000559) recent performance, when its stock has declined 12% over the past three months. We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. Specifically, we decided to study Wanxiang QianchaoLtd's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Wanxiang QianchaoLtd

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Wanxiang QianchaoLtd is:

9.1% = CN¥850m ÷ CN¥9.3b (Based on the trailing twelve months to March 2024).

The 'return' is the profit over the last twelve months. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.09.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Wanxiang QianchaoLtd's Earnings Growth And 9.1% ROE

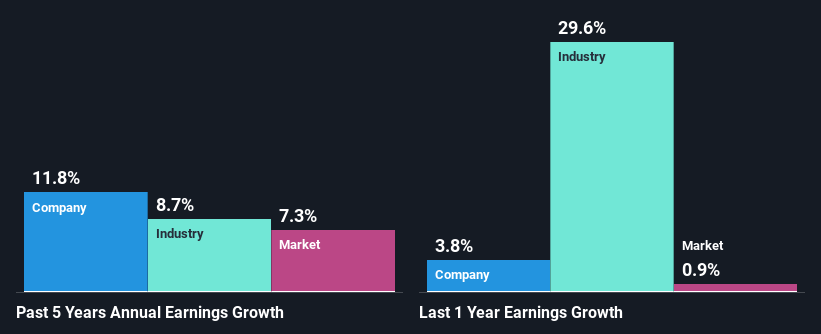

At first glance, Wanxiang QianchaoLtd's ROE doesn't look very promising. However, given that the company's ROE is similar to the average industry ROE of 8.2%, we may spare it some thought. Having said that, Wanxiang QianchaoLtd has shown a modest net income growth of 12% over the past five years. Considering the moderately low ROE, it is quite possible that there might be some other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Wanxiang QianchaoLtd's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 8.7%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Wanxiang QianchaoLtd fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Wanxiang QianchaoLtd Efficiently Re-investing Its Profits?

Wanxiang QianchaoLtd's high three-year median payout ratio of 101% suggests that the company is paying out more to its shareholders than what it is making. However, this hasn't really hampered its ability to grow as we saw earlier. It would still be worth keeping an eye on that high payout ratio, if for some reason the company runs into problems and business deteriorates.

Besides, Wanxiang QianchaoLtd has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

On the whole, we feel that the performance shown by Wanxiang QianchaoLtd can be open to many interpretations. While no doubt its earnings growth is pretty substantial, its ROE and earnings retention is quite poor. So while the company has managed to grow its earnings in spite of this, we are unconvinced if this growth could extend, especially during troubled times. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of Wanxiang QianchaoLtd's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Valuation is complex, but we're here to simplify it.

Discover if Wanxiang QianchaoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000559

Wanxiang QianchaoLtd

Engages in research and development, manufacture, and sale of auto parts in China and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)