Jiangling Motors Corporation, Ltd.'s (SZSE:000550) Shares Bounce 27% But Its Business Still Trails The Market

Jiangling Motors Corporation, Ltd. (SZSE:000550) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 106% in the last year.

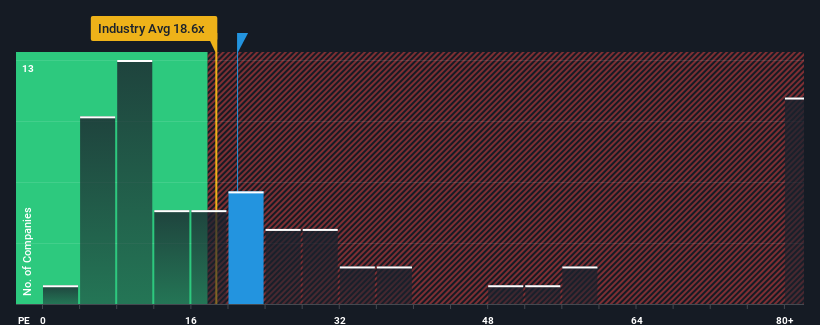

Even after such a large jump in price, Jiangling Motors Corporation's price-to-earnings (or "P/E") ratio of 20.9x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 60x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Jiangling Motors Corporation certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Jiangling Motors Corporation

How Is Jiangling Motors Corporation's Growth Trending?

In order to justify its P/E ratio, Jiangling Motors Corporation would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. Pleasingly, EPS has also lifted 240% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 9.4% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is noticeably more attractive.

With this information, we can see why Jiangling Motors Corporation is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift Jiangling Motors Corporation's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Jiangling Motors Corporation maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Jiangling Motors Corporation that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000550

Jiangling Motors Corporation

Engages in the production and sale of automobiles and automobile parts in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives